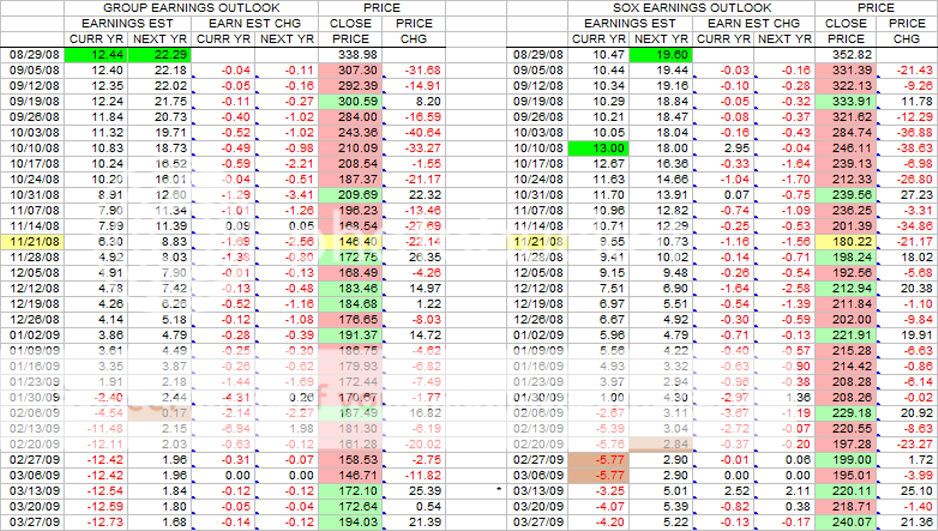

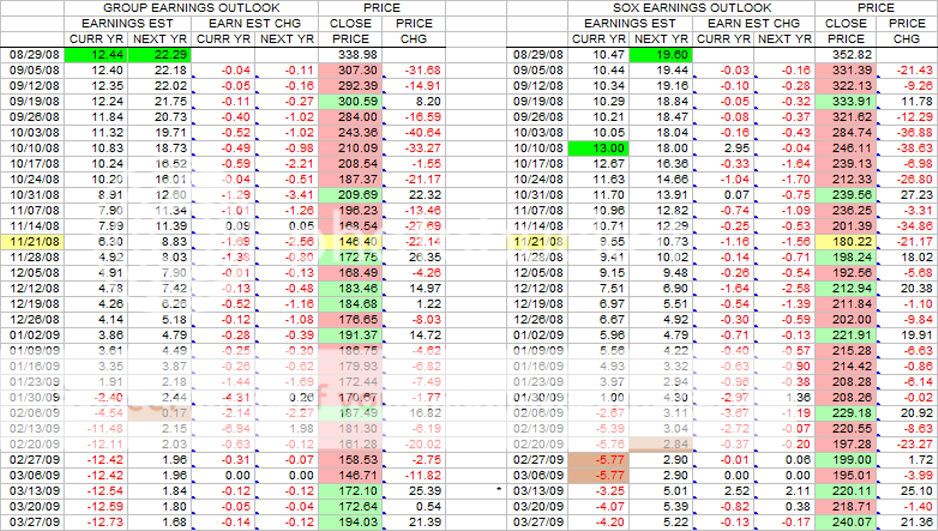

This is the weekly update of the Group and SOXM(SOX) tables in terms of earnings estimates and price changes.

Both the Group and SOX had medium type pullbacks this week. Looking in the right most columns for each table, this is the second pullback for the Group and the third pullback for the SOX in the last 14 weeks. These pullbacks do not seem to be enough to portend a change in the present up channel. The SOX broke through the 400 level 3 weeks ago, but fell off 5.25 points this past week to finish at 411.44.

The earnings estimates for both the Group and SOXM for the week were essentially "flat".

IMO, the "semi" market is acting quite rationally for a change and to me that is a little bit scary. I don't believe that situation happens very often. I say acting rationally because of the last few months of Bookings and Billings data, and the corresponding consensus earnings estimates put forth by the analysts. Bookings peaked in July at 1837M. Since then the trend has been down the past 4 months with the Nov number at 1509M, down 328M, or -18 percent. The Billings number is now following the Bookings number in Nov by pulling back as well.

In the meantime, from the Jul/Aug area, the table below shows the "peaking" of the earnings estimates and a slight downtrend starting to take place. This is a rational response of the analysts to the Bookings and Billings peaking and the following downtrend. Now also in the meantime, the Group and SOX prices have been expanding at a great rate, and for the moment, show no signs of stopping. My rationale for this situation is the semis had "room to run" because of their extremely low, unrealistic evaluation, during the past many months. The table posted at the bottom of this page has shown over the past many weeks how the PEs and PEGs have been increasing at a rapid rate to their more normal historical evaluations.

Having said all that, this situation cannot go on forever. If Bookings and Billings continue their downtrend into Dec and on into the new year, analysts will have to bring their consensus earnings estimates down, resulting in PEs and PEGs rising to unacceptable levels for the market if semi prices continue to rise.

In addition to all of the above, which is focused on the semi situation, the overall world and U.S economy outlook has an ongoing impact on stock prices in general. There are liable to be many changes in this area as 2011 progresses which will also impact semi prices. These events are very hard to gauge.

|