To Silver Super Bull on 'Silver Super Bull' -

my prime concerns are with FMNJ and the miners -

the poor working conditions and safety standard -

which still exist and have been poorly improved -

since centuries back -

the fmnj share price is also of corcern -

for with a fair FMNJ market share price -

it will be more easy for FMNJ to -

carry out our FMNJ Mission -

franklinmining.com

To Be Socially Responsible:

FMNJ will take a percentage of our profits and donate them -

for community programs to help with social situations -

such as health care and care for homeless children etc. -

I looking forward to that it will be great success for all

people of Potosi and fmnj's shareholders -

a hand in hand Blessing for all -

Note.

some short video of Cerro Rico, Potosi -

current mines conditions and history -

Visit of the Silver Mines of Potosi -

by Susan -

youtube.com

Visite de Potosi (Bolivie) et de sa mine d'argent,

In der Silberminen von Potosi (Bolivia) ,

Potosi (Bolivia), las minas de plata

Potosí is a city, the capital of the department of Potosí

in Bolivia.

It is at an altitude of 3967 meters and has about 115,000

inhabitants.

It is claimed to be the highest city in the world.

It lies beneath the Cerro Rico ("Rich mountain"), a mountain

of silver ore, which has always dominated the city.

youtube.com

Founded 1546 as a mining town, it soon produced fabulous wealth,

becoming the largest city in the Americas (except for Mexico

City) with a population exceeding 200,000 people.

youtube.com

In Spanish there is still a saying "vale un Potosí" meaning

"worth a fortune" and, for Europeans, "Perú"—Bolivia

was part of the Viceroyalty of Perú and was known as

Alto Perú before becoming independent— was a

mythical land of riches.

Potosí is the only American city mentioned in

Miguel de Cervantes's famous novel satirizing chivalry,

Don Quixote, with clear reference to its riches.

It is from Potosí that most of the Spanish silver came.

Indian labour, forced by Francisco de Toledo,

Count of Oropesa through the traditional Incan

mita institution of contributed labor, came to die

by the thousands, not simply from exposure

and brutal labor, but by mercury poisoning:

in the paved patio the silver-ore,

having been crushed to powder by hydraulic machinery,

was cold-mixed with mercury and trodden to an amalgam

by the native workers with their bare feet.

[1] The mercury was then driven off by heating,

producing deadly vapors.

After 1800 the silver and tin the main products -

This eventually led to a slow economic decline.

Still, the mountain continues to be mined for silver

to this day.

Due to poor worker conditions (lack of protective equipment

from the constant inhalation of dust), the miners still

have a short life expectancy with most of them

contracting silicosis and dying around 40 years of age.

It is estimated that, in the past years of Incan labour,

roughly 8 million indians died "eaten" by the Rich Hill.

During the War of Independence (1809--1825, see History

of Bolivia) Potosi frequently passed between the control

of Royalist and Patriot forces.

Major blunders by the First Argentine Auxiliary Army

(under the command of Juan José Castelli) led to an

increased sense that independence was needed and

fostered resentment towards Argentina.

During that occupation there was anarchy and martial excess,

and Potosi became unfriendly to the point where it could

not be defended.

When the second auxiliary army arrived it was received well,

and the commander, Manuel Belgrano did much to heal the

past wounds inflicted by the tyrannical minded Castelli.

When that army was forced to retreat, Belgrano took

the calculated decision to blow up the Casa de Moneda.

Since the locals refused to evacuate this explosion

would have resulted in many casualties, but by then

the fuse was already lit.

Disaster was averted not by the Argentinians who at that

time were fleeing, but by locals who put the fuse out.

In one stroke the good feelings Belgrano delicately built

were destroyed.

Two more expeditions from Argentina would seize Potosi.

----

RE:

FMNJ current shares price -

FMNJ Mkt.cap is appr. $34.1 million -

My estimation of FMNJ Franklin's Mines in US is

higher than the total mkt.capitalization -

to me the fmnj mkt.cap. is total unfair and

without any common sense -

compared vs. to other Silver minings properties -

around the world -

Note. the Silver mines info below needs to be upgraded -

for the last three month Mkt. cap. action is not included -

Market Cap. To The Largest Silver Undeveloped Deposits -

Include Market Capitalization for the Mining corp. -

SIL SILVER Bullions Mar 2007 -

(NYMEX:SI.H07) - liveSilverchart -

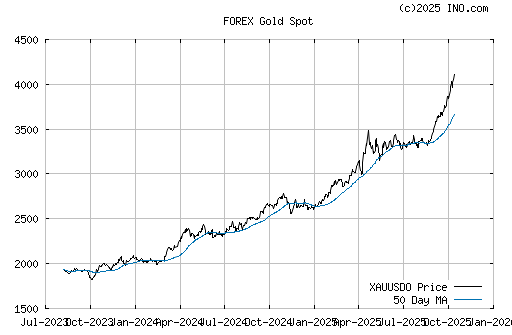

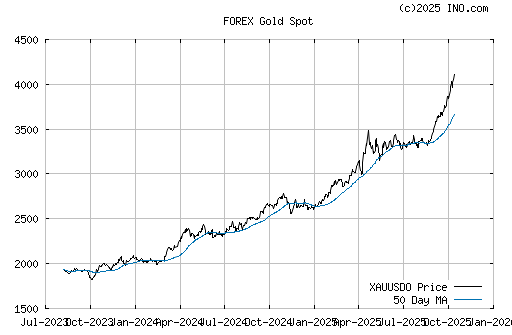

SIL GOLD Bullions (FOREX:XAUUSDO) - liveGoldchart -

Apex Silver Mines Limited - SIL -

Market Cap. $836.85 mil

Silver Deposits 20 Largest Undeveloped - Saved To The World's Liberty -

Most investors compare one good comp. to the rest -

to find what is undervalued to oversold -

to find the great strategic bargain -

with the most potentials to growth -

profit etc. -

to be at the right place -

at the right time -

Compare Apex Silver Mines Limited - SIL -

dd........ to other mining companies -

Silver Deposits 20 Largest Undeveloped - Saved To The World's Liberty -

Fys. DD........

Cerro Rico – Bolivia –

Corporación Minera de Bolivia [COMIBOL]

and Franklin Mining Inc (FMNJ) -

Market Cap. $66 mil.

investorshub.com

Subject 56926

Peñasquito, Mexico –

Glamis Gold [acquired by Goldcorp (GG) in early November] -

Market Cap. $11.4 bil.

investorshub.com

investorshub.com

Pascua-Lama, Chile –

Barrick Gold Corporation (ABX) -

Market Cap $25.42 bil.

investorshub.com

San-Cristobal, Bolivia –

Apex Silver Mines Limited (SIL) -

Market Cap. $836.85 mil

investorshub.com

Navidad, Argentina –

Aquiline Resources Inc. (AQI) and IMA Exploration (IMR)

are in a legal fight over ownership? -

investorshub.com

Market Cap. $327.84 mil.

investorshub.com

Corani, Peru –

Bear Creek Mining Corp. (BCM) -

Market Cap. $322.48 mil.

investorshub.com

Ocampo, Mexico –

Gammon Lake Resources Inc. -

Market Cap. $1.86 bil.

investorshub.com

Montanore, Montana, USA –

Mines Mangement, Inc. (MGN)

Market Cap. $71.85 mil.

investorshub.com

Veladaro, Argentina –

Barrick Gold Corporation (ABX) -

Market Cap $25.42 bil.

investorshub.com

Rock Creek, Montana, USA, –

Revett Minerals Inc. (RVM) -

Market Cap. $79.27 mil

investorshub.com

Prognoz, Republic of Sakha, Russia –

High River Gold Mines Ltd. (HRG)

Market Cap. $499.69 mil.

investorshub.com

Hackett River, Nunavut, Canada –

Sabina Silver Corporation (SBB) -

Market Cap. $112.95 mil.

investorshub.com

Maverick Springs, Nevada, USA –

Silver Standard Resources (Vista Gold) (SSRI)

Market Cap. $2.05 bil.

investorshub.com

Market Cap. $256.26 mil.

investorshub.com

Pirquitas, Argentina –

Silver Standard Resources Inc. (SSRI)

Market Cap. $2.05 bil.

investorshub.com

San Bartolome, Bolivia –

Coeur d Alene Mines Corporation (CDE)

Market Cap. $1.21 bil.

investorshub.com

Dolores, Mexico –

Minefinders Corporation Ltd. (MFN)

Market Cap. $484.62 mil.

investorshub.com

Palmarejo, Mexico –

Palmarejo Silver and Gold Corporation (PJO) -

Market Cap. $805.81 m

investorshub.com

Candelaria, Nevada, USA –

Silver Standard Resources Inc. (SSRI) -

Market Cap. $2.05 bil.

investorshub.com

Waterloo, USA –

Pan American Silver Corp. (PAAS) -

Market Cap. $2.14 bil.

investorshub.com

Bowdens, New South Wales, Australia –

Silver Standard Resources Inc. (SSRI) -

Market Cap. $2.05 bil.

investorshub.com

WHAT MADE CERRO RICO SO BIG? -

Cerro Rico dominates the town of Potosi, and

its Ag production has never been matched.

When one compares Cerro Rico to other BPV deposits,

three features stand out as being exceptional:

* The phenomenal Silver resource -

with Zinc, Lead, Tin, PM's Gold etc. -

* Cerro Rico - INCA - has produced -

almost five times more Silver than any other BPV deposit -

* still only at the top of the huge deeper deposits -

still intact about 12000' (3700 m) above sea level -

and the mining has been done down to 25000' below sea level -

in South Africa -

Its a long way down yet to mine for Cerro Rico, Potosi -

The worlds largest and richest Silver Mines -

Imo. Tia.

God Bless

tinyurl.com

investorshub.com

investorshub.com

|