The 'Green' Side of Natural Gas 3 comments

seekingalpha.com

by: Marc Courtenay July 30, 2009 | about: CHK / CLNE / MCF / SWN / UNG

Remember the "Pickens Plan"? T. Boone Pickens, the 81-year-old Chairman of BP Capital came up with the idea to reduce the nation’s dependence on foreign oil with a combination of wind-generated power and natural gas powered vehicles. In the process, the need for foreign oil could be drastically reduced or eliminated in as little as 10 years.

His timing - with oil prices hovering around $150 a barrel, is part of the reasons his "Pickens Plan" received a lot of attention.The publicly-traded company he launched with his plan in mind, Clean Energy Fuels (Nasdaq:CLNE) became a quick winner with many investors, as the chart below shows (then it dropped from $19.95 to $3.23 last year):

Now it’s one year later: Obama is President, oil prices are less than half of what they were a year ago, CLNE is above $8 a share again, and the country is using less oil and natural gas. Is energy dependence on foreign oill still a concern? Does natural gas still have a role to play in the plans for a cleaner, more sustainable source of energy and fuel?

In short, the answer is "absolutely"!

Energy analyst Matt Badiali, writing for The Growth Stock Wire, made the following observations when asked if natural gas was still a good longer-term investment:

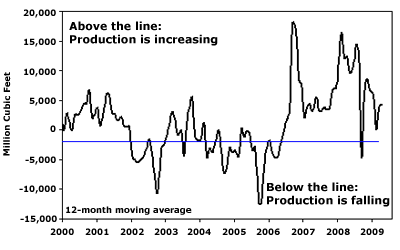

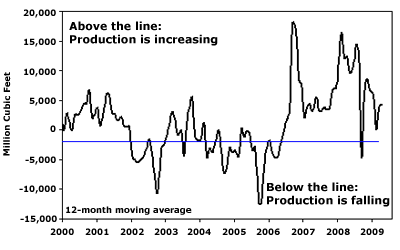

As I've pointed out, the problem is too much supply and declining demand. The graph below shows changes in natural gas production on a monthly basis (kind of like acceleration in a car). As shale gas wells came on line in late 2006, natural gas production exploded... It's kept growing almost nonstop since.

Source: Energy Information Agency

Production growth has been a disaster for natural gas prices. But here's some small comfort for natty bulls: Shale wells produce most of their gas in the first 12 to 18 months and then taper off sharply. The wells that were tapped in late 2006 should be "running out of steam" any day now. And few new ones are coming to take their place...

There's been an enormous decline in drilling. Last year, 1,555 rigs were drilling natural gas wells... There are only 675 today, less than half.

Over time, reduced supply will catch up with demand, which has been decimated by the sluggish economy. And demand may perk up...

If cap and trade legislation passes, the best alternative to coal is natural gas. I like nuclear energy for a long-term solution. But new plants take five to 10 years to plan and build... if they can be permitted. So natural gas is the only short-term source large enough to step in and replace coal and oil (which produce a combined 70% of our electricity).

I agree with Matt that at the present timenatural gas has horrible fundamentals. Supply is way up, demand is way down.

As I've written many times that will change over the next 12 months as demand catches up with and surpasses the supply-production that the decline in drilling will eventually create. That should be very good for ETF's like United States Natural Gas (NYSE:UNG) and companies like Chesapeake Oil (NYSE:CHK), Southwestern Energy (NYSE:SWN) and Contango Oil & Gas (Amex:MCF).

Concerning MCF, editor Chris Mayer of Capital & Crisis (which I subscribe to) captured my attention when he wrote

The key to Contango is low costs -- and a great balance sheet. Contango’s all-in costs [of natural gas] are less than $1 per MCF (million cubic feet). It has no debt and six employees. The company’s biggest expense is taxes.

We also have Ken Peak, the CEO and largest shareholder. (The management team and board of directors own 23% of the stock). Peak is a proven operator who built this company from practically nothing to its current depressed $700 million valuation.

MANY PEOPLE WONDER WHY NATURAL GAS PRICES FLUCTUATE SO MUCH

That is a long, long story, and too big for the scope of this article. I would recommend the article by the National Information Energy Center which is not hard to read and digest.

From a sustainability perspective natural gas is more abundant and significantly cleaner-burning than its counterparts, oil and coal. Plus the infrastructure for producing, refining, and distributing it is already in place. It will take many years before wind energy and solar energy can be as cost-effective and as plentiful.

If you're a big believer in Alternative forms of energy , you might want to consider the Calvert Global Alternative Energy C (CGACX).

The fund invests 80% of net assets (including borrowings for investment purposes) in equity securities of U.S. and non-U.S. companies whose main business is alternative energy or are significantly involved in the alternative energy sector. It invests in securities of all market capitalizations.

Of course I don't know how much lower natural gas prices will fall, but it seems clear that if it falls to new lows the traders are liikely to step in and drive the prices up again. Just look at the recent lows and highs of UNG from July 13trh ($11.91) to July 23rd ($14.00) and you will know what I mean.

Natural gas has a bright future as a sustainable, low-cost alternative to dirtier forms of energy. It might take a year or two, but eventually I think we will be surprised and rewarded.

Disclosure: I do not currently own any of the stocks or funds mentioned. |