Thanks Glenn

Here is a bearish take on NG (Although not entirely bearish for ESA or the Marcellus Shale):

Dispatch From the Marcellus: Natural Gas Prices and the Shale Paradox

In the middle of this decade, E&P companies were spurred on by rising commodity prices and easy credit to find and develop new sources of domestic natural gas–most notably shale gas. The forces that enabled this phenomenal growth in domestic gas production–the great asset and credit bubble–have vanished into air, into thin air.

Now, Shale-gas companies may have been impaled on their own bayonets. Yet some would have us believe that natural gas prices are poised for a great comeback–that all the fret and worry is for nothing because prices are going to come right back up and justify the development of all the shale in the country, and then some.

They are wrong: demand will continue to be weak and supply will not be nearly as sparse as the some of the gas bulls would have us believe. Instead, the story of 2009, 2010, and beyond will be not only how much farther natural gas prices will fall, but also how long prices will stay in the basement, and who will be counted among the casualties.

The Fallacy of the Rig-Laydown, Production-Decline Pricing Idea:

wellexplosion1

U.S. producers, loudest among them being Chesapeake (CHK), are howling that lower prices will eventually lead to less production, which in turn will severely impact supplies and raise the price.

But this is not a process which will lead to sustained greater prices, because even if this phenomenon caused a temporary or seasonal price increase, that would only encourage more production from known, vast shale supplies, and other prolific domestic sources like deep Bossier–which would result in another glut, and bring prices down again. In this scenario, wouldn’t the price just settle at a point which is only marginally better than the cost of production? Its also important to recognize that it takes less rigs actively drilling now to produce more gas than even a few years ago.

With more built-for-purpose horizontal shale rigs active in places like the Marcellus shale, a few new, successful horizontal units can bring forth a level of production that may have taken 10 or 20 vertical wells to equal only a few years ago.

For example, to date, CXG has drilled 5 horizontal wells with costs declining from $5.3mm for the first well to $3.8mm for the fifth well. The company expects the next horizontal well to cost ~$3.6mm. Average IP-rate for the first 5 horizontal wells was 4.3 MMcf/d. If we assume the lower horizontal well cost of ~$3.8mm with a 3 Bcfe EUR on 40-acre spacing

Another factor which could cut short a price spike is that gas companies may have wells they have shut in and are not producing. They will turn these wells on as prices rise, allowing a rapid flood of natural gas to enter the market much faster than an increase in drilling could respond. It is also likely that if storage reaches capacity there will be no choice but to shut in some production.

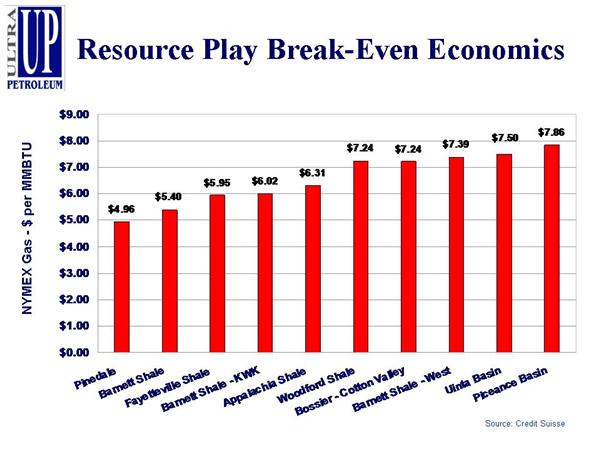

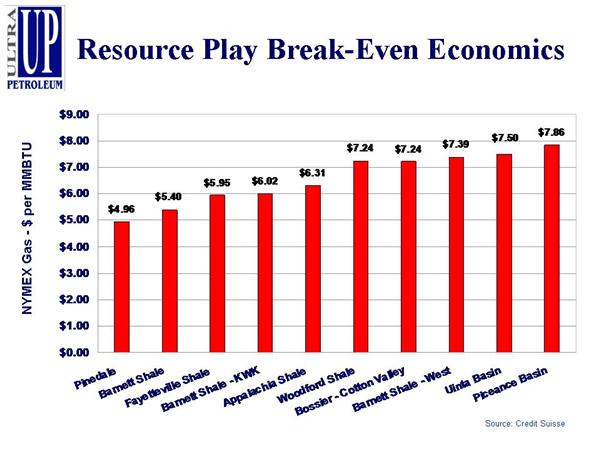

In any event, a slight rise in prices into the zone of marginal profitability would likely engender a race to bring on more production in order to realize cash-flow, which could flood the marketplace once again, causing the price settle at or near the break-even point. In this shale-supply driven scenario, prices will go to the marginal cost of production, so any industry gains in efficiency and cost-saving of production will only serve to drive the price down.

gas-play-break-even

In the shale-supply driven scenario, big regional shale leaders like Range Resources (RRC) could continue to make money producing high volumes at prices at or near the marginal cost of production, especially since Marcellus gas is usually sold at a Nymex premium in the Northeast market due to savings on transportation.

But this scenario does not factor in the burgeoning supply of natural gas headed to the U.S. on foreign-flagged tankers that can deliver as much gas in a month’s transport time as a good shale well can deliver over its entire productive life.

LNG and the Coming Wave of Cheap Foreign Gas

Another product of the price bubble in recent years that has gone unnoticed by many Americans has been the massive new development in overseas gas fields. Unlike previous years, this development will affect the price of domestic gas because the increase in U.S. import/gasification facilities in the coming months and years means NG is becoming a global commodity. The last few years have seen a significant growth in the availability of liquefied natural gas (LNG) as both liquefaction facilities and available tanker numbers increase. The world’s LNG supply capacity is expected to grow 25% this year, and global demand will not match this increase.

Therefore, LNG will be available to come into the American market. The United States tends to be the LNG market of last resort, as producers send LNG to the higher paying Asian and European markets first.

However, global LNG demand and prices have fallen, leaving more LNG for the United States, whose extensive storage and pipeline network means it can absorb LNG even at times of low demand. “It’s completely counter intuitive,” said Murray Douglas, a global LNG analyst with Wood Mackenzie in Houston, who is predicting U.S. LNG imports will grow 30 percent to 456 billion cubic feet this year and to more than 1.1 trillion cubic feet by 2013. “We don’t believe Asia and Europe will be in a position to absorb this new production, and the U.S. is the only market that can take it, that has a large amount of storage.”

lng-tankerLNG can be competitive priced as low as $3 per million British thermal units (and perhaps lower), said Zach Allen, head of Pan EurAsian Enterprises, a management advisory firm that follows LNG markets.

That’s a price the U.S. hasn’t seen since 2002. “Some cash is better than none, especially for producers who rely heavily on that cash for social and other programs that would be politically explosive to cut off or cut back,” Allen said.

The biggest contributors to the world LNG market is Qatar, followed closely by Indonesia. The productive capacity of the gas wells in these countries dwarf domestic production, and new liquification-export facilities that have activated in recent years, and more that will be coming-on-line in the coming months, will only add to the world’s ability to produce LNG.

What’s more, most of these big, foreign wells have zero or near-zero cost of gas production, because they produce liquids in volumes sufficient to pay for the cost of finding and developing the wells. So they are essentially producing gas for free.

Even more encouraging for foreign LNG producers is the discovery of new super-giant, and world-class giant gas production zones. Overshadowing them all, is InterOil’s (IOC) recent new discovery in New Guinea, the Antelope 1 well, which likely contains ten trillion cubic feet. One well, ten TCF. Just put a liquification plant near-by and that well could supply the gas needs of several countries for many years.

Even without any of the additional supply from these new fields, the new production coming on line in Qatar is more than the current market can absorb, and the Qatar CEO notes , “For the shorter term, I don’t think the UK will be able to take 16 million tons,” al-Suwaidi said. “Anything the UK cannot absorb, we will have to find a market for.”

The consumption of petroleum products in Japan, the world’s biggest buyer of LNG, is projected to fall 4.7 per cent in the year starting this month, according to the Institute of Energy Economics Japan.The global recession has reduced electricity use in Japan. Barclays Capital said the global LNG market will add 5.6 BCF/d of production capacity to the 23 BCF/d currently online.

Current U.S. LNG gasification-import capacity is about 60 million tons per year, and several new LNG receiving terminals are coming into operation in 2009, including Sabine Pass in Louisiana. (One metric ton is equivalent to about 48,700 cubic feet of NG). One LNG tanker can transport 6 billion cubic feet of gas–which is equivalent to estimated recovery over the lifetime of a decent shale well.

While the EIA estimates LNG imports to average about 369 BCF, estimates vary widely. “We are going to be awash in natural gas and could have $2 gas”, says Steve Johnson, president of Houston-based Waterborne Energy Inc., which tracks LNG shipments. He also predicts that the US will see 1.1 TCF of gas delivered to the US in 2009 as repairs to some LNG export facilities overseas are completed, new projects come online and seasonal shifts in global demand increase the amount of LNG in the market.

LNG: there’s plenty of it, just like there’s plenty of Shale. The difference is that no matter how cheap it gets to produce Shale gas, LNG will always be cheaper–it costs nothing to produce so the only cost is transport. And that transport cost is only between $1.29 to $2.09 from the Middle East to various U.S. import facilities. Its doubtful that Shale producers could be profitable at those levels.

With so much cheap LNG in the world, gas prices in the coming years may not be based on futures at all, Henry Hub could be a thing of the past, and U.S. traders might just be buying and selling gas based on spot LNG prices.

Demand Side

“Demand destruction will still outpace supply destruction through this summer and into next winter," Stephen Schork, president of the Schork Group Inc., an energy markets consulting company in Villanova, Pennsylvania, said in a note on April 24th. Businesses are closing, and unemployment continues to rise, which means big trouble for natural gas prices.

NG is a major power source for electrical utilities, and it has been building up in storage at levels well above seasonal averages as manufacturers cut back on production. The EIA reported Thursday that natural gas in U.S. storage is now 36 percent greater than it was at this time last year. On Friday, American Electric Power said that electricity use by industrial customers in its region fell 15 percent. That falling demand can also be seen clearly in recent unemployment figures, with energy intense industries like manufacturing hit particularly hard.

Earlier this year, Dow Chemical (DOW), which had previously been one of the largest single consumers of NG in the country, closed 20 plants and cut 5000 jobs since December. The three major U.S. automakers have slowed down production this year to match a plunge in demand. General Motors (GM) said Thursday it would shutter 13 assembly plants for up to 11 weeks this summer. Ford Motor Co. (F) also has cut back on manufacturing this year.

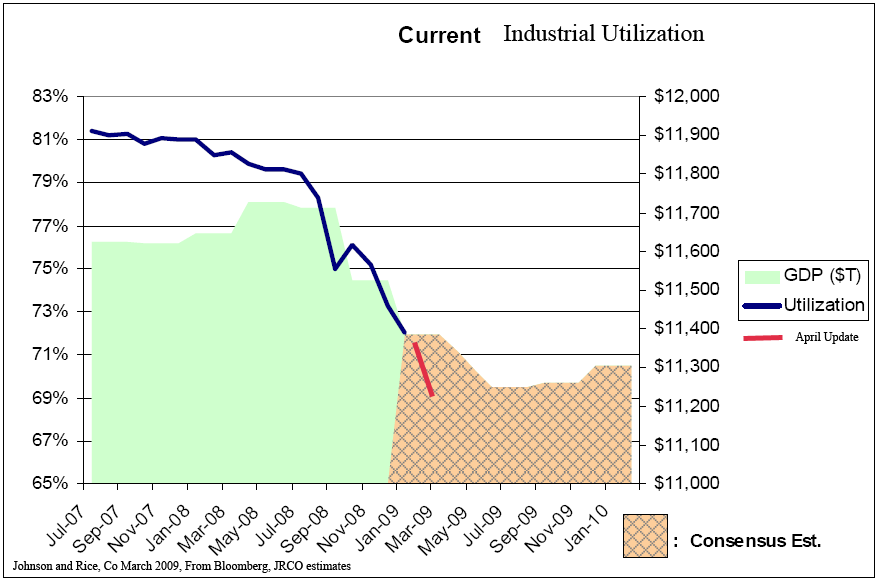

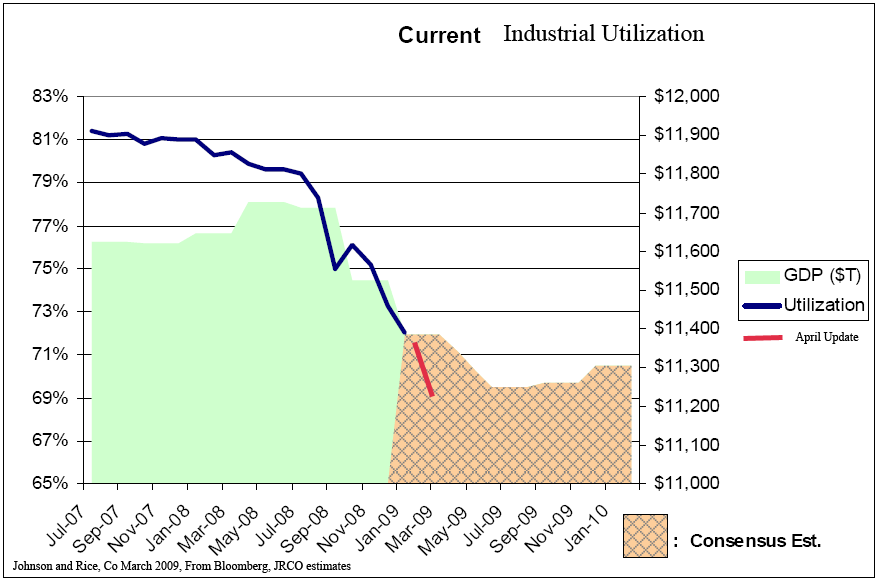

current-industrial-utilization1

In addressing the demand for natural gas this year and in the coming years, we must acknowledge that demand for natural gas is a reflection of aggregate demand in the greater American economy, and therefore the global economy. Because manufacturing and fertilizers make up such a large portion of the demand picture for NG, it is unlikely that such demand will increase to levels seen in recent years as long as the overall economy remains on its current deflation-depression path.

So, deflationary forces retrench across the world economy, even in the face of unprecedented low interest rates and quantitative easing by central banks, and demand for NG stays weak.

Where has growth come from, anyway, in the last ten years - other than by an expansion of the money supply and credit? The fate of NG prices is just a manifestation of the credit-bubble blow-back.

A look at almost all other asset classes shows them returning to 1997-1998 levels, adjusted for inflation. The S&P 500, at present writing, is at about 1998 levels, and real estate, though widely varied across the country, is at about 2002 levels and continues to fall as new-buyers shy away and inventories of unsold houses stagnate. If the most of the economic growth in the last ten years as been a product of the great asset and credit bubble, and all asset classes are deflating down to values last seen ten years ago, then why shouldn’t NG prices go back to 1997-1998 levels?

As we mentioned above, the cost of getting the LNG from its foreign origin to other markets is low. The 43-day round trip from the huge export terminal in Qatar to the Lake Charles LNG terminal costs $2.09 per million British thermal units. From Egypt to Lake Charles takes 30 days and $1.29 per million Btu. $1.29 to $2.09?

Funny, that’s precisely where gas prices were in 1997, 1998. The grip of deflation is firmly in place. Go down, Moses, and take NG prices with you. So, prices will revert to the mean and crash through it, right back to the late ’90s levels–which is where prices should be (after all) at a more honest time (perhaps), before the bubble took hold.

If we are going back to 1998 levels, then it looks like we can take several TCF off the table, which suggests that only the largest, most prolific, and most efficient domestic gas plays will be workable.

Without the drawing of a new source of domestic demand for NG, domestic marginal producers can fuggedaboutit. LNG will punish them. Still, the prospect of low natural gas prices persisting well into future makes NG attractive as a fuel for electricity generation and transportation.

I don’t know, but anyone in the power world out there please chime in, if you are operating a power plant at dual capability, at what point do you switch to NG from coal? $2.50? Please chime in and comment here, coal people. That may give a glimmer of hope to those in the NG business.

But no hope can be found in the Obama administration, which scorns all associated with the O&G business, so it's not likely that NG will get much support from government “stimulus” efforts of from Deparment of Energy policy. Even if we were to actually see a proliferation of new usage of gas as the product of government mandates or incentives, any marked increase in the actual amount of gas consumed from those hypothetical projects would still be years off. And it's doubtful that many domestic producers can weather such a long stretch of very low prices.

Disclosure: no positions |