The value of the currency is an effect, not a cause indeed.

Although I'm far from a big fan of Friedman, he got it right on inflation - "Inflation is always and everywhere a monetary phenomenon", and caused by excess creation of it... by every central bank.

Same with Keynes:

"By this means government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft."

-- John Maynard Keynes (the father of 'Keynesian Economics' which our nation now endures) in his book "THE ECONOMIC CONSEQUENCES OF THE PEACE" (1920). (this is in the context of speaking about the ability to control money supply)

And its not a recent phenomena:

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was every invented. Banking was conceived in inequity and born in sin . Bankers own the earth. Take it away from them but leave them the power to create money, and with a flick of a pen, they will create enough money to buy it back again . Take this great power away from them and all great fortunes like mine will disappear, for then this would be a better and happier world to live in . But if you want to continue to be the slaves of bankers and pay the cost of your own slavery, then let bankers continue to create money and control credit."

-- Sir Josiah Stamp, president of the Bank of England and the second richest man in Britain in the 1920's, speaking at the University of Texas in 1927

"The national budget must be balanced. The public debt must be reduced; the arrogance of the authorities must be moderated and controlled. Payments to foreign governments must be reduced, if the nation doesn't want to go bankrupt. People must again learn to work, instead of living on public assistance."

-- Cicero, 55 BC

Banks can also print all the money they want, but they can't control where it goes (if anyone has that quote, please let me know - and I don't have the ability to respond to private messages)... and when there are very real and long standing supply issues, as with food and various commodities, its almost inevitable it will go there since the returns are good.

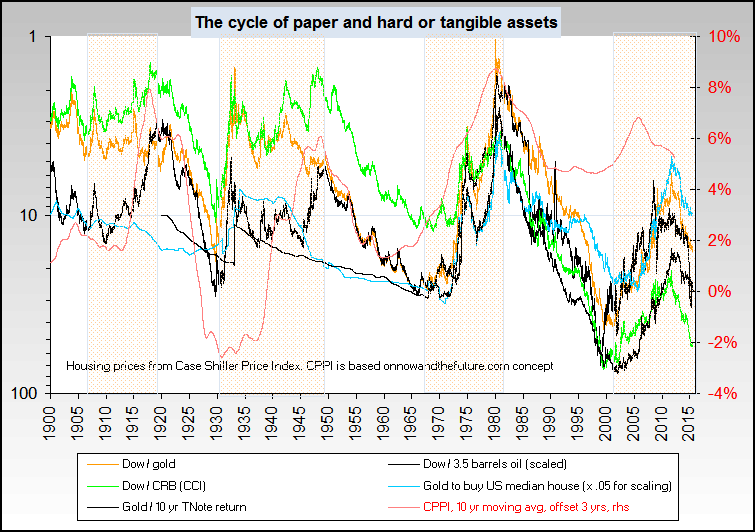

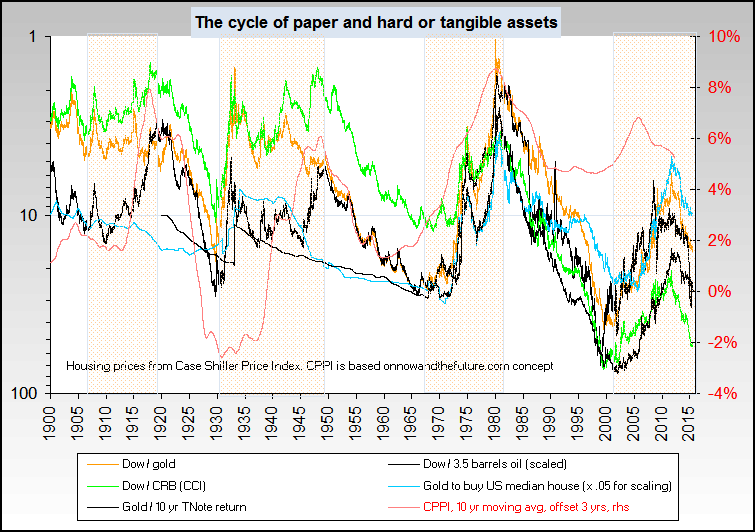

And then there's also the extremely long term fact based very high correlation between inflation and tangibles as shown in my partially tongue in cheek "the one chart to rule them all":

|