ComScore: Groupon-Living Social Battle Brewing In The New Wild West

BY E.B. Boyd

Fast Company

Fri Jun 10, 2011

A new analysis shows that the race between online discount services Groupon, Living Social, and others is less about what they're offering or even how they're offering it and more about where they're prospecting.

The daily deals industry is often written about as if it were a Groupon-Living Social horserace a la Coke vs. Pepsi, Apple vs. Microsoft, iOs vs. Android.

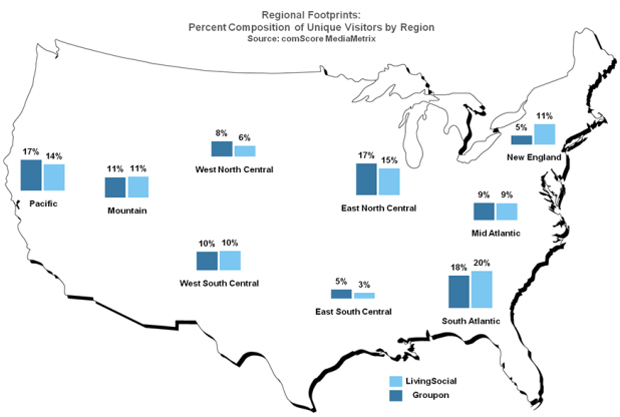

But a new analysis from ComScore shows that it’s more like the settlement of the American West: the market is a wide open territory and instead of competing head on, Groupon and Living Social are staking out different areas. All of which suggests that success in this business, at least in the immediate term, will depend more on execution than on market dominance.

“The sheer size and raw potential of the unclaimed market has meant that group buying businesses are engaged in a free-for-all land grab of markets and merchants,” analyst Peter Elbaor writes on the ComScore blog. “It’s easier to build a new market than to steal one away.”

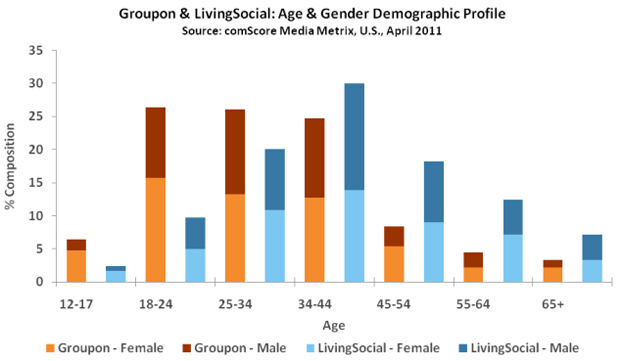

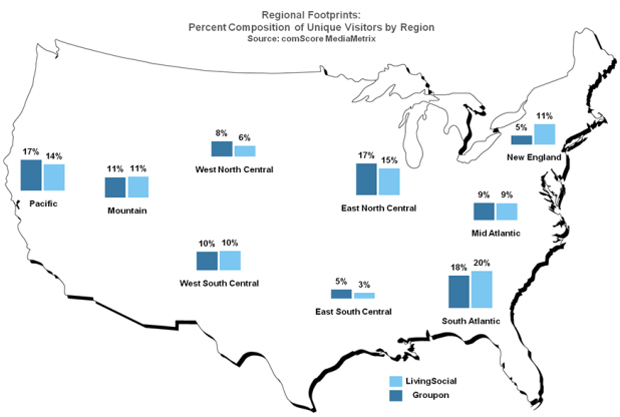

In the U.S., Groupon, according to ComScore, is getting more users in the Midwest and Pacific regions, while Living Social is doing better in the East. Groupon also does better among younger consumers and women, while Living Social’s skews more toward middle age and has equal representation among the genders.

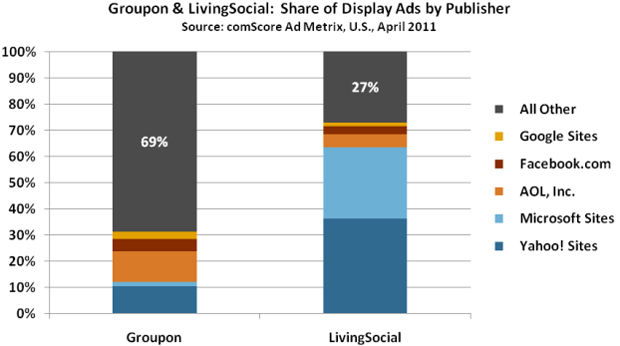

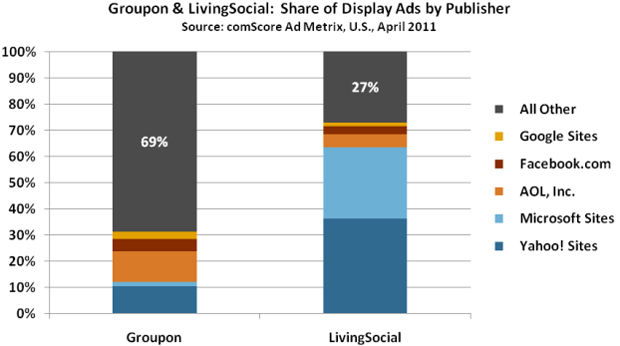

Given the land-grab nature of the current business, ComScore also took a look at the companies' customer acquisition strategies, as reflected in where they are advertising. Living Social places the bulk of its ads (73%) in the top five U.S. online properties, which Groupon does the opposite: Only 31% of its ads go to the top publishers, and the rest are scattered throughout smaller sites.

ComScore's thesis--that the couponing giants are involved in an immediate effort to acquire as many users as possible--is reflected in the pre-IPO S-1 Groupon filed last week.

Specifically, the filing said the company measures its performance based on three metrics. Two of them are standard: gross profit and free cash flow. But the third, adjusted consolidated segment operating income ("Adjusted CSOI"), caused a stir in the business press because using it makes Groupon's financials look stronger than they would if measured according to standard accounting principles.

But Groupon's S-1 argued that their approach is legitimate because it leaves out certain costs that the company does not believe are representative of future operating costs. Among those: online marketing expenses to acquire new subscribers. Those are "dictated by the amount of growth we want to pursue," the filing said.

E.B. Boyd is FastCompany.com's Silicon Valley reporter.

fastcompany.com |