Commercial Loan Defaults May Triple as Rents Decline (Update1)

Email | Print | A A A

By Hui-yong Yu

Dec. 22 (Bloomberg) -- U.S. commercial properties at risk of default could triple if rental income from office, retail and apartment buildings drops by even 5 percent, a likely possibility given the recession, according to research by New York-based real estate analysts at Reis Inc.

Lenders that used optimistic rent estimates to grant mortgages beginning in 2005 stand to lose as much as $23.1 billion, or 7.02 percent, of total unpaid balances if landlords lose 5 percent of net operating income, according to Reis. Analysts examined data on 22,890 properties that together may account for unpaid loans of about $329 billion in 2009, said Victor Calanog, director of research.

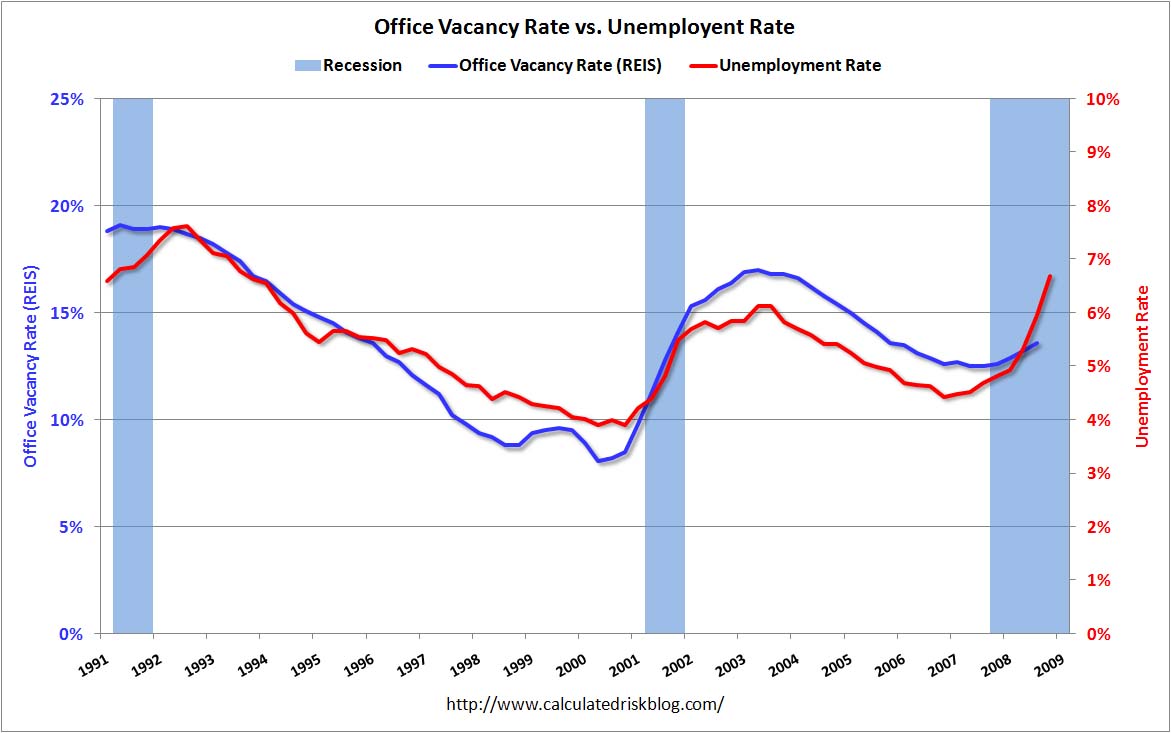

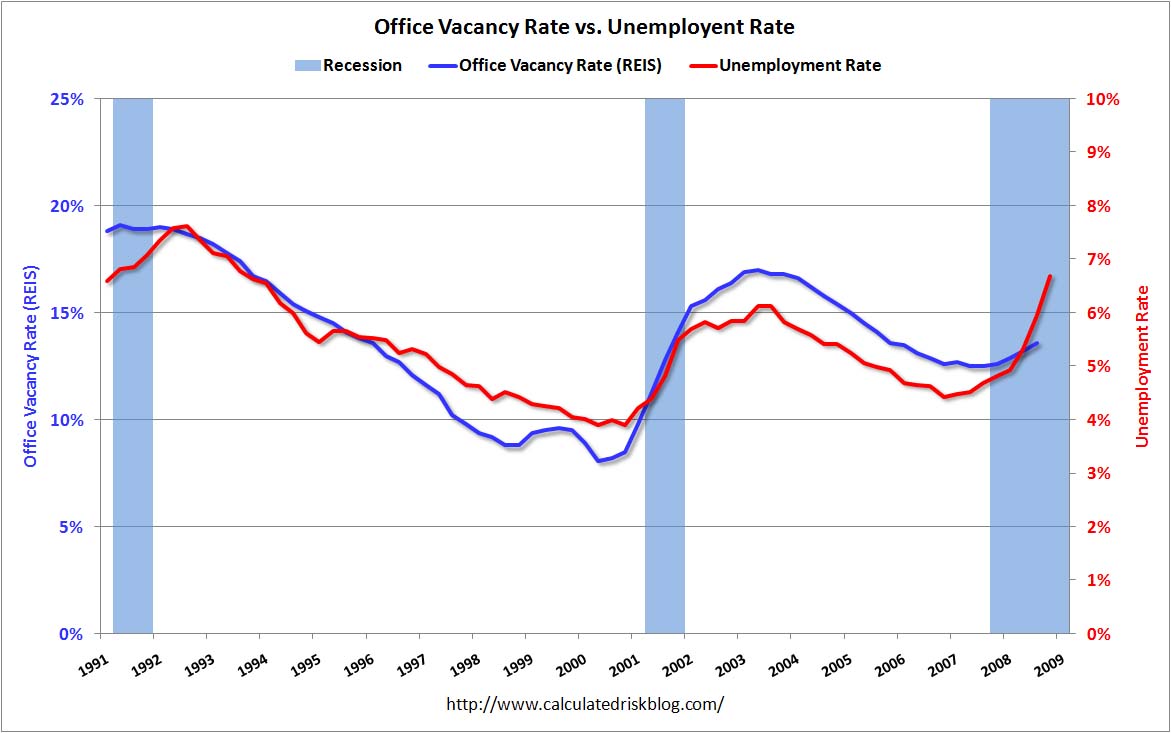

Banks are at risk as office vacancies are forecast to rise to 15.6 percent next year from an estimated 14.6 percent at the end of 2008. Lenders who sold commercial mortgage-backed securities to pension funds, investment banks and foreign governments have been hit by more than $1 trillion in losses and asset writedowns connected to bad residential loans.

“A large decline in net operating income isn’t necessary to shift a lot of properties underlying CMBS loans into debt- service coverage ratios that would be worrisome,” Calanog said in an interview.

Unwarranted Optimism

Over the last three years, lenders raised income projections for commercial properties by as much as 15 percent more than those properties’ historical performance, he said.

“That optimism might not be warranted,” Calanog said. “There’s a big pool of loans underwritten in 2005 and 2006 coming due in 2010 and 2011 that I believe will experience a rise in delinquencies and defaults.”

Loans from those years assumed strong growth in rents, a scenario that seems unlikely as the recession deepens, Calanog said.

The debt levels also reflected a deluge of credit, with a record $600 billion of commercial mortgage-backed securities originated between 2005 and 2007, according to Green Street Advisors Inc. The annual pace in those three years was almost three times that originated in the first five years of the decade and those loans now account for almost two-thirds of outstanding CMBS, according to Green Street.

Economic Slump

As credit became more available, capitalization rates, calculated by dividing a property’s net operating income by the purchase price, fell to record lows. In some cases the rates fell to less than 5 percent, reflecting higher property prices.

Economists expect the nation’s economic slump will be the longest since World War II as banks restrict credit, home and stock values plunge and job losses mount. The number of Americans filing first-time applications for unemployment benefits reached a 26-year high of 575,000 in the week ended Dec. 6, according to the Labor Department.

U.S. retail sales fell for a fifth consecutive month in November in the longest string of declines since recordkeeping began in 1992, according to the Commerce Department. The job losses and record drop in home values have shaken consumer confidence.

Green Street said Oct. 3 its research also indicates a potential increase in commercial defaults.

“The day of reckoning for commercial real estate has been delayed, not dodged, and the delay means that markets for commercial real estate will remain discombobulated long after conditions have improved elsewhere,” wrote Mike Kirby, director of research of Green Street in Newport Beach, California.

Defaults Rising

Reis estimates at least 353 properties, or 1.5 percent of the total number analyzed, could fall into default as net operating income, mainly from rent, barely clears loan payments.

Properties at risk include those with net operating income less than 1.1 times their loan payment, Calanog said. That “base case” translates to $9.08 billion of unpaid balances, or 2.76 percent of the total dollar value outstanding on the mortgages.

If the net operating income estimates used to make the loans were to fall by 5 percent across the board, the unpaid balance at risk would rise to $23.1 billion, or 7.02 percent of the total, Reis found.

A 10 percent drop in income would push up the portion of at-risk loans to $82.3 billion, or 25 percent of the unpaid balance, said Calanog.

More Help?

The Promenade Shops at Dos Lagos, a retail project in the Riverside-San Bernardino-Ontario area in Southern California, has been on Reis’s watch list and was transferred to a special servicer last November.

Even a building with a large, stable tenant in midtown Manhattan might be at risk, Calanog said.

The biggest property developers in the U.S. are asking to be included in the federal government’s efforts to jumpstart commercial lending, said Jeff DeBoer, president of the Washington-based Real Estate Roundtable.

The help could come through a new $200 billion loan program established to aid the market for car loans, student loans and credit-card debt, or through a separate pool that would allow property owners to refinance mortgages, DeBoer said in an interview. The group represents property owners, developers, lenders and management companies.

To contact the reporter on this story: Hui-yong Yu in Seattle at hyu@bloomberg.net.

Last Updated: December 22, 2008 14:03 EST

|