There is one thing about FNM, FRE which still puzzles me.

It has been widely cited that the worst excesses in housing occurred in the later 2006 and onwards; at a time when companies like CFC, IMB, WM and others originated the maximum volume, in questionable nonconforming contracts mostly in alt a,negams, IOs etc (see below).

During that time due to the high prices and the 417k cap, FNM and FRE always had amortizing loans, took on much less volume and on lower priced houses, increasingly being crowded out by the hotshot lenders as well as WBs Golden West and WM.

This means that FNMs and FREs portfolios should be (on average) in much better shape than the portfolios of the competitors which have due to growth in number of loans for even higher priced property a much higher share of new loans, anno 2006 and 2007.

So whats going on?? Does it mean Golden West and WM have even worse books?

Could it be that FNM and FRE were never adequately capitalised so they can´t stand comparably small losses?

See:

"During the boom, that is where other institutions jumped in with non-conforming loans such as Pay Option ARMs and jumbo loans that did not find a market and created a speculative fever. In fact, during the past decade Fannie Mae and Freddie Mac started losing a significant share of the mortgage market.

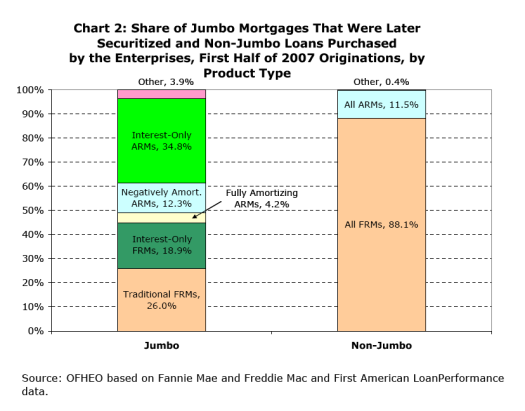

If you are curious to see how this market dislocation occurred, here is a snapshot of how the jumbo market for the first half of 2007:

doctorhousingbubble.com

As you can see, the non-jumbo market was rather bland and vanilla looking while the jumbo market is where much of the problems occurred. The push right now and the overwhelming mantra is to provide further liquidity. The market is in need of credit Drano and even with the current housing bailout bill which looks like it will pass, the idea was that Fannie Mae and Freddie Mac would be ready to saddle up to increase liquidity in the secondary market.

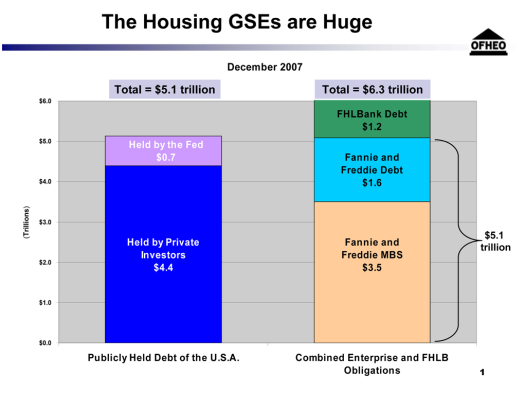

But this is really huge; too big to fail/rescue?

doctorhousingbubble.com |