Why Are Investors Dumping Commodities?

Gary Gordon

posted on: March 20, 2008

seekingalpha.com

It's not atypical for investors to lock in profits. In light of a 420+ point up day for Tuesday's Dow, the profit taking was a near certainty.

Yet there was something different about the selling pressure this time around... and I'm not sure people picked up on it. Rather than go right back to "dumping" or "selling short" the financial sector, investors got rid of their biggest gainers.

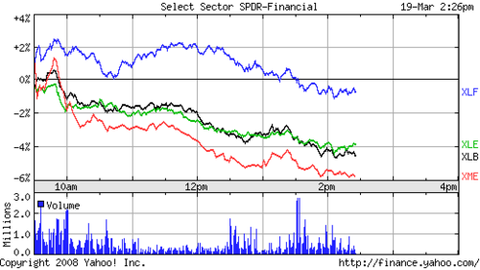

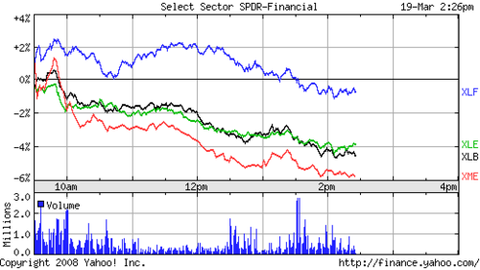

Yesterday, the S&P Select Financial SPDR (XLF) fared infinitely better than segments with far greater relative strength. Investors dumped Materials (XLB), Energy (XLE) and Mining (XME).

Why should that be? Isn't the story about global demand for "stuff" still compelling? Doesn't the world need gas, oil, metals, minerals, chemicals and paper?

And yet, the chart above shows yesterday's drag on commodity-related company stock. Perhaps this represents a shift in psychology from the 9-month credit crunch focus to the placement of a watchful eye on the "recession."

Although so many people have convinced themselves that the credit collapse is still in the early stages, there's a far greater likelihood that the world's going to pull itself and the U.S. through it. Not only did the Bear Stearns buyout/bailout serve as the "a big-one's-gotta-fail" poster child, but those who have studied Long-Term Capital in 1998 and the S&L Crisis of the 1990s recognize the tail end of financial implosions.

Will "credit" be more difficult to come by for months, maybe years to come? Sure. Nevertheless, the stock market has likely priced most of it in already.

That said, the stock market is still in the process of pricing in the extent of the current recession. We don't yet know how bad this thing is going to be for companies. More notably, a lengthy recession could prove to be a serious drag on demand for commodities.

Is the global growth story over? Doubtful. But yesterday's sell-off on companies that produce, manufacture and/or dig for "stuff" may speak volumes about the bull-bear battle ahead. |