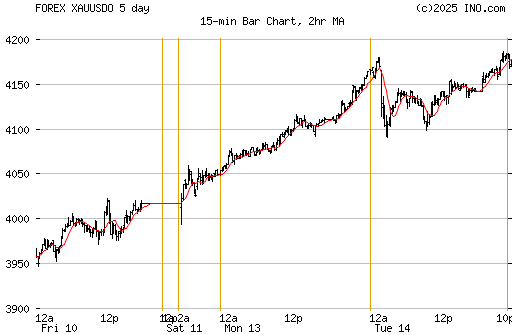

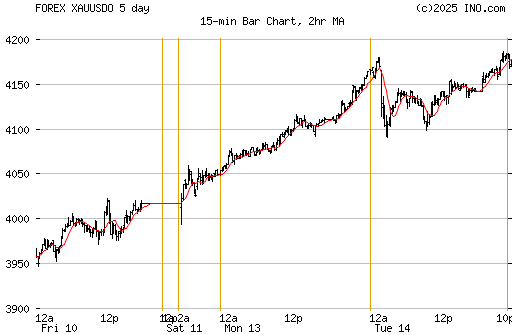

Gold rises in London as dollar hits new record low against euro

LONDON (Thomson Financial) -

Gold rose in London as the dollar fell to a new record low

against the euro in the wake of a dismal retail sales

report that showed consumer spending plunged in June amid

the ongoing housing crunch.

The Commerce Department said retail sales in June

recorded their biggest fall since August 2005.

The data disappointed analysts, who were expecting a rise

in sales as a result of falling auto purchases.

At 1.54 pm, spot gold was quoted as 667.00 usd an ounce,

compared with 655.40 before the data's release.

The metal was quoted at 666.90 usd in late New York

trades yesterday.

The dollar hit a new record low against the euro

of 1.3801 usd, from 1.3775 usd just before

the data release.

Against the pound the greenback sank to 2.034 usd, from 2.032.

Weakness in the US currency typically supports gold,

which is seen as an alternative investment

to the currency.

maytaal.angel@thomson.com ma/ejp

Gold hits 5-wk high, trade deficit hits $60 bln -

July 12 --

[fiatz$666.10/oz and Au for 888 times -

stamp-milling out 666 this year?] - when done -

Au gone fly -

Gold futures rose more than $6 an ounce Thursday,

to close at their highest level in five weeks,

as the dollar touched new lows against the euro

and the British pound and as oil prices remained high.

These factors combined to underpin investment demand

for the precious metal.

"The breakdown of the dollar is bringing investors

into the market," said Julian Phillips, an analyst.

"Both the gold price and the dollar breaking down through

long-term support is bringing professionals to adjust

their positions as well as short-term traders to

take advantage of the break through $665," he said.

Overall, the "change in the market mood after such a long

consolidation is more than noticeable.

We expect a lively market going forward," he said.

"Investors remained concerned at the vulnerability of

the U.S. dollar here," said Peter Spina, an analyst.

"From a technical perspective, the Dollar Index

is teetering at massive support," he said.

"Should there be a failure of support, the selling

is likely to accelerate and investors will flock to

precious metals."

The nation's trade deficit reached $60 billion in May,

on record trade flows across U.S. borders to meet rising

demand at home and abroad, the Commerce Department

reported.

Northgate Minerals Corp. NXG Last: 3.25

Change: +0.10(+3.17%)

Volume: 2.19 m

Last Trade: 3:59

DL 7/12/2007 10:49 PM

$6 price target for NGX -

Northgate Minerals Corp. (NGX : TSX)

Estimates upped on new gold & copper prices

Blackmont Capital maintains "buy",

12-month target price is raised to $6.00 -

Imo. Tia.

888c.com

God Bless

investorshub.com

investorshub.com

siliconinvestor.com

investorshub.com

Ps.

Its aproblem with fiatz we know -

we don't no know when all fiatz will be hit? -

but when it start -

EX.

With inflation at officially more than 3,700%

(some economists put it as high as 9,000%),

supermarkets are unwilling to comply,

so a price-control unit has been trying -

to enforce it -

news.bbc.co.uk |