Camtek shines after reporting record-high Q3 revenue

Nov. 12, 2024 11:07 AM ET

By: Brandon Evans, SA News Editor

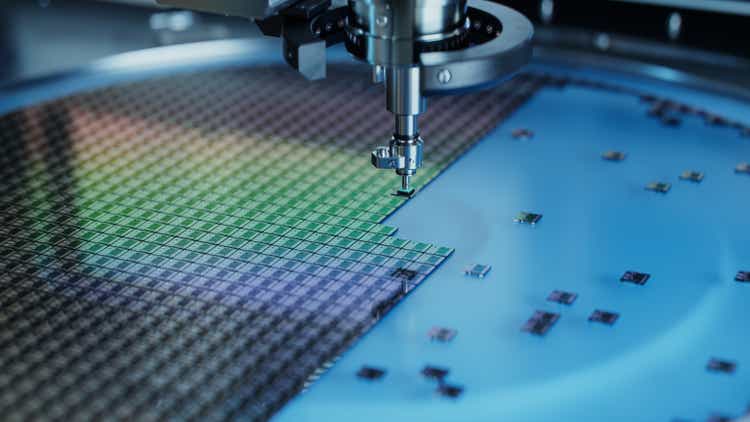

SweetBunFactory SweetBunFactory

Camtek (NASDAQ: CAMT) shares shot up 6% during Tuesday market action after the company revealed record-high revenue in its third quarter 2024 financial results.

The Israel-based Camtek reported third quarter revenue of $112.3M, which was a 40% year-over-year increase and a quarterly record. It also beat the consensus estimate of $108.7M. Adjusted earnings per share of $0.75 also topped the estimate of $0.69.

Looking ahead, Camtek expects fourth quarter revenue of $115M, which surpassed the estimate of $113M. Full-year 2024 revenue is targeted at $427M, which would represent 35% growth year over year and set a new annual revenue record for the company.

Camtek develops and manufactures high-end inspection and metrology equipment for the semiconductor industry. The company said High-Performance Computing, or HPC, is driving the revenue gains. HPC includes advanced artificial intelligence packaging applications such as high-bandwidth memory and chiplet.

"Looking ahead, the demand in the HPC segment remains healthy," said Camtek CEO Rafi Amit. "We expect the overall contribution of HPC to our business this year to be around 50% and expect it to be a major growth driver in 2025 as well. We also see an increased demand for a wide range of other applications."

"We see these comments, along with commentary that demand is broadening across a wider range of applications, as positive signs likely to drive a relief rally for the stock," said Stifel analysts, in an investor note.

Stifel assigned the stock a Buy rating.

Camtek competitors remained mostly static following the results. Coherent (NYSE: COHR) was flat, while F5 (NASDAQ: FFIV) was up 0.25%. Logitech International (NASDAQ: LOGI) slid 2%. |

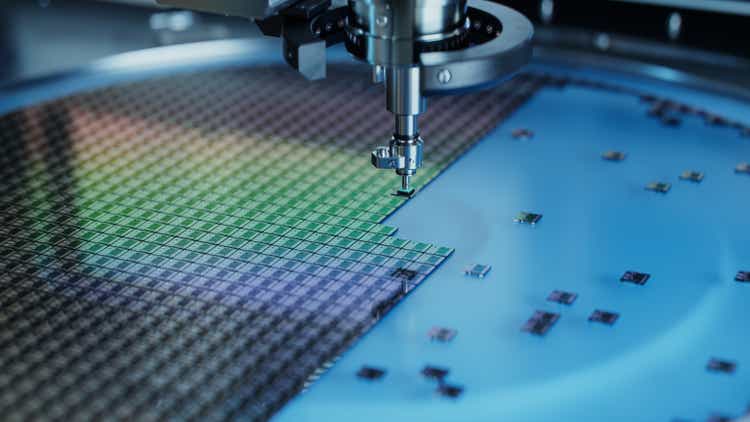

SweetBunFactory

SweetBunFactory