UCOI Gold & Silver -

Hit Longtime Highs -

with the help of fund buying Thursday -

as a soft U.S. dollar and strong crude oil -

generated enough upward momentum to trigger -

technically oriented buying -

Gold and Silver futures soared to multi-month highs

February Gold rose $11.10/oz to fiatz$652.90 an ounce

on the Comex division of the

New York Mercantile Exchange -

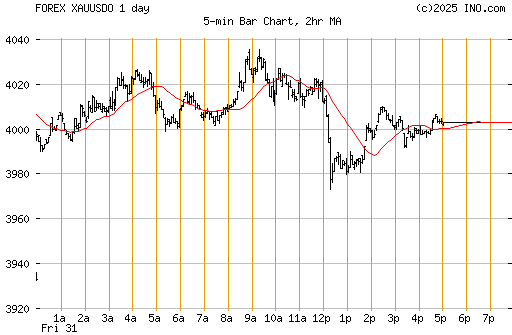

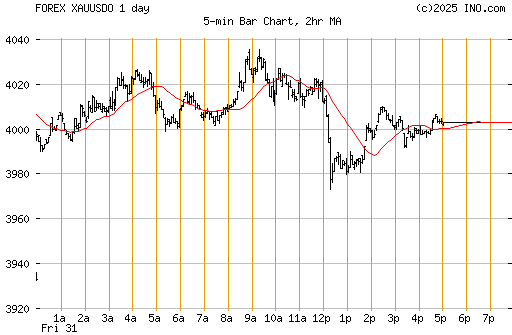

Gold Spot (FOREX:XAUUSDO) -

As it was closing, the February contract -

at the Chicago Board of Trade was up -

$10.70 to fiat$652.40/oz

Comex March Silver gained 35.5 cents to $14.115/oz. -

As it was closing, CBOT

March Silver was up 36.4 cents to $14.112/oz -

SILVER 5000 OZ Dec 2006 (CBOT:ZI.Z06.E) -

"We got a little help from the crude market,"

said Dave Meger, senior metals analyst --

"Firmness from the crude will continue to leak

into the other commodity markets, particularly Gold."

As of the close in Comex Gold, Nymex January crude oil

had been as high as $63.30 a barrel, its strongest level

in roughly a month.

The major commodity indices were all higher, and

precious metals tend to benefit from strength in

commodities as a whole, Meger said.

And, he continued, the slumping U.S. dollar is boosting

the metals and commodities in general -

The euro firmed as high as $1.3274 against the dollar,

its strongest level since March 2005.

The British pound hit a 14-year high against the dollar

at $1.9698.

"From a technical perspective, Gold and Silver continue

to look good," said Meger.

"There is a lot of talk about a technical breakout today."

Buy stops were triggered and fund buying was reported,

he said.

"Funds are generally momentum-based and technically

motivated," Meger added.

Gold and silver had been working lower earlier this fall -

That was mainly a continuation of consolidation after

the sharp run-up that occurred from 2005 into spring

of 2006, when both metals hit their strongest levels

in more than two decades, said Jes Black, fund manager.

"What are dictating the market's moves right now are

two things -

No. 1, we are breaking out of a very large consolidation

pattern after a very large run-up (last spring),"

said Black.

"The dollar's bad news is a catalyst pushing

it even further up out of the consolidation pattern."

Any breakout from a consolidation period tends to

capture the attention of traders, he explained.

"A trader looks at that and says, 'Wow, that's a

consolidation pattern.

That's going higher, so I'm going to buy.'"

Black said he looks for a retest of the highs -

from earlier in the year for Gold and Silver -

Gold had broken higher against all of the major currencies

earlier in the year, and this appears -

to be happening again, Black added -

"This is not just a dollar story, but is a Gold story,"

he said."

We continue to think Gold will rise substantially

in the coming years -

not just against the fiat dollar but

against all of the major fiat currencies."

Comex Feb Gold peaked at $654.50/oz -

its strongest level since early September.

Comex March Silver got as high as $14.19/oz

its strongest level since the middle of May -

The dollar hit longtime lows after disappointing

U.S. manufacturing data.

The Chicago Purchasing Managers Index slipped

to 49.9 in November from 53.5 in October,

when a 54.8 reading had been forecast.

The 50 level is generally seen as the breaking point

on whether the manufacturing sector is expanding or

contracting -

There had been limited forex reaction to economic data

earlier in the morning that included a rise of 0.4%

personal income in October (forecast 0.5% rise),

an increase of 0.2% in personal spending (0.1% rise forecast)

and an unexpected jump of 34,000 first-time weekly jobless

claims to 357,000 (forecast 3,000 rise).

Meanwhile, January platinum rose $24.30 to $1,176.70 an

ounce.

March palladium gained $6.85 to $334.35 an ounce -

"It's on the back of stronger crude oil and a weaker

U.S. dollar," said a desk trader.

Another trader commented that platinum may have drawn

some buying when technical support held.

In particular, he pointed to the 30-day moving in spot

metal near $1,150/oz

The main U.S. economic report on the calendar for Friday

is the Institute for Supply Management's manufacturing index,

expected to rise to 52.0 in November

from 51.2 the prior month.

This is due out at 10 a.m. EST along with

construction spending, forecast to be down 0.3% in October.

Several Federal Reserve officials are scheduled to make

appearances Friday, including Chairman Ben Bernanke

delivering a welcome speech to the

International Research Forum in Washington at 9 a.m. EST.

Settlements (open-outcry trading only):

London PM Gold Fix: $646.70 versus $637.50 Wednesday

U.S. spot Gold at p.m. ET: $647.55, up $11.15 from

previous day; Range:

$636.50-$648.95

February Gold (RGCG07) $652.90, up $11.10;

Range $646.50-$654.50

March Silver (RSIH07) $14.115, up 35.5 cents;

Range $13.95-$14.19

January platinum (RPLF07) $1,176.70, up $24.30;

Range $1,163-$1,182

March palladium (RPAH07) $334.35, up $6.85;

Range $331-$335

U.S $ INDEX (NYBOT:DX) -

Are the lemmings following LT Bucky? -

investorshub.com

Note.

The SEC - is a shame and disgrace to -

United State Of America -

for not been able to shut down the nss terror -

of illegal criminals to naked short sellings -

which been going on and increased since 9/11 -

666 terror plot -

The SEC - is a shame, disgrace and disgust to -

The World & Mining Industry -

United State Of America -

IMO!

Founded in 1911 by Samuel Dolbear -

Behre Dolbear -

is one of the oldest, continually operating minerals industry

consulting firms in the world -

Since its founding, the company has spanned the industry

from the primitive pick and shovel days of mining to

the computer age of geostatistics.

The company specializes in performing studies and consulting

for a wide range of businesses with interests in

the minerals industry, including:

* major and junior mining companies

* banks and other lenders

* venture capital syndications and private individuals

* government agencies

* native or First Nations peoples, tribes, or bands.

* mineral and other landholding companies

From offices around the world, the firm has performed

assignments across the whole spectrum of commodities

including base and precious metals, coal and lignite,

ferrous metals, uranium, industrial minerals and gemstones -

More about

Behre Dolbear -

they have the experience in the mining industry to Rec. -

UNICO INC. -

Great old US, Utah Gold & Silver Mines treasure Ore chests -

still has to be opened up recommisioned re-started

and the hard asset values of the PM metals of -

Gold, Silver, Copper, Zinc, Lead - PMG -

Uranium - rare earth strategic Ore minerals etc.

dolbear.com

investorshub.com

|