A Brief Nuclear Update

Posted by Gail the Actuary on July 10, 2010 - 9:25am

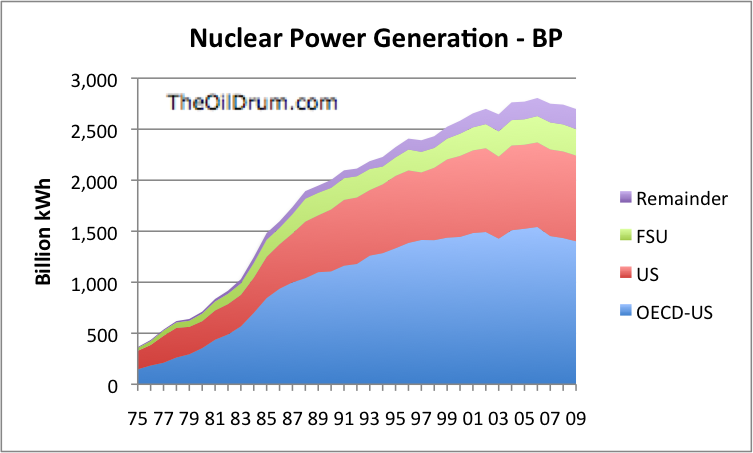

World nuclear power generation slipped again in 2009, continuing its slide since its peak in 2006. The data shown is from BP's compilation of statistical data, but data from the World Nuclear Association shows the same pattern--peak production in 2006, with declines each year since 2006.

The part of the world with what appears to be the clearest pattern of declining nuclear power generation is what I call OECD-US, the is, the countries in the Organization for Economic Development and Co-operation, minus the US. This group would include Europe, Japan, Australia, Canada, and Mexico.

It is possible that there are particular accidents and facilities being taken off line for upgrades or other reasons that are causing this pattern. But with aging facilities, it may very well be a pattern we can expect in the future, at least in the parts of the world with aging nuclear facilities.

Besides OECD-US, both the US and the Former Soviet Union (FSU) showed dips in nuclear power generation in 2009, at least partly related to declining electricity demand in general. The only group which showed an increase in nuclear power generation in 2009 was the group I call "Remainder", which includes China, India, and many "developing" nations.

Last year, Michael Dittmar wrote a series of posts on the future of nuclear energy. Brian Wang, writing under the name advancednano took issue with the projections he made. Brian Wang made a bet with Michael Dittmar regarding the future of generation of nuclear electricity, using World Nuclear Association figures, which are slightly lower than BP amounts, but seem to follow the same pattern as BPs, where both are available.

Wang forecasts a 46% increase over 2008 power generation levels by 2018, while Dittmar foreacsts a small decrease in the same timeframe. For the 2009 year, Wang forecast production of 2,600 billion kWh while Dittmar forecast production of 2,575 billion kWh. The actual amount was 2,560 billion, which was lower than either of the estimates, so Dr. Dittmar won for this year.

There was also a bet with respect to uranium production for 2009.

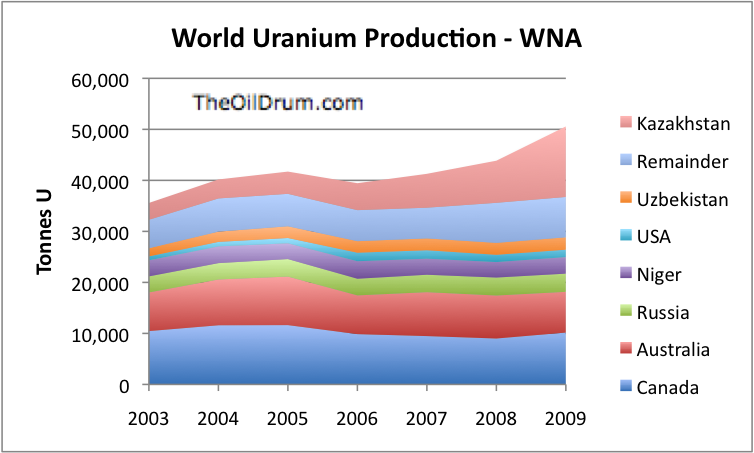

Wang estimated that for 2009, world uranium production would be 49,722 tonnes of uranium while Dittmar estimated that world uranium production would be 44,000 tonnes. The actual amount, based on figures of the World Nuclear Association was 50,272 tonnes, which is higher than either estimate. Therefore Brian Wang is winner on this part of the bet.

With one bet going each way, I would describe the situation as basically a tie.

Going forward, it is not entirely clear what will happen. The spot price of uranium is very low now, only a bit over $40 a pound. This low price is reportedly occurring because of the high production and low costs of Kazakhstan.

Another reason the price is low is because the US is because recycled US bombs are reaching the market. According to mineweb:

"Prices continue to be dampened by a low level of ‘uncovered utility requirements in the West, concern over further production gains in Kazakhstan and the barter of U.S. Department of Energy UF6 inventory to pay for an environmental cleanup at a closed Ohio uranium enrichment plant," Mohr advised.

The announcement of a DOE barter sale to USEC Inc., a leading supplier of enriched uranium fuel for commercial nuclear power plants, was blamed for the beginning of a uranium price decline a year ago. The sale will end in the third quarter of this year. However, Mohr said U.S. Energy Secretary Chu intends to sell additional federal uranium inventory under another program.

Long-term contract prices are down, but not as much.

The long-term contract uranium price is US$58.00/lb. It is down from US$61/lb January 2010, though has been relatively stable, compared with the more thinly traded spot market price, since peaking at US$95/lb from May 2007 to March 2008.

Australia has instituted a new tax on mining profits, and this is discouraging new production there. China has said it is planning a similar tax. Both higher taxes and lower prices would tend to discourage uranium production, although it is not certain by how much.

Current uranium consumption seems to be around 66,000 tonnes a year. The amount by which current production of 50,272 tonnes needs to be ramped up to meet consumption depends on whether nuclear generation is really increasing or decreasing. (Part of the demand is now being met by recycled bomb material from both US and Russia, but in not too many years, this will be exhausted.)

If nuclear generation is set to rapidly increase, as Brian Wang forecasts, then very large increases in uranium production will be needed over the next few years, so that production matches demand. But if nuclear electricity generation is really falling as a result of older facilities going off line, then annual uranium consumption can be expected to drop from the current 66,000 tonnes. If this happens, perhaps not too large an increase from current production levels is needed.

theoildrum.com |