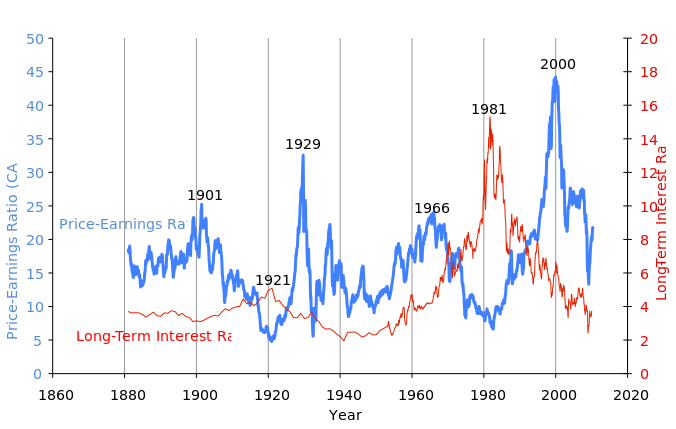

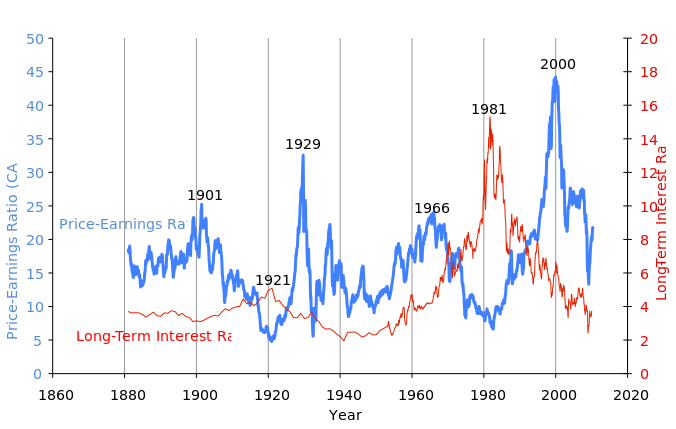

recession watch: LT PE vs. rates:

(Anyone who thinks valuations are now low, needs to reframe. Even after 11 years of falling stock valuations, we are still at the top of the LT range of 10-20.)

news:

Investors pulled the most money from global stock funds since 2008 in the past week bloomberg.com

More executives at Standard & Poor’s 500 Index companies are buying their stock than any time since the depths of the credit crisis... ...Sixty-six insiders at 50 companies bought shares between Aug. 3 and Aug. 9, the most since the five days ended March 9, 2009, when the benchmark index for U.S. equities reached a 12- year low bloomberg.com

This Time, Maybe the U.S. Is Japan: It is an analogy others have tried to apply before, but traders and investors say the similarities between the two countries have never been more apparent... ...William O'Donnell, chief Treasurys strategist at RBS Securities...now forecasts U.S. 10-year rates to reach 1.70% by the middle of 2012. online.wsj.com

Following the Federal Reserve's dim outlook on the U.S. economy, investors have pushed risk premiums on high-yield, or "junk," debt in the secondary market to an average of 7.39 percentage points above comparable Treasury yields. ..."the market is pricing in a decent chance of a recession," said Michael Anderson, a high-yield strategist at Citigroup.By way of comparison, during the previous recession in 2001, risk premiums ranged between eight and 10 percentage points... online.wsj.com

Americans saved 5.4 percent of their disposable income in June, the Commerce Department said this month.... It was 1.5 percent in 2005 bloomberg.com

Confidence among U.S. consumers plunged in August to the lowest level since May 1980 bloomberg.com |