(To borrow Taleb's formulation), is it a question of "Inflate or Die" that is facing the world?

De-flation appears to be the biggest, baddest threat of all world-wide right now.

Reducing Gross National Products and world economic output (and markets...), and revenues, the more that spending is cut, in a dangerous spiral down the drain into Depression.

These comments and charts excerpted from John Mauldin's latest missive:

Thoughts from the Frontline Weekly Newsletter

Europe Throws a Hail Mary Pass

by John Mauldin

May 15, 2010

In this issue:

Europe Throws a Hail Mary Pass

It's More Than Just Government Debt

The Grand Misallocation....

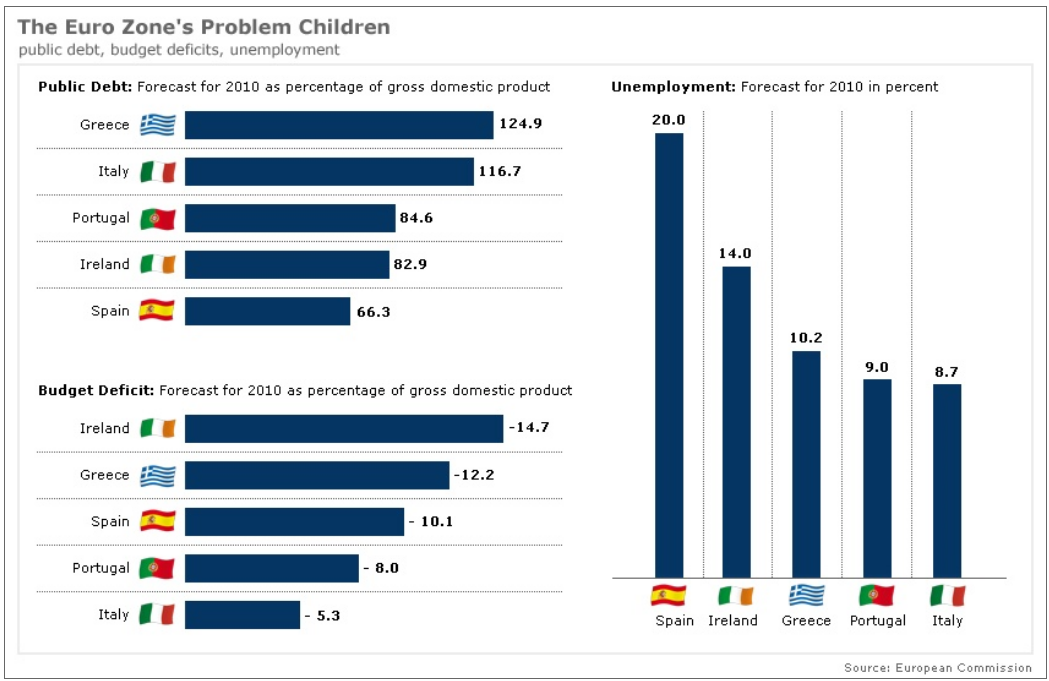

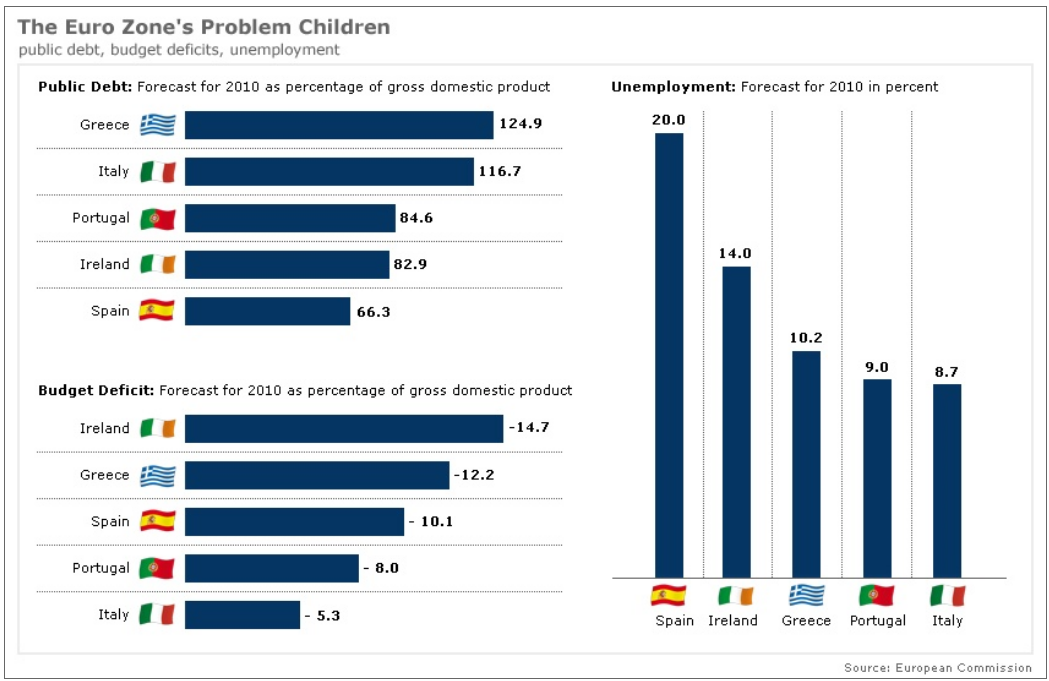

...But it is not just the PIIGS countries that are out of compliance in Europe. Look at the following chart from Der Spiegel. Note that France has a budget deficit of over 8%. There are going to have to be austerity measures enacted all over Europe.

Notice that Ireland has the largest deficit, at 14.7%. This is in spite of (or more aptly because of) the enactment of severe austerity measures, far beyond what Greece, Portugal, and Spain have contemplated. And what has that gotten them? An economy that has shrunk by almost 17% in the last two years, 14% unemployment, and a country in the grip of outright deflation. Property prices have fallen by 34% and are still falling. Their banks are in shambles.

And their debt-to-GDP is rising, because even as they borrow their GDP is falling. It is hard to cut that ratio when GDP is falling. If GDP falls 20%, then the debt-to-GDP ratio rises by 25%. And that means your interest-rate costs are an ever bigger chunk of your tax revenues.

Let's be clear. These austerity measures are not growth plans. They are not designed to help countries grow their way out of the problem. There is no reason to think that if Greece enacts the measures that have been proposed, that what happened to Ireland will not happen to them. It almost certainly will. Credible estimates I have seen suggest that the Club Med countries will see their GDP drop at least 4% this year.

It is not just the PIIGS. All of Europe will be making cuts. And in the short term that is going to be a drag on growth and a headwind for the euro....

===========================================================

And:

From: Friday Freak-Out, Global Edition

14 comments

by: Philip Davis

May 14, 2010 | about: BP / DIA / ERX / QID

seekingalpha.com

And:

'The EU Could Be Facing a Double-Dip Recession'

Der Spiegel

05/14/2010

spiegel.de |