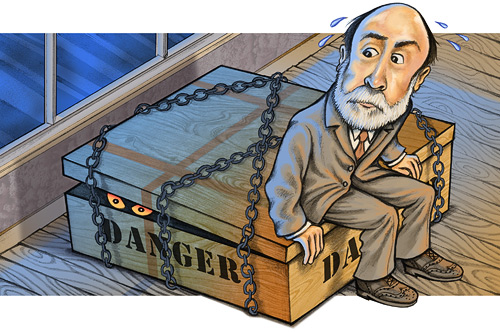

Fed Bailout - the predictable outcome... We are deleveraging.

Jamie, I heard you hold 16 Trillion in CDOs. How's that going?

<GGG>

May 22 (Bloomberg) -- The market for derivatives expanded at the fastest pace in at least a decade last year as the global credit crisis spurred trading in contracts used to hedge against losses, according to the Bank for International Settlements.

Derivatives, including those based on debt, currencies, commodities, stocks and interest rates, expanded 44 percent from the previous year to $596 trillion, the Basel, Switzerland-based bank said in a report today. The amount of credit-default swaps protecting investors against losses on bonds and loans more than doubled to cover a notional $58 trillion of debt.

jessescrossroadscafe.blogspot.com

The amount at risk in the entire derivatives market is $15 trillion, according to the BIS, which was formed in 1930 to monitor financial markets and regulate banks.

Hey, that's larger than US GDP, and it's NOT notional value,

it's real value! Got gold? <G> |