Impact of XL & WTI price on SU, COS, etc and US Gasoline prices:

Some personal critical thinking with some detail.

A conversation: "Very simple game. Three cups, one pea. Follow the pea. Find the pea and you win!" "Simple? How can it be simple with all this freakin' noise everywhere?" "That's the point. Follow the pea."

First, let me skip to the end. Here is a short set of my personal take-aways:

-XL: Verleger gets it. Follow the money. "but the point is to bring more supply to the market to keep Gulf Coast crude prices low—significantly lower, in fact, than the global price of oil."

-WTI & gasoline prices: Gasoline & refined products in the USA are 'world priced' and WTI is irrelevant.

-WTI & crack spreads: mid-continent crack spreads will adjust so that refined product matches world prices.

-WTI & Canadian Crude: Cushing oversupply has been enhanced to maximise crack spread on Cdn crudes but may 'ease up' a bit on WTI-Brent but not on heavy-light differentials.

Purpose:

I am attempting to cut through the 'shield of noise' to try to figure out what to do with my energy investments. This needs some critical thinking and some 'the devil is in the details' digging. I hope this board accepts this for what it is.... my attempt to pan for the nuggets within a lot of silt & gravel.

Cushing really is about supply and demand. Cushing crude is "supply/demand controlled" in a "buyers market".

Refined products are "supply/demand controlled" but in a "global market". Most of the US fuel consumption is serviced by port facilities. Refined product is easily arbitraged globally once waterborne. I would bet that gasoline in Tulsa OK would be tankered elsewhere in the USA if the price differential was greater than say $0.15~$0.20 per gallon. Example: Tulsa retail gasoline: $3.43. Nationwide: $3.58

tulsaworld.com

Scale of impact: max $0.20/gal x 42 gal/bbl= max $8.40/bbl. Nope. Not a huge issue

A simplistic anecdote of a current fact of life. Arbitrage is an efficient equalizer-by land or sea. The rest is noise.

Bottom line:

-US refined product (including gasoline) prices are determined by world price with a 'transport' adjustment.

-Right now, WTI is irrelevant to the price of gasoline in the USA.

-Any analysis linking WTI to the price of fuel is just noise.

Back to: Cushing crude is "supply/demand controlled" in a "buyers market".

Plenty of noise here... WTI, land-locked, waterborne, crude grades, Canadian crude imports, Keystone, Bakken, Keystone XL, Brent-WTI differentials, heavy-sour, light sweet, LLS-WTI, and on & on....

Let's dig deeper.... As Sgt Friday really said: "All we want are the facts."

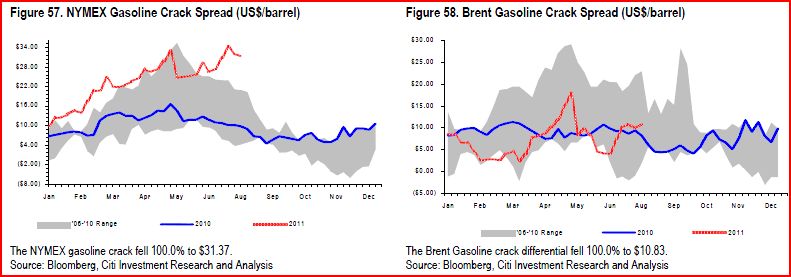

PADD II refiners have raised the crack spread. Last month NYMEX crack spreads were well above $30/bbl. Have a peek at the refining reports that Dennis Roth generously provides links to. Look for the graphs that show refining crack spreads. Here's an example:

Who was complaining that "WTI didn't reflect 'real' crude prices in the USA"? Not exactly right. "WTI plus a 'normal' crack spread does not reflect gasoline prices in the USA". This is more accurate than the first statement.

Let's gather some background data on the volumes & prices of Cdn crudes flowing into Cushing....

Volumes & grades?

About 2/3 of the Canadian crude imports into PADD II are heavy-sour grade and PADD II gets ~2/3 of the total of Canadian crude imports into the USA. So heavy-sour is ~43% of all Canadian imported crude into the USA (1Q11). This data includes the new Keystone flows to Cushing (Keystone became operational in June 2010)

Scale?

-1Q11 Cdn heavy conventional + bitumen blend imports= 906 kbpd (into PADD II only)

-1Q11 Cdn total crude imports= 1,414 kbpd (into PADD II only)

-1Q11 Cdn total crude imports= 2,098 kbpd (total)

-the balance is light conventional and synthetic upgraded crude (SYN) & very little medium grade

-PADD II domestic crude production= 756 kbpd May/11

Conclusion:

With Cdn import volumes at twice the domestic PADD II production, Cushing is a Canadian crude controlled situation. 'Ballpark' fractions: ~1/3 domestic crude, ~1/3 Cdn light-sweet and ~1/3 Cdn heavy-sour

Current price of light-sweet grades?

-Canadian sweet light going into Cushing= WTI (duh!)

-Syncrude premium to WTI= $+14 back in Mar/11. I don't have current data.

-Condensate premium to WTI= ~ $+24 back in Mar/11. I don't have current data.

Current price of heavy-sour grades?

The Cdn heavy sours & bitumen blends are being sold for ~$65/bbl (FOB Alberta)

Aug 18/11: Western Canadian Select: C$412/cu.m= US$66.15/bbl (6.292 bbl/m³, 1 USD= 0.9899 CAD)

That is up C$10/cu.m Friday from the last ten days when it was $64~$65/bbl (wild exchange rate) cenovus.com

Cenovus price data for July/11 says WCS at Hardisty averaged C$471/cu.m or US$71.53/bbl (at 1 USD= 0.956142 CAD July/11 average). So is Cenovus data lagging the drop of WTI from $100 to $80 in the last few weeks or what? My guess= "or what?"

The WCS versus WTI spread has been volatile at $-15 to $-30/bbl. Here is last fall's data (Argus):

So let's review so far....

-Refined products are 'world priced'

-The "Cushing crude discount" has minimal impact on US gasoline prices

-Refiner crack spreads (July) are ~$35/bbl in US mid-West (NYMEX crack spread based on WTI)

-Refiner crack spreads (July) are ~$10/bbl in Europe & elsewhere (crack spread based on Brent)

-WTI is at a $20~$25 discount to 'world priced' Brent

-Heavy-sour Canadian crude imports are discounted an additional ~$20 to WTI (pre-August cash).

-Cdn synthetic & condensates sell at a significant premium to WTI but not up to Brent based premiums.

Would that add up to be a $35~$45 discount for heavy sour Canadian crude from Brent?

What about the 'grade differential'? It costs more to refine heavy-sour crudes.

-Maya (API 22 degrees) is heavy but waterborne. Typical ~$-10 for 2010-2011 Brent-Maya differential [range: $-5~$-15]

Enough background of 'what is'. Time for some critcal thinking, panning for nuggets and wild speculation.

So why isn't this weird WTI pricing at Cushing been 'worked out' by the markets?

Maybe the wrong question. When was the last time you saw any company not take advantage of 'pricing power' or not 'push an advantage'? Better question.

For some reason, ConocoPhillips has continued to pump 'world priced' crude from Texas to Cushing via the Seaway pipeline (nameplate 350k bpd). That is about 85% of the new (2010) Keystone pipeline flow into Cushing so the Seaway flow is quite significant. However, the flow is going in the "wrong" direction based on crude prices at pipe ends and has been for some time. Apparently they have considered reversing the flow but it would involve changes of pipes and pumps and involve shutdowns and cause all sorts of headachey type things.... bloomberg.com

When was it that Encana swapped assets with ConocoPhillips (before the CVE/ECA split)? 2006? Encana got half interest in two of ConocoPhillips mid-West refineries in exchange for ConcocoPhillips getting a bunch of Encana's oil sand reserves? CVE website says it ended up with "ownership in two quality refineries, located in Illinois and Texas." Regarding the Wood River refinery, wiki says: "An expansion project (CORE project) is currently under way at the refinery, aimed at increasing processing of heavier crudes, and includes installation of a new coker unit. The project is expected to be completed by 2011. The expansion was undertaken specifically to handle heavy oil from Alberta."

As ConocoPhillips said in the Bloomberg piece about reversing the Seaway Pipeline (Feb 15, 2011)..... “We don’t really think that’s in our interest because we need more crude in the area” to supply the company’s refineries in the Midcontinent, Jim Mulva, ConocoPhillips’s chief executive officer, said during a conference call hosted by ISI Group today. [I assume: Ponca City Refinery (187 kbpd) & Wood River Refinery (350 kbpd)]

Am I picking on ConcocoPhillips by singling them out? Maybe. But the Seaway flows are real and the LLS-WTI spread says it should be reversed.

I don't even want to start digging into 'Koch brothers' factors.

So let's sift & review so far....

-WTI crack spreads near Cushing are ~$35/bbl (and climbing) because of an oversupply of Canadian crude

-ConocoPhillips was pumping ~350 kbbl/day from the Gulf Coast to Cushing to 'feed their refineries'

-Cushing/Brent spread=waterborne-Cushing: $+20 ~ $+25

-Heavy-sour versus sweet-light spread: waterborne= ~$-10 [$-5~$-15] (e.g. Maya 22 degree API-LLS)

-Heavy-sour versus sweet-light spread: at Cushing WCS-WTI= $-15 [range $-15~ $-30]

-Syncrude premium to WTI: ~$+14 & condensate ~ $+24.

-Keystone is already operational (410 kbpd) from Hardisty AB to Cushing (to be raised to 590 kbpd)

-The proposed Keystone XL would 'bypass' Cushing (510 kbpd)

A personal conclusion:

-Seaway pipeline (350 kbpd) pumping to Cushing is a significant factor in Cushing/World price differentials

Who said: "Follow the money"

Scale: Simple arithmetic says: 906 kbpd Cdn heavy-sour imports into PADD II x $20/bbl = $6.6 Billion/yr

Yup, pretty big scale.

Huh? A search of seaway pipeline conocophillips on wiki doesn't seem to have any search hits any more. It used to. At least Google still has some left. Wait a minute! What's this?

online.wsj.com

JUNE 8, 2011, 4:54 P.M. ET

DCP Midstream To Buy, Expand Conoco's Seaway Products Pipeline

DOW JONES NEWSWIRES

DCP Midstream Partners LP (DPM) said Wednesday it would buy Seaway Products Pipeline Co. from ConocoPhillips (COP), convert it for natural-gas liquids and expand it, for a total investment valued at $750 million to $850 million <snip>

The company will convert the currently 580-mile pipeline to ferry natural gas liquids and extend it to 700 miles between two major gas-liquids market hubs in Kansas and Texas. DCP plans to rename it Southern Hills Pipeline.

Holy Bit Shatman! The Seaway pipeline just 'disappeared'! This means that the Seaway pipeline will no longer be pumping crude from the GOM to Cushing..... sometime in the future.

Note to self: Remember to ask the right questions. How about:

-Will the Seaway 350 kbpd shutdown be sufficient to alleviate the oversupply of crude at Cushing?

-Or will the Keystone & upgrade (410 kbpd to be raised to 590 kbpd) plus new Bakken production more than compensate for the 'loss' of the Seaway?

-When might proposed Bakken pipelines be sufficient to replace the Seaway flows from GOM into Cushing?

-What would be the impact on liquids-rich NG well economics if the condensate premium to WTI was reduced (or eliminated) because of the Seaway conversion to NGL's?

All very confusing... then we get the gyrations in August. What do I conclude?

-supply & demand forces look like they are skewing heavy grade prices downward at Cushing versus the rest of the world.

-heavy grade downward price skew at Cushing is likely to persist for some time to come

-Cushing vs World crude discount is likely to persist for quite a long time.

The WTI price is just "the pea". Everyone tries to "watch the pea". We must all look like a field of bobble heads watching the price of WTI.

Potential impact of XL on heavy-sour crude prices?

More news reports that the US Gulf Coast refiners want to get the Keystone XL built to get Canadian crude pumped (bypassing Cushing) to the Gulf Coast presumably to compete with offshore heavy grades currently used. Plus a little stub to the Bakken. More news reports that Keystone XL is being vocally opposed by 'dirty oil' and environmental groups.

All sorts of noise here. Must sift for nuggets of significance and ask the right questions....

Some of the US Gulf Coast refiners are 'all set up' for Venezuelan heavy and Mexican Maya. Remember that Canadian crude hitting the Gulf Coast via the XL pipeline would have to displace offshore imported heavy crude. There really aren't all that many refiners globally that are set up to handle heavy grades.

So would the XL raise the price of Canadian heavy crude or drop the price of waterborne heavy crude? My gut says: mostly drop the price of waterborne heavy crude.

So what's up with Northern Gateway?

cost: ~$7 Billion. Would that indicate a 1~2 year ROI on a piece of pipe? That might depend on whose cost & whose benefit. I must be asking the wrong questions again. Maybe these are better questions:

-What is the NPV of a one year delay in Northern Gateway at 'Cushing discount' prices?

-What is the NPV of one year's refining of 510 kbpd from the Keystone XL at 'Cushing discount' prices?

-If Keystone XL bypasses Cushing, will the 'Cushing crack spread' be extended down to the Gulf Coast refiners?

-How & when would a Northern Gateway pipe affect prices at the Keystone exit points at Cushing and Gulf Coast?

These are probably better questions but I don't have the answers.

Impact on the 'Canadian Upgraders'... COS, SU, CNQ, etc?

Through all of this noise, synthetic grades have maintained a significant premium to WTI. I suspect the reason is quite simple. If a bbl of SYN hit a dock at an ocean port, it would instantaneously be priced at a premium to Brent. So the price differential of SYN to Brent cannot get very negative for very long. Unit trains & new pipes would fix that situation in due course. Brent is the key.

My conclusions:

-I think I will join B Bob in some bottom fishing on SU, COS & CNQ with a focus on Brent prices. The upgraders have some pricing power.

-I think the 'bitumen only' producers are gonna have a tough time for quite a while. Gonna avoid those.

-I think the 'stranded' Bakken producers are going to be disappointed with their prices for quite a while but will eventually get a reasonable price for their product.

So what the heck is the Canadian view of all this?

Looks like Jeff Ruben has awoken from his slumber.

theglobeandmail.com

Time for Canada to find new trading partners

jeff rubin

Special to Globe and Mail Update

Posted on Friday, August 19, 2011 5:24AM EDT

The spread between Brent-based world oil prices and West Texas Intermediate, the land locked American prices based in Cushing, Oklahoma, is over $22 per barrel, and it seems to be getting bigger with every passing month.

That is a huge price to pay, not only for major Canadian oil producers such as Suncor but the Alberta Treasury’s royalty revenue. One of these days, the oil sand producers and their pipeline partners are going to wake up to the fact they are sending their fuel to the wrong market.

Give Rubin a chance to catch up. Check out some of the "ratings" on the G&M article comments. lol It seems to have hit a nerve. 'Canada subsidizing the USA' is not doing well in the 'click polls'. Wait until they figure out that Canada is only subsidizing US refiners. Sorta feel sorry for Harper as this may not end well. All done on his watch. Scratch that. Won't feel sorry for Harper if it doesn't end well. All done on his watch.

IMHO, simple math says the Canadians can no longer continue to (captively) sell a growing heavy crude production into a flat (or declining) US market. Solutions will be found and implemented. Just a matter of when & how. In the meantime, to me anyway, the Keystone XL will do little to change the WTI-world price differential.

The 'disappearance' of the Seaway pipeline will ease the 'Cushing discount'. The cynic in me might suspect that it might happen just before the Northern Gateway comes up for a decision.

And, sadly, none of all this will significantly impact the price of gasoline in the USA.

"Very simple game. Three cups, one pea. Follow the pea. Find it, you win. Wrong cup, you lose."

Damnit. Where did my wallet go?

Ray |