Gold: Conspiracy Theory or Cold Calculated Reality...

Why Didn't Gold Rise By $100?

By Patrick A. Heller

April 28, 2009

numismaster.com

Several major news stories broke last week that all should have sent the price of gold soaring. Gold did rise 5.3 percent [from 4/17], which did not reflect the importance of the developments.

There is a theme to the eight news items cited here. China has been buying large amounts of gold, it wants even more and the U.S. banking system is still in dire straits.

What this means is obvious, but if you are willing to dive in with me here, the details follow:

Let's look at these news items, then discuss why the price of gold, in my judgment, did not fully react.

Story 1: About 10 days ago, the Gold Anti-Trust Action Committee filed a new set of Freedom of Information Act requests with the U.S. Treasury and Federal Reserve to seek information on the U.S. government's gold swap activities. The first attempt to dislodge this information was filed in December 2007, with dismal results. After carefully analyzing the loopholes used by the Treasury and Federal Reserve to avoid disclosing the requested information, these revised FOIA requests include detailed instructions to overcome the government's obstacles. For example, one FOIA request noted that the agency was unable to uncover where its own public Web site discussed gold swaps.

Story 2: The federal government has conducted "stress tests" of individual banks to help find out which were financially strong, or average, or in serious trouble. It was reported that these tests were completed a few weeks ago, but the government was slow to release the results.

On April 19, the Turner Radio network reported that it had obtained a copy of the results of the stress tests and passed along a summary of more than 10 points. Among these summaries were statements that 16 of the nation's largest banks were already technically insolvent and that the failure of any two of these institutions would wipe out the current assets of the Federal Deposit Insurance Corporation.

On April 20, the Treasury Department issued a statement claiming that it was not possible for Turner to have had the information as the Treasury Department itself had not yet seen the information. Release of the information was promised for April 24.

Meanwhile, the Federal Reserve prohibited any banks from discussing the results of their stress test.

In mid-week, the Associated Press reported that it also had obtained a copy of the bank stress test report and confirmed the information reported by Turner Radio. It also said that the Treasury Department was lying when it claimed on the 20th to have not yet seen the test results.

On April 24, the official unveiling of the stress test results only included the bare minimum information, stating that large banks should beef up their capital to strengthen the entire financial system. The reports neglected to cover the specific points listed by the Turner Radio network. The mainstream media dutifully picked up the government's spoon-fed version of the stress test results without any serious questioning.

Story 3: On April 24, Bloomberg reported an analysis released by Washington Service of Bethesda, Md., stating that insiders at New York Stock Exchange-listed companies in the first 20 days of April had sold more than eight times the amount of stock that they had purchased.

According to William Stone, the Chief Investment Strategist for PNC Financial Services Group, Inc, "They should know more than outsiders would, so you could take it as a signal that there is something wrong if they're selling."

This was the fastest rate of insider selling since stocks hit a major peak in October 2007. The rate of insider purchases was on track to be the lowest for any month since July 1992. In the past, such lopsided insider selling versus buying has been followed by stock market declines.

Story 4: Bank of America CEO Ken Lewis testified under oath for New York Attorney General Andrew Cuomo that last December he had notified the federal government that the bank had discovered huge new losses ("material adverse changes") at Merrill Lynch and was going to exercise an escape clause to cancel the bank's takeover of the brokerage firm. Upon hearing this, then Treasury Secretary Henry Paulson blatantly told Lewis, at the behest of Federal Reserve Chair Ben Bernanke, that Bank of America had to go through with the takeover or all of the bank's directors and senior management would be fired. The federal government did not want the public to become aware of the weakness of Merrill Lynch and the U.S. banking system that the cancellation of the transaction might expose. Bank of America then closed the Merrill Lynch purchase deal.

Paulson's testimony to Cuomo largely confirms the details of Lewis's testimony.

In effect, Lewis labeled Paulson and Bernanke as blackmailers. Their actions in this matter also show them as liars in repeatedly stating that the U.S. banking system is sound and solid.

The letter with these details released by Cuomo's office puts the Bank of America and possibly the federal government at risk of being sued by bank shareholders for actions taken against the best interest of the bank's owners. Note: Bernanke has denied making any of the statements in the letter that are attributed to him.

Story 5: At the G20 meeting, the International Monetary Fund was pressed to sell 403 tons of its gold reserves to be used to ease the global financial crisis. China has since gone on record as advocating that the IMF sell its entire 3,217 tons of gold holdings. The Chinese central bank may be looking to purchase another 4,000 tons of gold, which is a larger amount than all the gold reserves reported by the IMF, and is also larger than those held by all but a handful of the world's central banks. At a price of $1,000 per ounce, China would need barely five percent of its central bank reserves to buy this much gold.

In effect, if the IMF does not sell a lot of gold, and sell it soon, that supply shortage could help drive up the price of gold.

A reason that China may be pressing the IMF to sell gold and why the Chinese central bank may want to add gold reserves is a long-term plan to revalue gold, similar to what U.S. President Franklin Roosevelt did in 1933.

Story 6: In 2008, 1.7 million American homes were lost to foreclosure. In 2009 Lazard Asset Management forecasts 2.1 million U.S. home losses. Despite regular news reports trying to portray positive news about the real estate market, the truth is that foreclosure rates should continue rising at least until early summer. It doesn't take a genius to figure this out. All you have to do is look at delinquency rates and foreclosure notices. How will the U.S. financial system react to this surge in bad debts?

Story 7: After so much fuss was made at the G20 meeting about the IMF possibly selling gold, the subject has either been dropped or been reclassified as a very low priority task. In the last few days, the IMF has said instead that it plans to sell bonds to finance its activities. Several years ago, these fund-raising activities were supposedly being done to help the world's poor people. Now the IMF is raising funds to support central banks and governments. This shift in emphasis at the IMF adds credence to the assertions by several analysts, including me, that the IMF gold sale will never occur.

Story 8: On April 24, the Xinhua News Agency reported that China's gold reserves had increased from 600 tons at the end of 2002 to 1,054 tons, a rise of 76 percent Until this announcement, the Chinese central bank had continued to report only the 600 tons in reserves. The spokesman claimed that all gold had been purchased from domestic mine sources.

This 14.6 million ounce increase in reserves has been almost precisely reported by GATA ever since September 2003. GATA has a confidential source that was told in 2003 by a man, who insisted on speaking behind a screen to avoid disclosing his identity, that there was a large buyer of gold entering the market. This source was able to identify the agent acting on behalf of the buyer and quickly deduced that the buyer was from the Far East and almost certainly Chinese.

Over the years, this confidential source was able to learn the price levels at which the buyer was planning to make purchases, and the approximate size of purchases being planned. With the revelations by the Chinese central bank, the information reported by GATA (some on GATA's Web site and some on GATA chairman Peter Murphy's Le Metropole Café subscription Web site ) has largely been confirmed.

The impact of this announcement has ramifications far beyond that fact that China has been buying gold without reporting it. The World Gold Council and major precious metals consultancies such at GFMS regularly report gold supply and demand statistics that are widely quoted in the financial press. None of their reports include the Chinese central bank gold purchases as part of gold demand. Even more damaging to their reputations, these reports do not show any gold supply to cover what the Chinese have purchased.

Let me make this explicit. The gold purchased by the Chinese could not have come from mine production, recycling, investor liquidation, or announced government sales. Almost certainly, the gold bought by the Chinese had to come from other central banks that secretly sneaked these supplies on the market.

In other words, the supply and demand statistics used by the mainstream financial press have been wrong for years. The question is how large are the errors. GATA researchers assert that the annual supply and demand statistics reported by the World Gold Council and GFMS could easily be off by 50 percent. With GATA's enhanced credibility confirmed by China's admission of their gold purchases, the mainstream financial press should seriously examine their data.

By the way, the way the Chinese government operates is not open and direct. Changes in policy are signaled by speeches or papers by lesser officials. And has been shown repeatedly, when the Chinese government issues a statement that it is considering something such as purchasing gold, they really mean they have already been actively doing it. It is entirely possible that China's central bank gold reserves are much higher than they now confirm (GATA has documented higher purchases than the Chinese have admitted).

Another note: GATA's special source says that the Chinese are looking to remain a buyer of gold as long as the price is under the $940-$960 range.

One last note on this subject: All of the implications of the increase in Chinese gold reserves are positive for higher gold prices in the future, and negative for the value of the U.S. dollar. So naturally, the U.S. government has a huge interest in seeing this story get as little coverage as possible. In the weekend edition of the Financial Times of London, England, this story was front page news. At the same time, The Wall Street Journal buried this news on page B6. My local newspaper, issued in Michigan's capital, did not even include this news.

So, with all this positive news for the price of gold, why did the price only rise 5.3 percent last week? I think the answer is obvious. The U.S. government is trying to hold off further financial crises as long as possible. One way to accomplish this is to suppress the price of gold. Gold serves as a report card on the value of the U.S. dollar. As long as the price of gold can be held in check, then it is easier to prop up the dollar. If the dollar starts to drop significantly, interest rates will soar, and foreign central banks will become more aggressive in dumping their dollar reserves.

U.S. Congressman Paul Kanjorski, D-Pa., already revealed that the U.S. financial system was perilously close to collapse at 2 p.m. last Sept. 18, 2008. With all the above news hitting in such a short time, it is entirely possible that the U.S. economy could have crashed last week.

If you still don't think it's time to consider owning gold or silver, you probably never will.

----------------------------------------------------------------------------------

Conspiracy theory, coincidence, or cold calculated action?

The Robert Rubin & Larry Summers Gold Suppression

In 1995 during the Clinton Administration, Robert of Rubin as Treasury Secretary and the U.S. government was facing default on its financial obligations due to a bitter, partisan debate causing delay on raising the debt ceiling. In the words of Robert Rubin himself in his book, In An Uncertain World, on page 170 he states:

“Without an increase, the federal government would hit the debt ceiling before the end of 1995, possibly as early as October. Default and the President being forced to sign an unacceptable budget were both untenable. We needed to find a way out, rather than simply hoping that at the last minute the opposition would blink and increase the debt limit.”

The ultimate response to this dilemma is chronicled by Rubin, on page 172, where he reveals,

“It was Ed Knight, our savvy chief Treasury counsel, who suggested borrowing from the federal trust funds on an unprecedented scale to postpone default.”

You see folks; as Mr. Rubin was well aware, the federal trust funds DO NOT AND NEVER DID CONTAIN ANY MONEY . These accounts exist in the minds of accountants and lawyers [ledgerdom] only. So here's what was going on:

Beginning Nov. 12, 1995, the Treasury started issuing government bonds, IOU's, and putting them in the Social Security Trust Fund “cookie jar” – with the Fed then PRINTING the corresponding amount of money they needed and called this a ‘legitimate loan'.

By accounting for their finances in this manner, the government got to understate their annual budget deficits by the same amount that they were burdening the cookie jar with IOU's – all the while dramatically increasing the unfunded [off balance sheet] liabilities of the government by the same amount. Where I come from, this is neither savvy nor a loan. It is better described as treasonous, fraudulent and larcenous.

At the same time, the methodology for measuring inflation was undergoing rigorous fraudulent changes – which made a mockery of ‘then' Fed Chairman, Alan Greenspan's claims of a productivity miracle and, through the yeoman's work of John Williams [www.Shadowstats.com] was exposed for what they really were: deceitful obfuscations to mask profligate monetary policy being pursued by government. This deception was reinforced by the jaw-boning-ruse we know as the Clinton/Rubin/Summers “strong dollar policy”.

Market rates of interest are historically set at the real rate of inflation plus 250 basis points. The real rate is determined by backing out “inflation” from nominal rates of interest. By understating inflation, interest rates look higher [or more positive] than they otherwise would be.

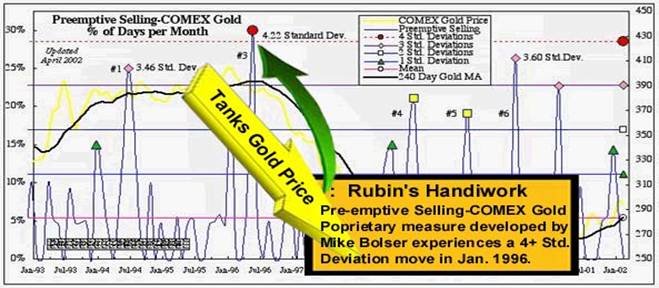

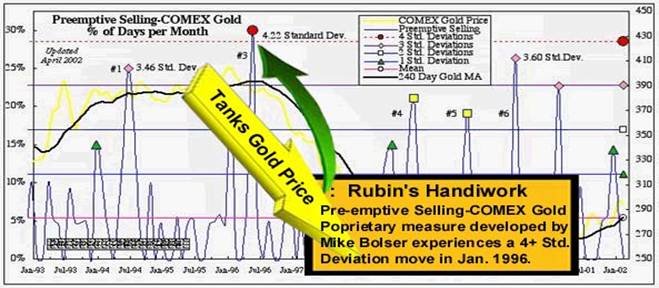

The budding fraud depicted in the graph above shows that interest rates were behaving as they should but the gold price reacted counter-intuitively?

Why the Gold Price Dropped

In late 1995, Rubin knew that the course being charted, Government profligacy, would naturally lead to a much higher gold price and higher rates; so, the Fed / Treasury [Plunge Protection Team] unleashed their “stealth” gold price suppression scheme, a direct hit from a golden-torpedo, in Jan. 1996:

In the chart above, mathematician Mike Bolser employs ‘ statistical regression analysis' to depict what amounts to forensic statistical accounts of how an ‘invisible participant' involved in the trade whose actions dictate they are not motivated by “profit maximization”.

“Preemptive selling, which is a fraud detection algorithm , measures very aggressive COMEX gold market selling when compared to the London gold market (LBMA). Table 1 displays the percentage of days per month in which the COMEX gold price falls 300% more than the London gold price. The probability of changing macroeconomics being the cause for such extreme New York price drops is highly diminished because the two markets trade the same commodity on the same day.

Preemptive selling should not be confused with price volatility or rate of change, which are measures of rapid price fluctuation. In addition, preemptive selling is a measure of relative activity between two markets. Recall also that it does not measure the volume of comparative selling, only its effect as measured by gold market prices.”

With the gold price effectively “dead and buried”, there was still a problem that needed to be tended to – to prevent or stem the “Bond Vigilantes” from selling bonds in sufficient quantities to “ FORCE ” interest rates higher.

The solution to this part of the problem [rising rates] is where J.P. Morgan's [now] 93 Trillion Derivatives Book swung into action.

Embedded in every interest rate swap is a bond trade. In simple terms, the greater the volume of interest rate swaps – the greater is demand for bonds to hedge them. Ergo, if enough interest rate swaps are transacted – they serve as a “ VACUUM CLEANER ”, sucking up ALL MEDIUM TERM BONDS [3 – 10 yrs.] in their path.

In this respect, bond trading volume originating from the interest rate swap derivatives complex overwhelmed and supplanted traditional bond market participants. The motivations and risk tolerances between these two classes of “traders” are not necessarily consistent with one another – and in the extreme - manipulatively opposite to one another. We have been witness to the same type of phenomena in the precious metals arena where futures [COMEX and LBMA] prices have served to “trump” or suppress those which would be dictated by physical supply or demand.

This is now manifesting itself in bifurcation of our capital markets – banks are now refusing to lend money at Libor [an interest rate futures derived price] because it is not reflective of their costs of funds and owners of physical metal are refusing to part with their precious at COMEX prices, because it costs more in many cases to mine it. This is evidenced by stiff and increasing premiums being paid for physical metal.

What's more, interest rate swaps being “off-balance-sheet items” – an untrained eye [or Bond Vigilante, perhaps?] was none-the-wiser as to why yields were counter-intuitively falling or remaining at low levels despite demonstrable inflationary pressures. According to the Office of the Comptroller of the Currency's [ archived ] Quarterly Derivatives Fact Sheets:

“J.P. Morgan's Interest rate swap book grew from 12.716 Trillion Notional at Q4/1995 to 14.7 Trillion at Q2/1996.”

Back in those days a couple of Trillion used to buy a lot of love, or respect.

Against this backdrop, bond vigilantes quickly joined the ranks of the “extinct” – acquiescing or losing their jobs - while interest rates, the primary efficient arbiter of capital – became fallacious and meaningless.

It was this GROSS mis-pricing of Capital and associated market rigging practices that facilitated ALL THE ASSET BUBBLES - from the contorted Dot Com Boom to the Real Estate debacles that followed.

To mask and obfuscate their ever heightening profligacy [if you consider 850 billion dollar bail-outs for Wall Street profligate], officialdom has increasingly relied on the handiwork of their agents in the derivatives markets of strategic commodities to suppress or cap prices – trying to turn back accelerating runs-on-banks. In this surreal set of circumstances, while fiat currency continues to self destruct before our very eyes, the saying that, “price action makes market commentary” leaves the mainstream financial press and unwitting market commentators babbling about rampant deflation even as these “bank-runs” and counter-intuitive physical shortages intensify.

Not by coincidence, if one reads an Introductory Economics Text Book, one would read that artificially low, negative real interest rates deter savings and encourage consumption and frivolous speculation while creating shortages of basic goods.

Does any of this sound familiar?

Welcome home, folks.

By Rob Kirby

kirbyanalytics.com

-------------------------------------------------------------------------------

From Volcker to Greenspan to Rubin to Summers to Geithner

news.goldseek.com

*Robert Rubin hatched the gold price suppression scheme while running Goldman Sachs’ operations in London. This was many years ago, when interest rates were very high (say from 6 to 12% in the US). Rubin had Goldman Sachs borrowed gold from the central banks at about a 1% interest rate. Then he sold the gold into the physical market, using the proceeds to fund their basic operations. This was like FREE money, as long as the price of gold did not rise to any sustained degree for any length of time.

He continued his innovative money ploy as CEO of Goldman Sachs in New York and then put his Strong Dollar Policy ploy on steroids as Treasury Secretary under President Clinton.

*Lawrence Summers followed Rubin as Clinton’s Treasury Secretary, and who could be more qualified to continue Rubin’s gold price suppression scheme than him? After all, while at Harvard he co-authored a paper, "Gibson’s Paradox and The Gold Standard." The bottom line of Summers’ analysis is that "gold prices in a free market should move inversely to real interest rates." Control gold and it will help to control interest rates.

Obama has designated Mr. Summers to be the Director of the U.S. National Economic Council.

*Which brings us to Timothy Geithner, who is President-elect Obama’s nominee to be U. S. Treasury Secretary. Geithner was named president and chief executive officer of the Federal Reserve Bank of New York on November 17, 2003. In that capacity, he serves as the Vice Chairman and a permanent member of the Federal Open Market Committee, the group responsible for formulating the nation's monetary policy.

Mr. Geithner joined the Department of Treasury in 1988 and worked in three administrations for five Secretaries of the Treasury in a variety of positions. He served as Under Secretary of the Treasury for International Affairs from 1999 to 2001 under Secretaries Robert Rubin and Lawrence Summers.

Geithner is also happens to be a member of the Bank for International Settlements and since 2005 has been Chairman of the Committee on Payment and Settlement Systems. You might want to see what The CPSS undertakes "at their own discretion" as listed here:

bis.org

Like outgoing Treasury Secretary Hank Paulson, Tim Geithner is a graduate of Dartmouth College. Talk about knowledge of the gold price suppression scheme!

*And then there is the venerable Paul Volcker, who so effectively brought down runaway inflation in the US, starting in 1980. His one regret:

"Joint intervention in gold sales to prevent a steep rise in the price of gold (in the 1970s), however, was not undertaken. That was a mistake."

… Former Federal Reserve Chairman Paul Volcker

(writing in his memoirs).

-------------------------------------------------------------------------------

Did the ECB Save COMEX from Gold Default?

April 02, 2009

By Avery Goodman

On Tuesday morning, gold derivatives dealers, who had sold short in the face of a fast rising gold price, faced a serious predicament. Some 27,000 + contracts, representing about 15% of the April COMEX gold futures contracts remained open. Technically, short sellers are required to give “notice” of delivery to long buyers. However, in reality, buyers are the ones who control the amount of gold to be delivered.

They “demand” delivery of physical gold by holding futures contracts past the expiration date. This time, long buyers were demanding in droves.

Mysteriously, on the very same day that gold was due to be delivered to COMEX long buyers, at almost the very same moment that Deutsche Bank was giving notice of its deliveries, the ECB happened to have “sold” 35.5 tons, or a total of 1,141,351 ounces of gold, on March 31, 2009. Convenient, isn’t it? Deutsche Bank had to deliver 850,000 ounces of physical gold on that day, and miraculously, the gold appeared out of nowhere.

It is quite important to determine whether or not Deutsche Bank was bailed out by the ECB because that will answer a lot of questions about allegations of naked short selling on the COMEX. If the ECB knew that its gold would be used as post ipso facto “cover” for uncovered shorting, staffers at the central bank might be co-conspirators...

seekingalpha.com

---------------------------------------------------------------------------------

So it was written and so it is being done...

"Central banks stand ready to lease gold in increasing quantities should the price rise."

-- "Federal Reserve Chairman Alan Greenspan

In testimony to Congress on July 24, 1998

---------------

SOTB |