Preliminary Smartphone Unit Sell-In and Share for Q3 2009 ...

Psylent,

<< I'm sure Eric is preparing his normally excellent write up, but in the meantime, the raw, unformatted data will need to suffice for those interested. :) >>

I'm still on walkabout. <g> & I haven't had the opportunity to abstract and spread smartphone sales for the quarter just concluded (or the prior quarter) but here are some preliminary sell-in estimates and estimated share from Canalys (which I consider to be the most authoritative source) and IDC for Q3'2008 and Q3'2008 (and Canalys estimates for Q2) ...

IA. Smartphone Vendors Unit Sell-in and Share in Q3 2009 (Canalys)

IB. Converged Mobile Device Vendors Unit Sell-in and Share in Q3 2009 (IDC)

Source: IDC Worldwide Quarterly Mobile Phone Tracker, November 5, 2009: Note: Vendor shipments are branded shipments and exclude OEM sales for all vendors

II. Q3 2009 Smartphone Sales by Region (Canalys)

III. Q3 2009 Smartphone Sales by OS (Canalys)

IV. Prior Quarter Smartphone Vendors and OS Unit Sell-in and Share in Q2 2009 (Canalys)

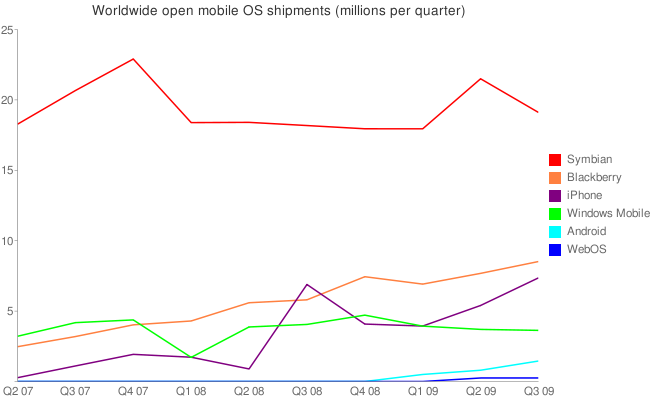

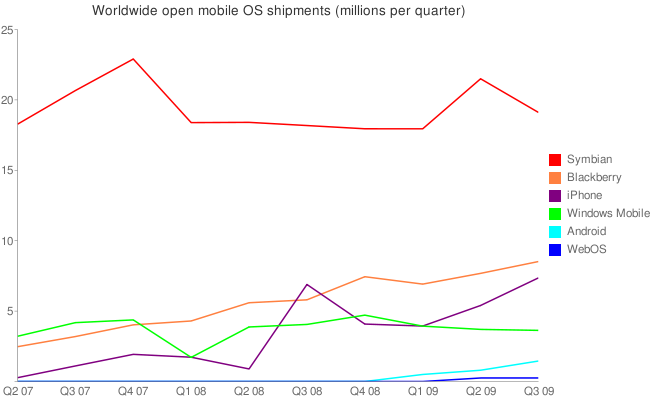

V. Composite of Smartphone Unit by Quarter since Q2 2007 (All About Symbian)

Data sources: Canalys, Gartner, and Manufacturers own results

>> Smart Phone Market Shows Modest Growth in Q3 ... but Apple and RIM hit record volumes

Canalys Press Release

Palo Alto, Singapore and Reading (UK)

3 November 2009

canalys.com

canalys.com

* Global smart phone shipments grew 4% year on year, to 41.4 million units in Q3 2009

* Nokia, RIM, Apple and HTC command over 80% of the market between them

* The APAC region shows the highest growth, at 26%, while EMEA shrinks

* Proportion of smart phones with touchscreens reaches 45%, up from 31% a year ago

* Over 80% of smart phones now ship with integrated GPS, more than 75% have Wi-Fi built in

Global smart phone shipments in Q3 2009 rose 4% year on year, slower than the 13% annual growth seen last quarter, and held back primarily by a 6% fall in EMEA. Shipments in North America were up 5%, but the APAC region saw a remarkable 26% rise after several flat quarters. ... <snip regional table shown above>

Nokia retained its worldwide smart phone lead, with a share of 40% – slightly up on its year-ago position, but down almost 5% sequentially. RIM held onto second place with a largely unchanged (compared to Q2) share of 21%, while Apple reached a new high of 18% share in third, significantly up from the 14% it held in Q2 as supply of the iPhone 3GS improved in many countries. HTC retained its fourth-place position with 5% share.

Looking at the market by operating system, Symbian’s overall lead shrank as its share fell to 46%, ahead of RIM and Apple. Microsoft remained in fourth with its share dipping slightly below last quarter’s previous low point of 9%. The proportion of smart phones running Google’s Android OS climbed to almost 4%, from just under 3% in Q2. ... <snip table shown above>

“The smart phone market continues to hold up pretty well,” commented Canalys senior analyst Pete Cunningham. “While growth has undoubtedly slowed, it is still outperforming the overall mobile phone market by some margin, as well as driving data revenue for operators, and smart phones are ushering in a range of changes in user behaviour when it comes to what people actually do on their phones.”

Notable performers in Q3 included Apple and RIM, which both saw a new record volume of devices shipped in the quarter. “Demand for the iPhone 3GS far outstripped supply,” Cunningham added. “And we expect to see continued growth for Apple, especially with new operators coming on board, for example in the UK with the end of O2’s exclusivity on the device. Our end-user research indicates growing demand for touchscreen products and Apple’s satisfaction ratings in our surveys are consistently the highest of any vendor. Furthermore, the iPhone’s appeal is not limited to the consumer market, in our October study of 600 European decision makers in medium and large enterprises, more than 20% said they expect the iPhone to be the dominant smart phone platform for running business applications in their organisation within the next 3 to 5 years. In France, the iPhone was ahead of Windows Mobile and RIM in this regard – a remarkable result.”

Operator exclusivity is likely a barrier for many companies. While Apple leads in France, Canalys’ enterprise survey shows RIM in pole position in the UK, and Windows Mobile holding a strong lead in Germany. But Apple is already ahead of Microsoft in the minds of those UK decision makers and wider availability can be expected to translate to greater acceptance among business buyers.

“As well as enjoying a sustained strong position in the UK and North America, RIM is seeing great growth in other parts of the world and overcoming some difficult market conditions,” added Chris Jones, principal analyst and VP. “Despite overall market contraction in both Latin America and the Middle East, RIM saw strong growth in both of these regions, of 54% and 214% respectively. This was aided by demand for the Curve 8900 and the newly introduced Curve 8520, and supported by specific in-country marketing campaigns and promotions.” ... <snip Share by OS table shown above>

Nokia remains the smart phone volume leader by some distance and its share is stable year on year. In Q3 it suffered somewhat from component shortages as suppliers reduced capacity due to the overall market slowdown, but while its smart phone volume was down 10% in EMEA year on year, in the APAC region 29% growth put it comfortably ahead of the market average. “Much of the recent growth in the smart phone market has come in the high tier, with products like the Nokia N97, the iPhone and the BlackBerry Bold,” observed Rachel Lashford, MD of Canalys APAC. “Vendors are now beginning to drive smart phones into a new segment, with products such as the Nokia 5230, targeting consumers who are new to smart phones. We expect this to boost growth and penetration of smart phones substantially over the next two years. There will be increasing competition in this space – T-Mobile, for example, is already offering the Huawei-built, Android ‘Pulse’ on pre-pay, and it is likely we will see more Symbian devices being pushed at price-sensitive segments.”

The changing dynamics of the smart phone industry will be one of many topics discussed at the Canalys Mobility Forum in London on November 17. Full details are available at www.canalysmobilityforum.com ... ###

>> Worldwide Converged Mobile Device (Smartphone) Market Continues To Grow Despite Economic Malaise, Says IDC

IDC Release

Framingham, Mass

November 5, 2009

idc.com

The worldwide converged mobile device (commonly referred to as a smartphone) market continued to weather the economic recession and reached a new record for shipments during a single quarter. According to IDC's Worldwide Quarterly Mobile Phone Tracker, vendors shipped a total of 43.3 million units during the third quarter of 2009 (3Q09), up 4.2% from the 41.5 million units shipped in 3Q08, and up 3.2% from shipments of 41.9 million units in 2Q09.

"Demand for converged mobile devices has remained strong all year," said Ramon Llamas, senior research analyst with IDC's Mobile Devices Technology and Trends team. "These devices provide more utility and entertainment than traditional mobile phones. Moreover, users have plenty of devices from which to choose, whether it be a multimedia powerhouse, a messaging machine, or a social networking tool. As users expect greater functionality from their devices beyond telephony, we believe the converged mobile device market to grow faster than the overall mobile phone market."

"With the release of Android-based handsets from several different OEMs, most recently Motorola, but also HTC, Samsung LG, and Sony Ericsson, the buzz surrounding Android OS is reaching critical mass," added William Stofega, research manager with IDC's Mobile Devices Technology and Trends team. "HTC was first to come to market with an Android device, other vendors took longer to develop their Android portfolio. However, the release of new Android devices has picked up dramatically over the past several months and the release of version 2.0 demonstrates that Android is rapidly evolving and responsive to suggestions from OEMs and developers. With an expanding portfolio of handsets and a just released update of the code, Android is poised to mount a serious challenge to the incumbent smartphone OEMs for the first time in its brief history."

Top Five Converged Mobile Device Vendors

Nokia maintained its position as the overall leader in the converged mobile device market. Driving shipments forward were its popular flagship device, the N97, and an improving enterprise-focused portfolio led by the E71. Nokia also announced its first Maemo-powered device, the N900, targeting high-end users. While its worldwide leadership position is clear, Nokia still struggles in North America.

Research In Motion continued on its upward path with BlackBerry devices available for first-time users and returning users alike. Although most of its volumes remained within its home region of North America, the company also posted significant improvement internationally, with some regions recording triple digit growth year over year. Research In Motion launched two new devices during the quarter; the BlackBerry Tour for CDMA networks and the BlackBerry Curve 8520 for GSM networks.

Apple reached its highest volume yet in a single quarter. The nearly global availability of the iPhone 3G S sparked another round of annual replacements for Apple loyalists, while the lower price on the iPhone 3G put the device well within reach of customers wary of the price. Although the iPhone has struggled within emerging markets, its arrival at China Unicom this year could foreshadow greater shipment volumes.

HTC finished the quarter in fourth place (with HTC shipment data excluding phones sold under another company's brand). HTC remains the largest provider of Windows Mobile-powered devices, with several new devices shipping the new Windows 6.5 operating system. These include the HD2, Imagio, Tilt2, Pure, and Touch2. Not to be overlooked is its quickly growing Android-powered volumes with the Dream, Hero, and Magic.

Samsung returned to the top five vendors during 3Q09. Although volumes were flat from a year ago, the company saw marked improvement in Asia/Pacific, Latin America, and EMEA. The company has been a big supporter of Windows Mobile on its devices, and features Windows 6.5 on its Intrepid device. Samsung also plans to launch its Android-powered offering with the Moment and Behold II. ... <snip table shown above >

Converged Mobile Devices – These mobile devices are either voice or data centric and are capable of synchronizing personal information and/or email with server, desktop, or laptop computers. These devices must match wireless telephony capability to high level operating systems, include the ability to download data to local storage, run applications, and store user data beyond PIM capabilities. Converged mobile devices must offer the full extent of their application processing capability to the user, regardless of network availability. ###

>> Q3 Smartphone Sales Figures Now Out

Rafe Blandford & Steve Litchfield

All About Symbian

November 4th 2009

allaboutsymbian.com

Canalys' Q3 worldwide smartphone sales figures have been published. Headline figures are that the entire smartphone market grew by 4% year on year, with Nokia's S60 smartphone sales growing by 6% year on year and with their world market share now also up to 40%. RIM are in second place worldwide, with 21% (and impressive 40% year on year sales growth) and Apple are in third place with their iPhone with 18% (6.7% year on year sales growth). Down in marketshare are HTC and 'others'. However HTC's figures hides an increase in Android shipment and a decrease in Windows Mobile shipments.

Symbian device sales grew 3% year on year, but their worldwide market share was down 0.4% percent to 46.2% in the face of increased competition from RIM (20.5% up from 15%) and Apple (17.6% up from 17.3%). Microsoft's Windows Mobile was the big loser, with world market share now down to 8.8% from 13.8% a year earlier. Android figures for the first time, with 3% market share. ###

Gartner's Q3 Sell Through report due by months end will be interesting. Nokia had a big sell through quarter in Q2 (continued sequential rebound from Q3'08 & Q4'08 which will be hard to match in Q3. OTOH, Apple had a rather large inventory overhang. Android should start to shake things up in Q4.

- Eric - |