Ron Paul's economic viewpoint as seen from two intelligent sides of the debate: Cullen Roche v Karl Denninger

DEBUNKING RON PAUL’S TALKING POINTS

by Cullen Roche

Pragmatic Capitalism

18 October 2011

Ron Paul is one of the truly honorable and honest men in Congress. I doubt that there are many in power who want better for this country than he does, but some of his talking points need to be re-framed and corrected in order to avoid confusion about the way our modern monetary system operates. In an interview this morning on CNBC he made some frighteningly inaccurate points.

The most glaring mistake he makes is his comparison of Europe and the USA. He says:

“we have a debt crisis in Europe and here. That’s why we have to cut back.”

I’ve covered this point ad nauseam ( mostly thanks to Paul Ryan’s persistence), but this myth persists so it’s important to reiterate. The EMU is made up of currency USERS. The USA is a single currency system with a Federal Government (unlike the EMU). This means the USA is a currency ISSUER. EMU countries have to always obtain revenues or borrow before they can spend. The same does not hold true for the USA. If the USA wants to create money they simply spend it into existence by changing numbers in the computer system. It might sound bizarre to the layman or even the neoclassically trained economist, but the USA no longer resides in a system in which its currency is convertible into gold. Therefore, there is no such thing as a solvency constraint. Your taxes and bond purchases do not help to “fund” the spending of the USA (Confused? See my videos explaining the basics of the modern monetary system).

The only constraint the USA has is an inflation constraint. And while this might be a form of insolvency, it is by no means similar to what the EMU nations are undergoing. Dr. Paul is implying that the USA can spend too much and cause a “debt crisis”. This is categorically false. There is no such thing as the bond market funding our spending or holding us hostage as they hold Greece hostage. The price of our debt is controlled by our central bank which sets the interest rate via open market operations. You can call this manipulation or whatever you want, but it is an irrefutable fact that the Fed controls interest rates as the monopoly supplier of reserves to the banking system. The point is, Dr. Paul’s comparison is based on a convertible currency system (which he is an advocate of), but it is 100% inapplicable to our non-convertible fiat monetary system. Comparing the federal government of the USA and the nations of the EMU is like comparing apples and oranges.

Dr. Paul implies that we must cut back because we could have a debt crisis like Greece. But nothing is further from the truth. We could suffer an inflation crisis, but that’s a very different phenomenon than the crisis Greece is suffering from. The distinction here is incredibly important and should not be overlooked as a semantic point. Our government could certainly benefit from cutting back on some unproductive forms of spending so as to avoid potential decline in our standards of living, but to imply that we are somehow Greece or Spain is a gross misunderstanding of our monetary system.

He later says:

“you can’t keep dumping the debt on to people.”

This is another bizarre comment. Have you ever heard your Grandmother say: “Gosh I wish Uncle Sam would pay off the national debt so I could get rid of my Treasury bonds!”? Of course you haven’t. Government bonds are the equivalent of a savings account. So, when you hear people like Ron Paul talking about paying off the national debt while also complaining about how the Fed is “starving savers” via low rates, you can hopefully see the obvious contradiction in these two comments.

The deficit of the entire government (federal, state, and local) is always equal (by definition) to the current account deficit plus the private sector balance (excess of private saving over investment); see here for a more precise and detailed discussion on this. The private sector in this country owns over $10 TRILLION in government bonds. These are safe interest bearing instruments which allow the private sector to save. ”Dumping” debt on the people provides them with a savings account in place of what is essentially a checking account. Now, this is not an excuse for the government to issue more debt or spend recklessly, but again, he’s making a basic misunderstanding of national accounting by implying that these bonds represent some outside constraint that makes us at risk of some solvency crisis. There is simply no such thing.

Dr. Paul has been very vocal about massive spending cuts. Joe Kernan mentions the austerity that is ravaging Europe and Dr. Paul’s response is the standard mainstream austrian econ response. Kernan says:

“you know, you’re talking about a trillion dollars in cuts in one year. You’re going to immediately hear about, you know, they tried austerity in Greece. It made things work. They tried austerity in the UK and it made things worse. The pain that people would talk about, the american public feeling with a trillion dollars in cuts.”

The pain is relatively easy to quantify given the current economic malaise. Unfortunately, Dr. Paul misunderstands our current economic crisis so he thinks the cuts are necessary due to the insolvency of the USA that is not going to occur. He says we need to cut the deficit massively in order to stave off our Greek moment. But again, this is a basic misunderstanding of irrefutable national accounting identities. If we review the sectoral balances we can see exactly how the above mentioned accounting identity looks. What you’ll notice is that the US government is pretty much always in deficit (and we have been since inception). This is because, as the currency issuer, they must make the currency available to its users before they can ever use it. So the government’s deficit is the non-government’s surplus.

So what happened when the “fiscally responsible” Bill Clinton decided to balance the budget in 1999? We can see exactly what happened. You’ll notice that he literally starved the private sector. As a current account deficit nation, our budget deficit failed to offset this leakage and directly contributed to the private sector’s deficit. This forced the private sector to tap into the banking system as their ATM in an attempt to maintain their standard of living. What ensued was one of the great debt bubbles in modern history and one of the worst periods of economic growth in American history.

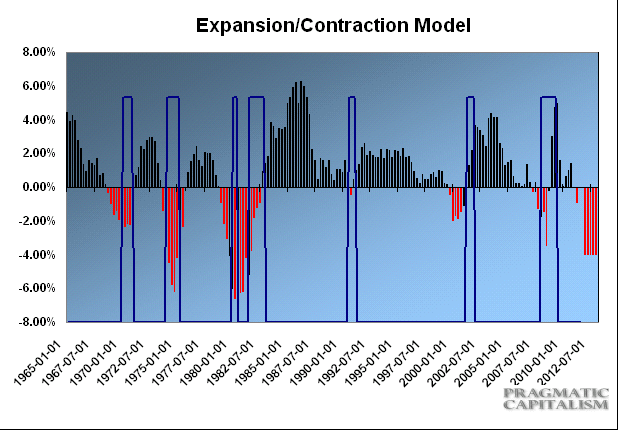

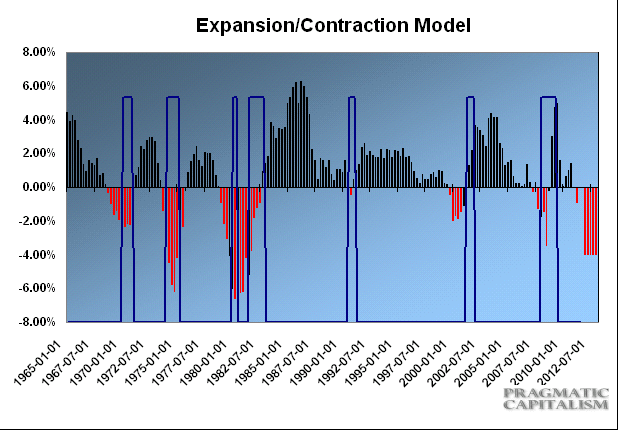

What would a $1 trillion cut do to the US economy currently? Well, we know that the sectoral balances must add up to zero ((I – S) + (G – T) + (X – M) = 0). And we all know the private sector is suffering extraordinary weakness on the back of this massive debt bubble as they de-leverage. The USA runs a current account deficit so the math is very straight forward. If all three sectors try to “tighten their belts” at the same time the economy will contract. If we assume continued weak private sector growth, continued current account deficits and a $1 trillion cut to the budget deficit in the coming 12 months my growth model looks like this:

I hope it’s becoming clear to the reader why austerity is pulverizing many of the EMU nations. They are suffering this same sort of rare recession where all three sectors are “tightening their belts”. Except, as currency users, EMU countries are unable to counteract the effects of their trade imbalance and solvency constraint. It’s a total disaster. The EMU is an incomplete monetary system without sovereignty. In this regard, it is similar to the gold standard and it is failing for the same exact reasons the gold standard failed (trade imbalances leading to solvency constraint).

Now, in fairness, Dr. Paul likely wants to see some retrenchment. As an Austrian economist he thinks the market should “clear” its excesses. But what excesses are we experiencing (aside from the obvious private sector debt excesses)? I hope I’ve already conveyed the message that we don’t have excess debt (there is simply no such thing for a sovereign currency issuer). So perhaps he believes we are suffering from an inflation problem (even though headline inflation is in-line with its historical average and core inflation is running well below average)? Either way, it seems as though his message is not being portrayed in a light that accurately reflects the realities of our modern monetary system.

In fairness, I should add that Dr. Paul makes some excellent points in this interview. Specifically, he says:

“sometimes the government spending is actually a negative.”

100% accurate. A printing press and monetary sovereignty does not give the USA the right to print in excess of our productive capacity and effectively reduce the overall standards of living of the citizens. But we have to understand that government spending is not always evil. In fact, as the currency issuer, some level of deficits (I prefer tax cuts to spending) are necessary. Furthermore, we must ignore these debt warnings. They are just flat out wrong. If you want to make the inflation or hyperinflation argument then let’s hear it. But scaring people about debt because of your misunderstandings of the workings of the EMU or the USA is a grave injustice to your listeners.

He continues:

“certainly I do defend those who have their head turned –screwed on right and say, yes. We’re sick and tired of the bailouts. And when corporations and banks get held at the expense of the middle class.

the poor are getting more numerous and the wealthy are getting wealthier. And they have a reason to gripe about that. But it’s not because the few are productive. It’s because the system is designed to help those who made how to lobby washington and get either regulation or the tax code written in their favor.”

I agree 100%. We should not be angry at our great innovators and wealth accumulators. We should be mad about the 0.15% of our population who trade financial products like hot potatoes and create systemic risk leveraging government money for no public purpose. And we should be furious that these banks have been bailed out with more government money in order to sustain this unproductive business. I could care less if private companies want to run speculative businesses, but the banking system in this country cannot be poisoned by greedy profit motives that lead to excessive leveraging of the system and increases overall systemic risk by causing contagion in the private banking system.

Dr. Paul makes some really excellent points in his discussion this morning, but we have to better understand our modern monetary system before we can move forward with policy prescriptions that will increase our standards of living and help get this country out of its current rut.

[edit, illyia: please see link for CNBC interview with Ron Paul]

pragcap.com

*********************************************************************************************************************

CullenRoche: Smackdown Of The Day

Karl Denninger

The Market Ticker

10-19-11

Cullen Roche: Smackdown Of The Day

I am usually reasonably polite in Tickers. (I am often less-so in commentary on the forum.) I am usually reasonably polite in Tickers. (I am often less-so in commentary on the forum.)

This time, I'm not going to be particularly nice as I've about had it with the "MMT" look-alikes running around peddling trivially-provable false impressions through the use of half-statements and arm-waving.

So I'm going to do exactly that (prove the impression he wants to leave you with false) and in doing so issue a well-deserved smackdown to this author.

In the interest of full disclosure, I am not a particular fan of Ron Paul. I find his foreign policy prescriptions and view on immigration along with a number of other things to be entirely unworkable and some of his economic policies are frankly more than a bit twisted, with the largest part of that problem being his marriage to "hard currency." He seems to not understand that money and credit are fungible in the economy; we didn't get in trouble due to too much money (e.g. "printing") we got in trouble due to what amounted to a naked short on the currency run by the banks and shadow banks. Note that this is not stopped by the use of "hard currency", and in fact we have examples through history where there were utterly ridiculous valuation swings in the currency (in some cases 20%, 30% or even more!) in the space of a single year as a consequence of these machinations under gold-backed dollars in the US.

With the disease misdiagnosed the treatment is misdiagnosed too: Hard currency would not have prevented the bubble nor will it prevent the next one. Focusing there is in fact a negative sum game as it simply further concentrates the illegitimate places where this power is abused.

With that out of the way (in an attempt to deflect those who will, ignorantly, simply say I'm a "Paulbot" despite the several years of proof otherwise in my former writings including some aimed directly at Ron), let's turn to the subject matter.

I’ve covered this point ad nauseam (mostly thanks to Paul Ryan’s persistence), but this myth persists so it’s important to reiterate. The EMU is made up of currency USERS. The USA is a single currency system with a Federal Government (unlike the EMU). This means the USA is a currency ISSUER. EMU countries have to always obtain revenues or borrow before they can spend. The same does not hold true for the USA. If the USA wants to create money they simply spend it into existence by changing numbers in the computer system. It might sound bizarre to the layman or even the neoclassically trained economist, but the USA no longer resides in a system in which its currency is convertible into gold. Therefore, there is no such thing as a solvency constraint.

Technically true and operationally false. The author goes on the say:

The only constraint the USA has is an inflation constraint. And while this might be a form of insolvency, it is by no means similar to what the EMU nations are undergoing. Dr. Paul is implying that the USA can spend too much and cause a “debt crisis”. This is categorically false. There is no such thing as the bond market funding our spending or holding us hostage as they hold Greece hostage. The price of our debt is controlled by our central bank which sets the interest rate via open market operations. You can call this manipulation or whatever you want, but it is an irrefutable fact that the Fed controls interest rates as the monopoly supplier of reserves to the banking system.

And there's your problem.

There most certainly such a thing as the bond market holding our funding hostage. Go ask President Clinton about it - be prepared to duck, he might hit you if the various reports of his reaction to the bond market's revolt when he floated the idea of Hillarycare are correct.

By the way, Bill Clinton, for all his faults (and I didn't like him much as a President either) is smarter than Cullen. He backed off, recognizing that the alternative (run the printing presses either directly or indirectly) was ruinously stupid.

George Bush was a mental midget in this regard. He (and Cheney) both bought into the MMT nonsense: Deficits don't matter (and in fact are good)

Dr. Paul implies that we must cut back because we could have a debt crisis like Greece. But nothing is further from the truth. We could suffer an inflation crisis, but that’s a very different phenomenon than the crisis Greece is suffering from.

No it's not.

I don't care how much money I have. I care how much whatever I have buys.

A simple example will make this clear. Let's assume you are paid $1/day. This is a terrible wage, right?

Well, that depends. What if gas is a penny a gallon, milk is two cents a gallon and eggs are a penny? Your rent is $5/month. Electrical service is 50 cents. You tape a nickel to the trash container once a month to pay for waste disposal.

Are you in terrible shape or great shape? Not so bad, right?

Now let's take the opposite. You make $100,000 a day. But gasoline is $50,000/gallon. Bread is $10,000 a loaf and milk costs as much as gasoline. Your rent is $5 million. And you literally starve, despite making $100,000 a day, and are evicted as you can't make the rent (do the math.)

The latter, by the way, is more-or-less what happened in Weimar.

This is another bizarre comment. Have you ever heard your Grandmother say: “Gosh I wish Uncle Sam would pay off the national debt so I could get rid of my Treasury bonds!”? Of course you haven’t. Government bonds are the equivalent of a savings account. So, when you hear people like Ron Paul talking about paying off the national debt while also complaining about how the Fed is “starving savers” via low rates, you can hopefully see the obvious contradiction in these two comments.

They are? Only if they earn at least a zero rate of real return. Otherwise they're not a savings anything; they're organized looting and theft. They seek, in fact, to hide the stealing they're doing.

This is the primary problem with the "MMT" folks and their derivative offshoots: They ignore the fundamental relationships that underlie ALL economic systems and cannot be changed.

The first (and most-important) of these is MV = PQ

Simply put, that's "Money" (inclusive of credit) * "Velocity" (number of times each unit turns) = "Price" (of each item in the economy) * "Quantity" (number of items, goods and services)

You can see that this must be a factually-correct equation. That is, every good or service that is sold (P * Q) must be transacted using either a unit of money or credit, and that unit will change hands some number of times during a period of time. Therefore, MV = PQ.

So if we simply "emit" more credit (by pushing buttons on a computer) then "M" (money and/or credit) increases. Assuming "V" (number of turns) holds constant then either "P" or "Q" must increase, as the equation must, by definition, balance.

The issue of course with the so-called "demand driven" folks is that they argue that by increasing "M" through government deficit spending you drive increases in "Q". But this is not a given; "P" may increase instead in which case you are stealing from everyone who has stored some of "M" and redistributing it to the government. This is functionally identical to increasing taxes since all I care about is the purchasing power of what I have and earn, not the number of units I possess!

This is because, as the currency issuer, they must make the currency available to its users before they can ever use it. So the government’s deficit is the non-government’s surplus.

True but only half the story. The monetary system is in balance if and only if the total supply of money and credit in the system matches "Q". With a stable "V" then "P" (price) is fixed. This is "no inflation", the desirable condition.

Why is "no inflation" desirable? Simple: Assuming all things remain the same the person who produces more than they consume - that is, an economic surplus - should be able to save that surplus for use later without penalty.

This is very important for two reasons: That person owns that economic surplus as the fruit of their labor and intentional distortion of these relationships cause them to do foolish things with it lest it be stolen and (2) capital is formed from economic surplus and it is capital formation that creates jobs.

Now let's go one step further. Productivity improves over time. We learn how to do things with better efficiency. We invent. In the last 100 years we came up with practical motor vehicles, the telephone, electrification of basically the entire country, mechanical refrigeration, aircraft, the transistor, electronic computational devices, electronic data storage, the personal computer, the Internet and more. All of these things reduced the number of hours of labor you had to perform in order to produce a specific set of outputs that could then be sold into the marketplace.

Without interference the amount of time you must put into a vocation to acquire the basics of life goes down. Now who has the right to that improvement in standard of living? I argue you do, since it is you (collectively) that created it.

Therefore, the natural state of all economies over time is a modest deflation - that is, the aggregate price level determined by labor inputs, not in nominal currency terms, should decline over time.

What the author of this piece argues is that governments should wave their hands and steal some (or even all) of this improvement in living conditions and then go even further and take some more! They should do this by "harvesting" credit bubbles and/or monetary inflation and achieve it without the revolt of the citizenry through hiding their acts by either obfuscation or simple zipmouth from the population, hoping they don't catch on to the scam that is being run.

Let's just call that what it is: Theft.

And let's call the advocates of such paths what they are: Thieves who operate by obfuscation and conversion.

Incidentally, the latter is typically thought of as a crime when you do it to a little old lady. Why don't we recognize this for what it is when people try to run this crap in the government funding sphere and start telling them to either (1) cut it out or (2) go to prison?

Well that's easy: Washington loves it when you're ignorant and they won't prosecute when they're in on the scam (what, prosecute themselves? Ha!)

So what happened when the “fiscally responsible” Bill Clinton decided to balance the budget in 1999? We can see exactly what happened. You’ll notice that he literally starved the private sector. As a current account deficit nation, our budget deficit failed to offset this leakage and directly contributed to the private sector’s deficit. This forced the private sector to tap into the banking system as their ATM in an attempt to maintain their standard of living.

That's because we in fact had been doing the same thing since 1980:

It was Clinton who did this eh? Uh, not according to The Fed and the BEA!

According to The Fed and The BEA we have been pulling out the charge card and living beyond our economic output for 30 years. In fact this is exactly what one would predict given the inexorable nature of exponents - plot the growth of systemic debt and the growth of GDP as percentages of growth and... oops - it looks exactly like that... or this:

Now pay attention to that last little bit there in the second chart. Notice how the Federal Government has been borrowing like crazy to prevent a contraction of systemic debt? They in fact have been spending 10-12% of GDP on the credit card for the last three calendar years. That's a pyramid scheme too - it can't continue forever as attempting to do so simply destroys purchasing power which is all the common man cares about!

We run a current-account deficit because of these monetary policies. With a balanced economic and monetary system -- that is, one where money and credit match Quantity and Price for a fixed Velocity -- you can't run a current-account deficit as capital drains out of your nation and this automatically corrects the problem as the other guy's products become more expensive until he becomes uncompetitive!

So how'd we do it?

That's simple: The Fed and Federal Government replaced the draining capital with more and more credit. And remember - while credit spends the same way that capital does, it is not the same thing as credit is a promise to produce tomorrow while capital is the surplus of what you produced yesterday.

This distortion, however, isn't permanent. China, by pegging their currency to ours, tries to dilute the impact of our credit emission (which would otherwise turn into a huge problem for them immediately.) But that simply shifts our inflation to them. They've tried to ignore it via their own credit bubble both officially and otherwise but that will fail too, and when it does they're going to blow up in spectacular fashion. If you're not seeing the results: Empty cities, off-sheet lending and other games being played in China, and the cracks in the veneer of "it's all ok" coming from there at this point, you're not paying attention and are in for a very rude surprise.

Now, in fairness, Dr. Paul likely wants to see some retrenchment. As an Austrian economist he thinks the market should “clear” its excesses. But what excesses are we experiencing (aside from the obvious private sector debt excesses)? I hope I’ve already conveyed the message that we don’t have excess debt (there is simply no such thing for a sovereign currency issuer). So perhaps he believes we are suffering from an inflation problem (even though headline inflation is in-line with its historical average and core inflation is running well below average)? Either way, it seems as though his message is not being portrayed in a light that accurately reflects the realities of our modern monetary system.

Bah. Ron Paul misunderstands how it works but he gets the punch line correct: Our purchasing power has been trashed. You may believe in "headline inflation" if you wish (or not), but the fact of the matter is that we're all getting poorer. Not only has median wage gone down over the last ten years in nominal (not inflation-adjusted) terms look at what has happened to the dollar in reference to other currencies since 2002!

Beyond the fact that the standard of living (which is all that matters) has been trashed in this country since 2000 (if you care to argue otherwise go price gasoline, heating oil, electricity and similar - all are up monstrously) you can easily see what has happened in terms of global trade-weighted value of your labor expressed in dollars over that time - it has lost nearly 40%.

Go take a trip to Europe and tell me how far your dollar goes, compared against 2003. Better bring about twice as many dollars as you did just a few short years ago.

The US Federal Government may in fact not be able to technically go broke but that's a false God you're worshiping. Should the government be unable to redistribute (which is all government does) by taxation as the ability to tax economic surplus is exhausted (you can't tax a broke man; at the point you render him homeless he no longer has an income on which you can levy a tax!) and turns to raw credit or currency emission then the same effect ensues on the population as if the government increased taxes anyway as the value of the currency unit falls and the impact on the population is exactly identical when measured across everyone using that currency.

The authors views are amusing but he conveniently leaves out the rest of the story, which renders the position he puts forward simply (and sadly) incorrect.

market-ticker.org |