Income Inequality and Great Depressions

by: Dirk Ehnts

May 09, 2010

seekingalpha.com

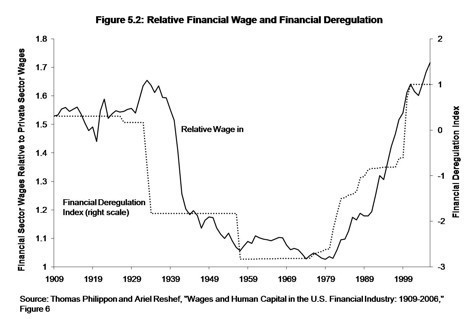

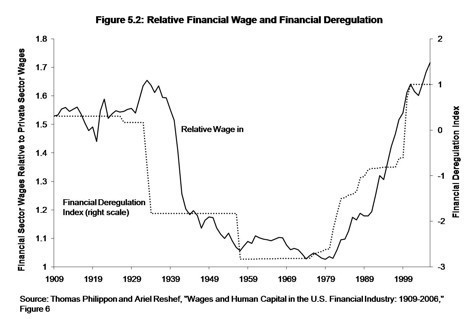

More than a year ago I had wondered what role income inequality played in the financial crisis. Mike Konczal has put up a very interesting blog post in which he blames the financial industry for the divergence in incomes. This is the main graph:

This is just what I (and many others) expected to find. The financial sector has grown very big, for reasons that do not seem to be connected to productivity. We have a whole industry creating excel sheets that are so big that nobody will bother to read them, like CDOs, and squared and cubic and what-not CDOs.

Here’s an idea that crossed my mind more than once. When societies get rich (and don’t die trying, like in wars), the use of money changes from being a means of payments towards being a store of value. This creates pressure for the financial system to create more investment opportunities. This translates into liberalization of financial markets and then innovation of obscure financial products and investment in assets that are not sustainable, but look good in the short run. This process would also explain why central banks are so keen to suppress inflation, since this helps to stabilize the value of financial assets. However, judgment day will come.

How it comes about, and what is influencing its exact date, is a very interesting question. Think of Japan in 1990. They had a double bubble, and since these burst Japan has been in a slump continuously. First idea: demographics – is there a generational storm to come? Second idea: shifts in economic geography – what happens if Chinese savers will never be able to save by buying foreign assets, but Western asset holders need this additional demand to keep asset prices from falling when they cash in to retire in style?

Both of these problems are under the radar of current mainstream macromodels which just assume that investment=saving and that therefore intertemporal equilibrium <hand waving> will be established. A shrinking population or a geographical shift of production to other countries is not allowed under the rule of the (RBC) models require – or if it is allowed, it comes with more (unrealistic) assumptions.

About the author: Dirk Ehnts

I am a research assistant at the chair for international economic relations at University of Oldenburg, Germany. This year I completed my doctoral degree after participating in the PhD program “Globalization and Employment”. In this blog I write about stuff that crosses my mind, mostly from... |