Delusions of Finance: Where We are Headed

Posted by Gail the Actuary on February 8, 2010 - 10:51am

Topic: Economics/Finance

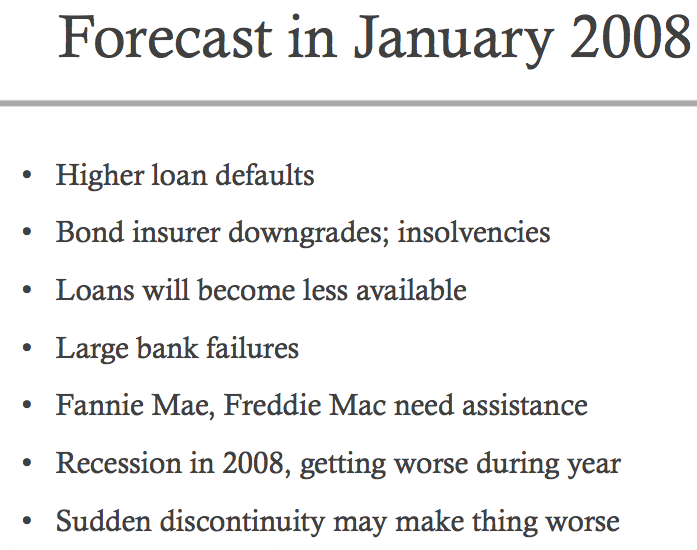

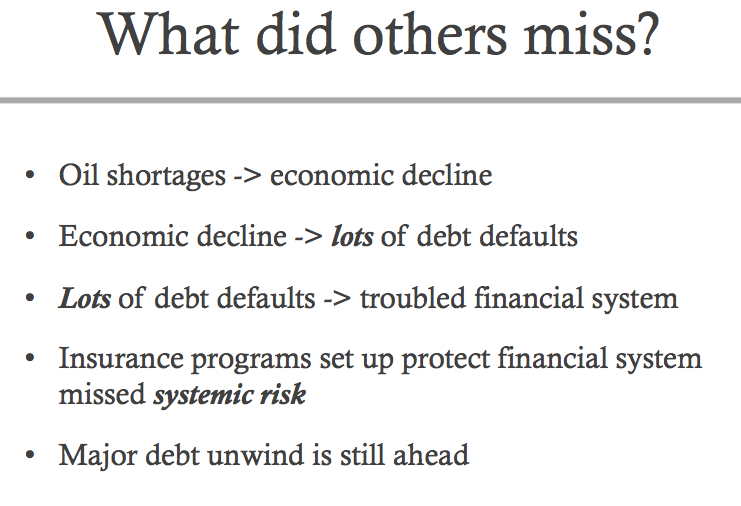

Back in October, I participated in the 2nd International Biophysical Economics Conference at SUNY-ESF in Syracuse, New York. Charlie Hall had written to me, inviting me to come and give a talk. Specifically, he wanted me to go back to my post from January 2008 called Peak Oil and the Financial Markets: A Forecast for 2008 and explain why my forecasts had turned out pretty close to correct, while many others widely missed the mark. The title he suggested for the talk was Delusions of Finance.

My financial forecast really has implications for beyond 2008, so I added some more forecasting thoughts as well. In this post, I would like to share this presentation with you. A download of the presentation, plus an audio recording, are available at the Biophysical Economics Conference Proceedings website under Gail Tverberg.

I am a casualty actuary by training and spent many years doing forecasting and modeling as an insurance company employee and later as a consultant to insurance companies. Many of these companies were small medical malpractice insurance companies that provided insurance for a group of hospitals or physicians. Medical malpractice claims are notoriously slow to be reported and to be paid, so we had to forecast many years of reporting and payments, (and corresponding investment income). These models were used both for determining appropriate insurance rates and for determining balance sheet reserves for these companies. Quite often I was involved in putting together models for proposed new companies in order to estimate likely capital requirements. I was also prepared a lot of estimates of the likely impacts of medical malpractice reforms.

All of this didn't really give me any special training for making financial forecasts relating to peak oil, but it did give me a lot of practice with making forecasts and trying to think outside the box. I needed to figure out what was unique to each situation, and figure out a way to model it. I hadn't gone through the standard MBA training, but I had bumped up against a fair amount of it along the way.

My background goes back far enough that I had a chance to see how badly insurance companies fared back in the 1974 period, when oil shocks affected insurance companies. One of my former employers went bankrupt, and another one nearly did. I could see that if a similar situation happened now, other financial companies would likely be affected as well.

Quite a bit of the rest of this presentation is fairly self-explanatory, especially if you have seen some of my other presentations, so I won't provide too much in the way of comments.

theoildrum.com |