Silver in 1477 Peaks at $806/oz that is 520 years ago -

Year 1477 fair Ag market price was higher than the Gold price -

Investors have been told to calculate inflasion into prices -

well calculate the inflasion cost into the Silver price -

for the last 520 years and please tell me what the fair

Silver market value price should be today? -

Cerro Rico INCA Silver price 1477 was $806.- per ounce -

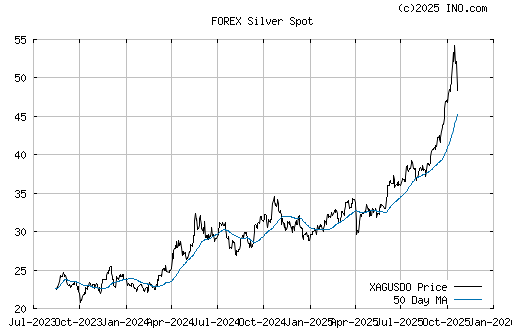

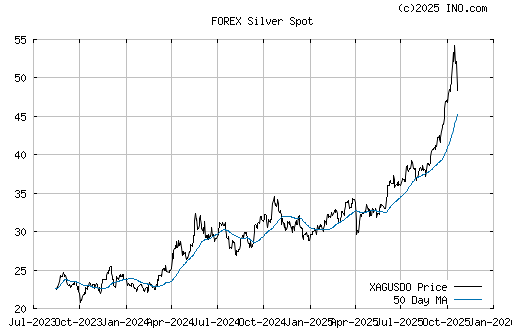

Silver - TA Long Term LT - oversold - undervalued -

the LT manipulations creates hardship for all Silver money -

Silver miners and collectors worldwide -

Experts telling that in the future Ag will explode -

The more manipulation the higher the Silver will fly -

History often repeat itself -

(to see the 600yearsilver chart better -

put your mouse arrow to the box -

use the right side -

button on your mouse -

click view image)

Franklin & COMIBOL Set to Recover Gold, Silver & Zinc -

Franklin & COMIBOL NEWS Set to Recover Gold, Silver & Zinc -

Cerro Rico & Pulacayo Projects May Hold Increased Potential

LAS VEGAS, NV -- (MARKET WIRE) -- January 24, 2007 --

Franklin Mining, Inc. -

(FMNJ) and its wholly owned subsidiary,

Franklin Mining, Bolivia SA,

are set to begin retrieving gold, silver and zinc

under terms of a COMIBOL partnership agreement.

Franklin Mining, Inc.'s partnership with COMIBOL

was the first to be signed with an American company

since 1952.

Metals Markets Continue Strong Performance:

With Gold's seven week high and Tin's all time high,

with Silver's strength despite forecasts for a decline

in demand and with recent projections that China's Zinc

consumption could rise as much as 56% by 2010 --

total revenues and profits from both the Cerro Rico

and Pulacayo projects stand to increase significantly

as world-wide demand and pricing continue these

upward trends.

Cerro Rico de Potosi:

Franklin's partnership agreement with COMIBOL to -

begin redevelopment of the historic -

Cerro Rico de Potosi Silver Mine -

promises to yield significant profits which will be

shared equally by Franklin and COMIBOL once Franklin's

initial investment has been repaid.

Reports provided by COMIBOL on Franklin's assigned veins

in the Cerro Rico have indicated yields

totaling 36,274,137 Troy ounces of silver;

586,117,434 pounds of Zinc;

and 159,518,908 pounds of Tin.

When the partnership agreement was originally prepared,

Franklin/COMIBOL projected the total value of these five

veins to be approximately $2.2 Billion (USD).

Highlighted Links

MacReport.Net

Franklin Mining, Inc.

Pulacayo Mining Fields: Franklin is also set to begin

processing tailings found in the Pulacayo Mining Fields.

Yields from these tailings deposits are estimated to

total 7,973,507 Troy ounces of Silver and 128,605 Troy

ounces of Gold.

At the time of this agreement's preparation, recovery

rates from this tailings field were conservatively

estimated at 60%, yielding approximately $109 Million (USD).

The pilot plant necessary to process tailings is now in

La Paz, Bolivia and ready to be relocated to

the Pulacayo work site -

(please see our Jan 9, 2007 Press Release on this project).

Additional information on Franklin projects can be found at

franklinmining.com.

About Franklin Mining, Inc.

Franklin Mining, Inc. has interests in the United States,

Argentina and Bolivia which include a wholly owned subsidiary,

Franklin Mining, Bolivia, as well as 51% interest in

Franklin Oil & Gas, Bolivia and 51% interest in

Franklin Oil & Gas, Argentina.

DISCLOSURES:

"Safe Harbor" statement under the Private Securities

Litigation Reform Act of 1995: ---- These risks could cause

Franklin Mining, Inc.'s actual results to differ materially

from those expressed in any forward-looking statements made

by, or on behalf of, Franklin Mining, Inc.

For Further Information check out our website franklinmining.com or

contact:

Investor Relations:

Mr. Andrew Austin

1-702-386-5379

SOURCE: Franklin Mining, Inc.

A government feasibility study calculated -

on shallow drilling results -

subterranean mine burrowing into -

the Cerro Rico could produce -

266 million ounces of Silver over 25 years -

churning through 54 million tons of ore -

graded Ag at 182 grams per ton -

Eyeing the bigger load lurking in the lure of -

the Cerro Rico - mountain's interior, which

estimated at shallow upper chamber levels -

a minimum 250 million ounces of Silver worth billions -

of fiats remain for -

FMNJ Mission - with social majority resp. accepted -

in Potosi -

Rhodium $5005.- per ounce - Silver to follow -

kitco.com

Its a start - Silver above $800.- per ounce in 1477 -

gold-eagle.com

fig. the inflasion since - the Silver would be much more

than $8000.- per ounce today -

(if it was a fair market playingfield -

without ratchillz banksterz manipulated the market -

since the past 500 years) -

Are the lemmings following LT Bucky? -

U.S $ INDEX (NYBOT:DX) -

FMNJ - dd --

franklinmining.com

FMNJ - Cerro Rico - Inca - Potosi or “Rich Mountain” -

great bonanza periods have been reported for the quality

of the mineral, with ore contents between 1,500 and

9,000 Silver ounces per ton -

and est. reserves are about 938,130 kgs of Silver -

by very shallow drilling -

250,004 tons of zinc - by very shallow drilling -

dd --

The Worlds Richest Silver Mines -

has been mined for more than -

- 500 years -

Est. 1864 -

Franklin Mining - Cerro Rico Palivari II Alternative III - Bolivia -

tinyurl.com

investorshub.com

FMNJ - Mission |