Michael Brandt in the kitchen of his two-bedroom condo in the 82 percent vacant Bellevue Towers in Seattle. (Jeff Tyler/Marketplace Staff)

Except this building is in Bellevue, WA, not Seattle. Bellevue is a weaker downtown market than Seattle.

The article is focusing mostly on the Downtown Seattle market which became overbuilt when people cancelled their pre bought units during the Great Recession and not very comprehensive.

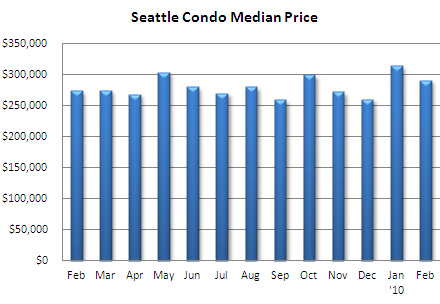

Here is a more accurate view of the entire Seattle condo market:

February 2010 Seattle condo market update

Posted on March 12 2010 | The Seattle Condo Blog |

February’s median Seattle condo price of $290,500 highlighted only the second year-over-year increase in the past 12 months, up 6% over the median price last February. Though, it did slip 7.4% from January. Given that sales were weighted towards the lower price points (54% of all condo sales were priced below $300,000), it’s good to see that values rose over the same period last year.

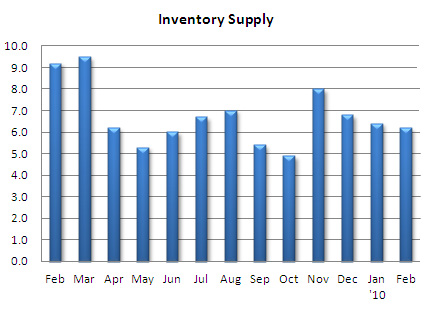

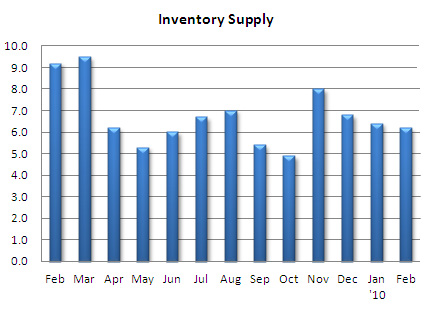

Inventory increased as expected, up 8.7% over January and 1.9% above last February. However, the inventory supply rate dipped to 6.2 months of supply. When factoring in the phantom inventory of unlisted new construction condos, the rate rises to 8.8 months of supply citywide. Though, in the Belltown/Downtown area, the rate shoots up from 7.8 to a 21-month supply.

The number of pending transactions rose 51.1% over last February and 11.7% above January, fueled by the robust sales of affordable condos and the tax credit incentive. Closed sales also increased 18.4% compared to last February, but down slightly from January.

read more..........

seattlecondosandlofts.com

Given the dwindling inventory and lack of significant construction, I expect the inventory to be below 6 months by Fall. |