The Obama Spending Future

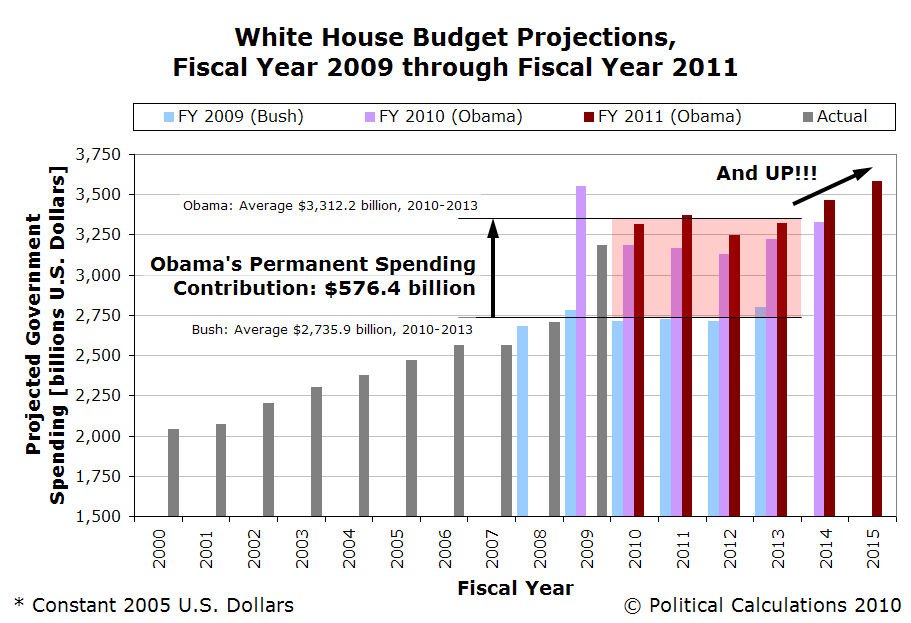

We've been digging through the White House's budget projections for Fiscal Year 2009, which was produced under President Bush's tenure, and Fiscal Years 2010 and 2011, which were both produced under President Obama's direction, to compare how much of the U.S. taxpayers' money each would have planned to spend in the years from 2010 through 2013.

Why these years? Simple! The budget for spending in Fiscal Year 2009 was crafted to reflect many of President Bush's priorities prior to the beginning of the October 2008 financial crisis.

With the fallout from the financial crisis of October 2008 receding in 2010, we can use President Obama's Fiscal Year budgets beginning with that year and projecting forward in time to compare his proposed spending with what President Bush had proposed for those same years to see exactly what President Obama intends to contribute to the total level of the federal government's spending.

Our results are shown in the chart below, in which we also showed the actual amount of spending that occurred in the years from 2000 through 2009 for reference:

3.bp.blogspot.com

All dollar amounts in the chart above are adjusted for inflation and presented in terms of constant 2005 U.S. dollars.

What we find is that even after adjusting for inflation, President Obama intends to permanently increase the federal government spending's by an average of $576.4 billion during the years from 2010 through 2013. We also see that he doesn't plan to stop there, as he would plan to spend even more money in 2014 and 2015, the last year for which he projects spending in his Fiscal Year 2011 budget.

Now, if you combine the Obama Spending Future above with the Obama Tax Future, where he projects taxes will rise to a larger and larger share of the U.S.' annual GDP, you can see why there's such a problem with the Obama Deficit Future. Even though President Obama plans to raise taxes by quite a lot, he plans to increase federal government spending even faster.

Note to President Obama's debt and deficit commission: That's not a tax problem - that's a spending problem.

Don't blame us. We're just showing you what's in President Obama's proposed budget plans. It's not like he didn't tell you....

politicalcalculations.blogspot.com

The Obama Tax Future

How heavily will President Obama's planned tax hikes weigh upon the U.S. economy?

Going by Table S-1 from his administration's Fiscal Year 2010 and 2011 budget proposals, either the economy is going to start growing like gangbusters next year, or the future tax burden is going to come down pretty heavily, like a boot on the neck of an oil company:

4.bp.blogspot.com

Looking back over history, since World War II, the federal government's total tax collections have only exceeded 19.0% of GDP in eight of those 65 years, each of which represented unique conditions in the U.S. economy: the 1969 surprise 10% surtax on high income earners, the hyperinflation of 1981, and the Dot-Com Bubble of 1997-2001. And that's regardless of how individual, corporate and payroll tax rates have been set through all those years!

It's just a shame they won't ever be enough to cover the deficits he'll be leaving behind!

But then, check out the gap between what President Obama's top budget officials forecast in 2009 versus what actually happened in that year. Or for that matter, what they expect to happen this year versus what they originally anticipated, when they might actually have thought that $787 billion stimulus package might actually work. It's not like his team is particularly gifted where any kind of economic forecasting might be concerned....

politicalcalculations.blogspot.com |