The Fed's injection of funds – some $24 billion – came only two days after it decided to keep its policy on interest rates unchanged. In its statement Tuesday, the Fed noted that "credit conditions have become tighter for some households and businesses," but it did not mention a breakdown in the securitization market.

"A few days ago, it would have been advisable for the Fed to be more aggressive," says Mr. Zandi. "They are taking baby steps versus man-sized steps."

However, others felt the Fed took the right steps. "They're clearly vigilant. But are they sitting there with their finger on the panic button? We just don't think so," says James Sarni, a managing principal at Payden & Rygel in Los Angeles, which manages bond and money-market mutual funds.

In his press conference Thursday, President Bush tried to calm the markets. The fundamentals of the economy remain strong, he said. And, he added, "There is a lot of liquidity in our system. Liquidity will provide the capacity for our system to adjust."

The scope of the crisis began to dawn Thursday on Wall Street. The stock market opened sharply lower, with the Dow Jones Industrial Average off nearly 200 points in the morning.

"What caught everyone by surprise is the turbulence in the related hedge funds," says Fred Dickson, chief market strategist at D.A. Davidson in Lake Oswego, Ore. "In fact, it's been more of a shock factor than a surprise factor."

Mr. Dickson says the markets began to understand the severity of the problem on July 14, after the debt rating services downgraded $6.5 billion in subprime mortgages. Five days later, the Dow peaked at 14,000.41. "After that, it was like a seismic shock and you could see the fear levels rising," he says.

Until Thursday, most economists thought the problem in the securitization market was isolated. "It looked kind of localized," says Scott Brown, chief economist at Raymond James & Associates in St. Petersburg, Fla. "Credit standards seemed to be a little bit tighter, but there didn't seem to be a credit crunch here."

But the Fed's actions, while calming the markets somewhat, have made the markets realize they need to be alert, Mr. Brown says. "While no one thinks this will push the economy into a recession, there is a kind of nervous optimism," he says.

FED injected $12 billion of reserves into the banking system Thursday morning...Others also note that European and Asian investors may be at the center of the current credit malaise, but at least one believes there is more pain to come.

csmonitor.com

No mention of the usual suspects...

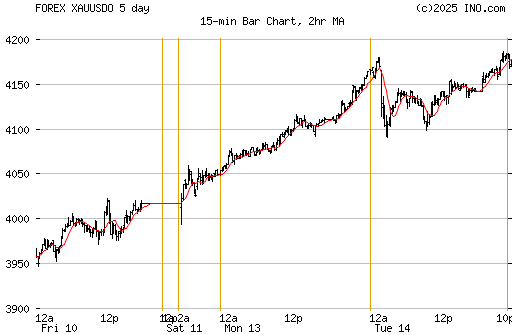

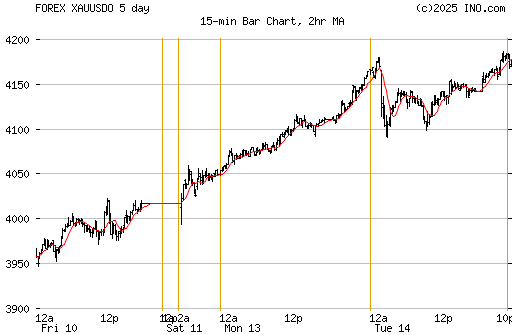

Gold fell. Not spiked! |