Nvidia is speeding up its cadence. Why that could be bad news for rivals.

Oct. 15, 2023 8:30 AM ET

By: Chris Ciaccia, SA News Editor

BING-JHEN HONG BING-JHEN HONG

Nvidia (NASDAQ: NVDA) has had a remarkable few years, but Bank of America said the company's future is even brighter, as it speeds up the pace of product releases and strengthens its position against its competitors.

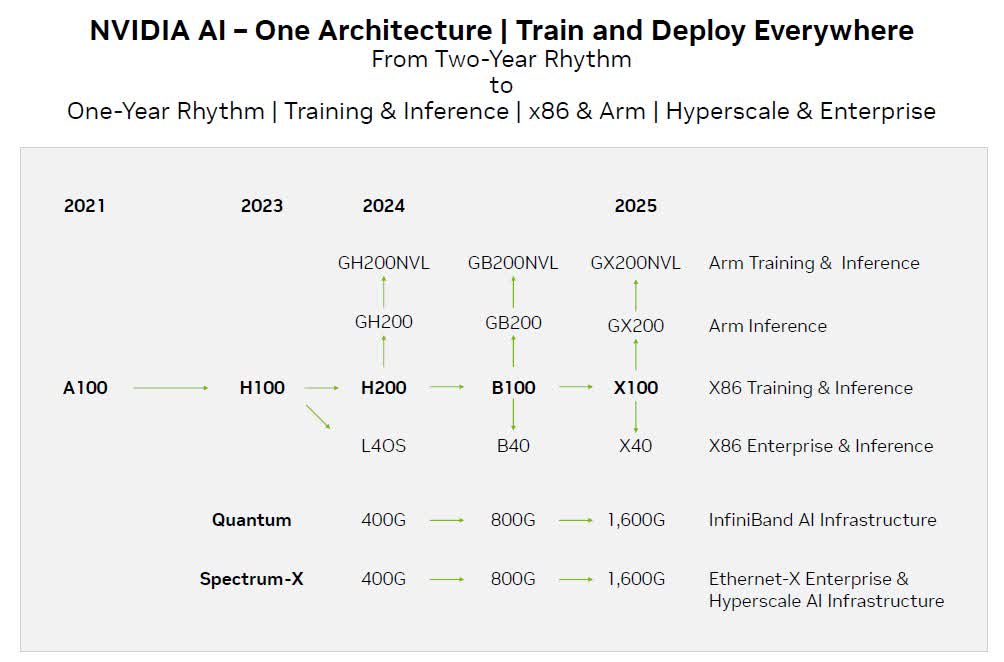

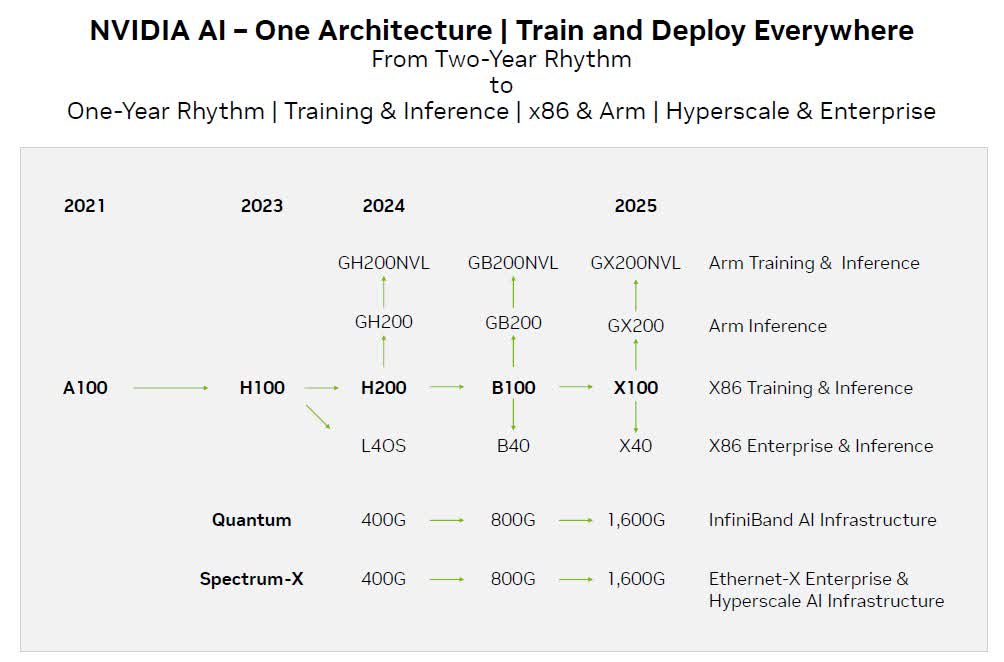

Analyst Vivek Arya, who has a buy rating and $650 price target on the GPU giant, said Nvidia is likely to release chip sets for Arm training and inference, Arm inference, x86 training and inference, as well as artificial intelligence infrastructure and Enterprise and Hyperscale AI infrastructure in 2024 and 2025, as per the company's updated product pipeline.

Additionally, Arya said while the roadmap doesn't show manufacturing nodes, it's likely that Nvidia ( NVDA) will be amongst the first companies to bring AI accelerators to 3 nanometer processors and perhaps 2 nanometers as well. Smaller nanometer processors are known as leading-edge, or more advanced than larger, or trailing-edge processors.

"Similar to NVDA’s strategy in gaming where products span the $50-$1,500 price ranges, we believe the new data center roadmap disclosure suggests widening product breadth with an accelerated launch cadence that can continue to make it tougher for merchant competitors ... to catch-up or internal cloud silicon efforts to prove themselves in the era of rapidly rising silicon cost/complexity," Arya wrote in an investor note, referencing Nvidia's competitors in the data center, AMD (NASDAQ: AMD) and Intel (NASDAQ: INTC).

Though Nvidia and Intel are rivals in the data center market, Arya posited that Nvidia could turn to Intel as a potential foundry partner and use its 18A manufacturing node, while still keeping Taiwan Semiconductor ( TSM) as its primary foundry.

Generative AI

Generative artificial intelligence is the topic of the year in technology, thanks to chatbots such as ChatGPT. However, these apps and services require loads of computing power to power the large language models used to train them, which Arya said results in a need for "scale compute optimization," or the most efficient computing power at significantly high levels.

And for now, Nvidia's approach via systems and software is in stark contrast to the "silicon-only" approach of rivals.

(Earlier this week, AMD announced it was acquiring open source AI software company Noda.ai in an effort to boost its software capabilities).

With Nvidia seeming likely to stay out in front of its rivals, Arya said there could be upside to the revenue it's likely to generate from data centers over the next three calendar years, estimated to be worth around $42B, $70B and $88B, respectively.

Nvidia is slated to report third-quarter earnings on November 21. A consensus of analysts estimate that the company will earn $3.35 per share on $15.89B in revenue for the coming period.

seekingalpha.com |

BING-JHEN HONG

BING-JHEN HONG