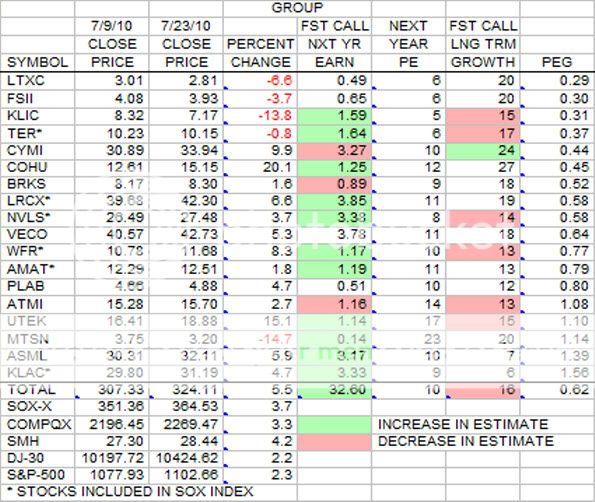

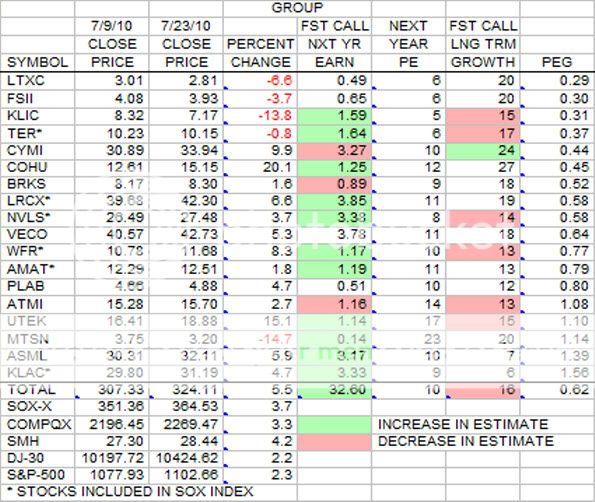

This is the same Group data as the last post, but this time it is sorted by PEG. Notice that KLIC is down 13.8 percent for the 2 week period, so it now has a PE of 5, the lowest in the table and a PEG of 0.31. This was all caused by the a meeting held by KLIC on 7/14 as follows:

<<Kulicke & Soffa said in a conference presentation Wednesday that some fiscal fourth-quarter orders were being pushed back, though the company expected to be able to patch any holes with other demand, which in general remained high. But the softness splashed cold water on the bullish semiconductor views coming out of Intel Corp. (INTC) and ASML Holding NV (ASML, ASML.AE) this week, even as analysts said it didn't appear other equipment makers were as concerned.

Kulicke & Soffa shares fell 7.7% on Wednesday and recently tumbled another 10.3% to $7.17 on Thursday. Before the two-day swoon the stock had rallied for six straight days, gains that now have been nearly wiped out.>>

Two weeks ago, bottom line PE, Growth and PEG's were 10, 16 and 0.61, so very little change over the 2 week period. Seven of the stocks have PEs under 10 and 6 have PEGs less than 0.05.

|