How Not to Trade Natural Gas

seekingalpha.com

by: Condor Options December 03, 2009 | about: UNG

In early September, I tried to take the other side of the case against UNG, the popular natural gas ETF, regarding its perceived failure to track spot natural gas prices (”The Fuss Over Natural Gas“).

At the time, I admitted that my defense – roughly, “it isn’t as bad as all that” – was anecdotal and didn’t address any of the fundamental worries that caused the dislocation in the first place. I also warned that UNG shareholders weren’t being compensated for the weird risks they were taking – i.e., risks that had nothing to do with the fundamentals of the physical commodity.

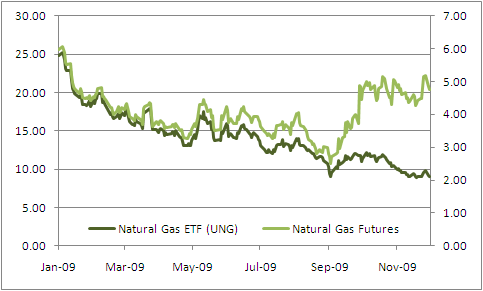

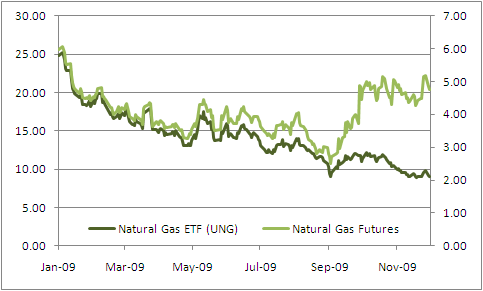

Three months later, it looks like everyone was right to warn retail investors away from the fund. Since early September, as natural gas futures have recovered much of their 2009 losses, the ETF has just kept chopping and dropping (h/t Maoxian for revisiting the issue and tradingpoints for a nicely annotated chart).

Near the end of Pygmalion, Higgins remarks: “Would the world ever have been made if its maker had been afraid of making trouble? Making life means making trouble.” Investors could be forgiven for wondering whether the issuers of UNG have essentially the same ethos in mind. Instead of getting the price at Henry Hub, the central delivery point for North American natural gas, UNG shareholders have received something more akin to the efforts of a meddling professor attempting to run a social experiment. The analogy isn’t entirely apt – Eliza Doolittle performs admirably, after all, while UNG has done anything but.

Notice the effects this Fall’s dislocation has on the correlation coefficient between the futures and ETF, versus their relationship since UNG’s inception (April 2007):

Inception 2009

Correlation 0.919 0.403

R^2 0.845 0.162

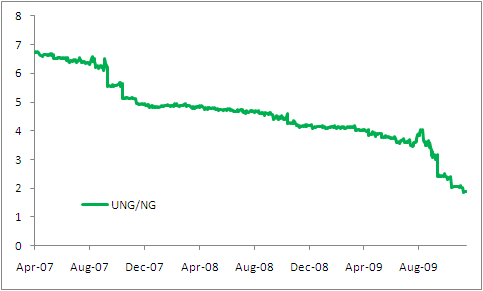

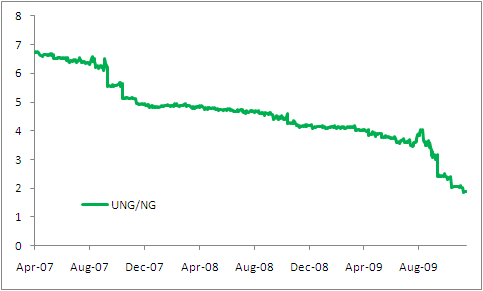

Given the steady decline in the ratio of UNG to NG (below):

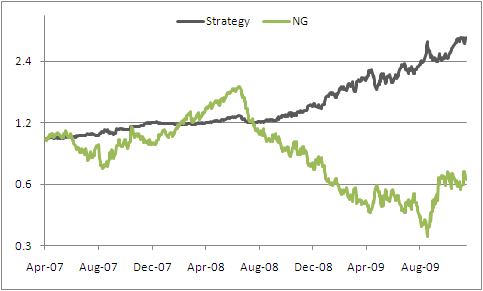

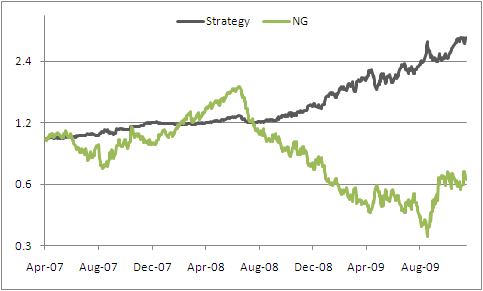

A viable strategy would have been to short UNG at inception and buy the futures in equal dollar amounts, and hold the positions since then. Log-scaled results for that strategy are below, versus buying and holding the futures alone.

I’m not advising anyone to pursue such a strategy at this stage; for one thing, UNG shares are hard to borrow (although the options look active enough to warrant a synthetic short) and, more importantly, the two vehicles could easily converge from here. But this equity curve suggests that UNG’s current set of problems – the halt on new shares, CFTC eyebrow-raising over position limits, swap market size, etc. – are not the only troubles plaguing the fund. Even if all the regulatory troubles disappear, the smartest and least painful thing for any trader to do who wants to take positions in natural gas would be to simply trade the futures.

I think this lesson generalizes pretty well, in fact: no one should trade a new non-equity ETF unless and until it has proven its ability to avoid massive tracking error.

Disclosure: No positions |