Supply chain

Global ESS shipments hit 286 GWh as Tesla and Chinese heavyweights out front, InfoLink says

Global energy storage shipments jumped 84.7% in the first three quarters of 2025, with Tesla and Chinese manufacturers leading the charge.

By

Vincent Shaw

Dec 05, 2025

Markets

Supply chain

Image: Infolink

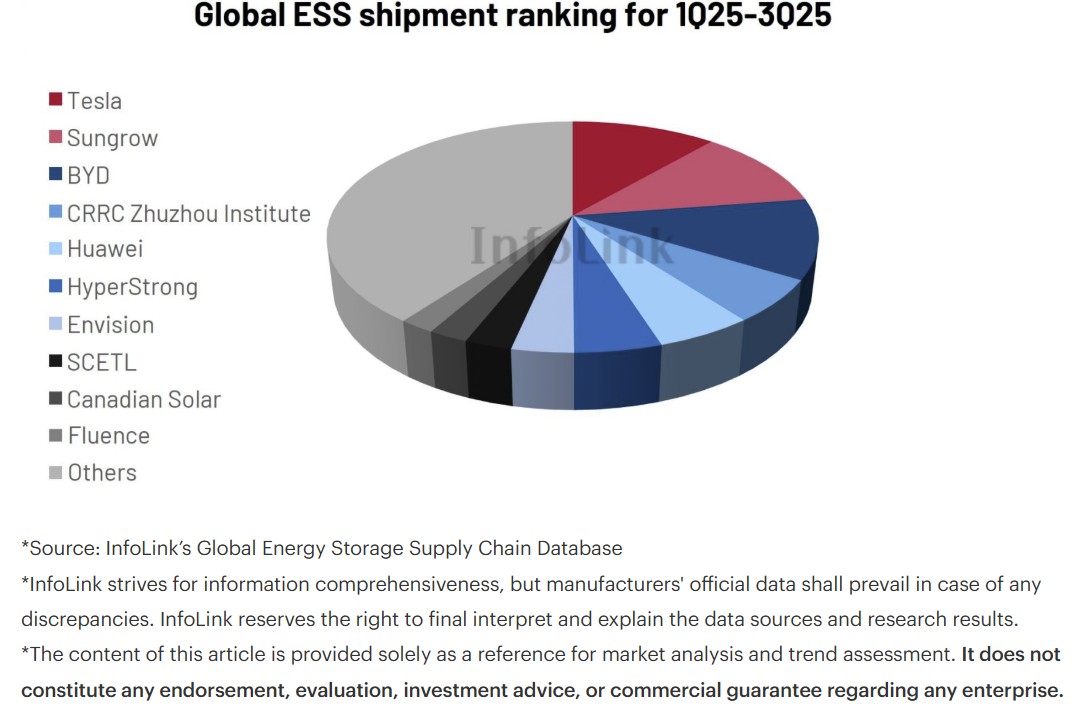

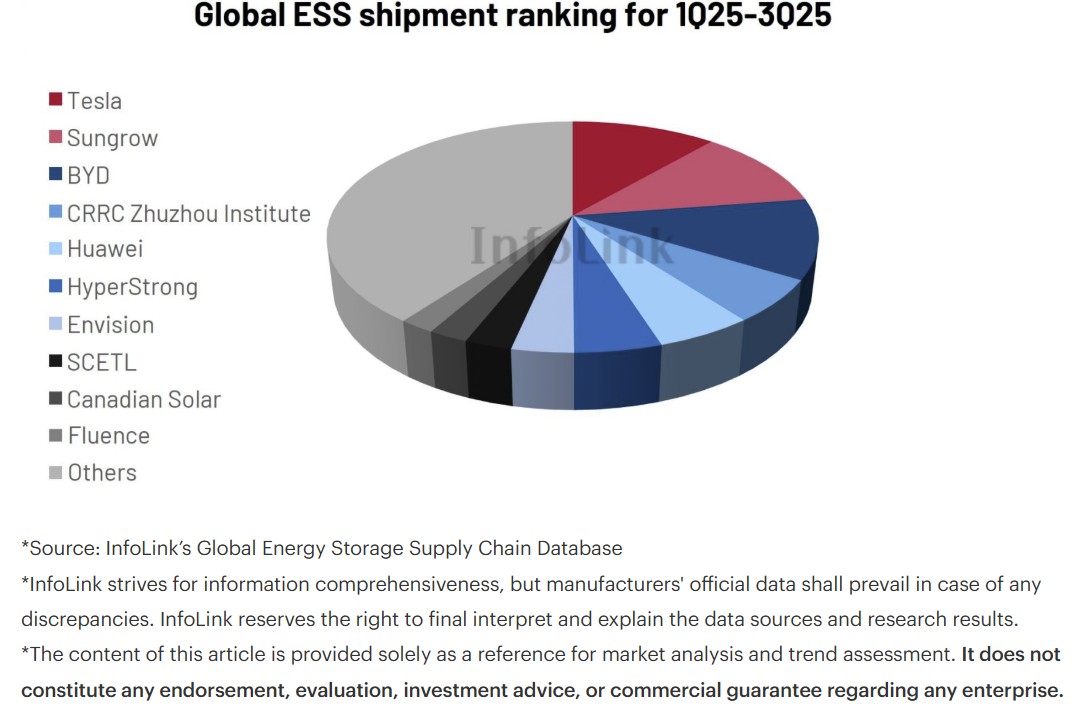

InfoLink’s latest ranking, drawn from its energy-storage supply-chain database, shows global ESS shipments reached 286.35 GWh in 1Q–3Q 2025, with volumes exceeding 100 GWh in a single quarter for the first time in Q3. Market concentration remained high: the top ten suppliers (CR10) accounted for roughly 60% of shipments, indicating the emergence of a clear leading cohort even as no single company has achieved dominance.

Across all ESS system shipments, the top five suppliers were Tesla, Sungrow, BYD, CRRC Zhuzhou Institute and Huawei. InfoLink characterizes competition among the top three as “fierce”, noting that while they maintain a clear lead in market share, their internal ranking has been reshuffled and is likely to keep shifting through 2026.

A central theme in the report is the rise of emerging markets. Leveraging large orders from these regions, leading suppliers have expanded their geographic coverage beyond core markets such as China and the US. According to InfoLink’s Emerging Market Energy Storage Demand Database, shipment growth in these newer markets has already outpaced that of traditional centres, making diversified regional exposure increasingly critical for maintaining long-term leadership.

The Asian supply chain remains pivotal. US-based players such as Tesla and Fluence have established system-integration facilities in Asia, a move InfoLink expects will narrow their cost gap with Chinese rivals.

A further structural trend is PV–storage integration. Major solar manufacturers have pushed deeper into ESS, blurring the line between module suppliers and system integrators. Canadian Solar, supported by its position in North America, has entered the global top ten ESS suppliers, while Trina Solar and JinkoSolar are posting rapid growth that could see them challenge today’s storage leaders as early as 2026.

The utility-scale segment continues to anchor global demand. Shipments reached 252.5 GWh in the first three quarters, while CR5 slipped to 47.3% quarter-on-quarter, signaling intensifying competition among top suppliers. The leading five manufacturers were Sungrow, BYD, Tesla, CRRC Zhuzhou Institute, and HyperStrong, with BYD overtaking Tesla for second place in the third quarter. Looking ahead to the full year, InfoLink identifies Sungrow, BYD, and Tesla as the primary contenders for the 2025 utility-scale crown.

In the residential market, global ESS shipments reached 26.6 GWh in 1Q–3Q 2025, with third-quarter volumes close to 10 GWh. The top five suppliers were Tesla, Huawei, BYD, Pylontech and Deye. Here, CR5 rose to 50.9%, about three points higher than in the previous quarter, with Tesla and Huawei clearly widening their lead over smaller competitors.

Looking ahead, InfoLink expects global ESS shipments to approach 400 GWh in 2025, roughly 60% growth year on year, and to climb to around 600 GWh in 2026, maintaining strong momentum. At the same time, the consultancy flags rising price signals in midstream and upstream segments, warning that the ability of system integrators to control supply-chain costs, secure constrained capacity and protect margins will be a key differentiator in the next phase of competition.

Headquartered in Taipei, InfoLink is an independent renewable energy market research and consulting firm, providing PV and energy storage data, price assessments and industry analysis.

ess-news.com

My comments:

The Chinese will dominate this segment going forward.

Unfortunately for Tesla most of it's battery cells are sourced from..

China |