This guy is not very smart. We can all agree that Consumer Spending is 2/3rds or more of GDP. So to say that Consumer spending is a large part of GDP is correct, but to say it drives the economy is mixing up causality with correlation. There's an old saying in Six Sigma circles: "Correlation is not the same as causality" or something to that effect. However, let's do our due diligence.

One of the things I tell my team when we're investigating a large problem is to ask the 5 Whys to get to the root cause of things. It's another old Six Sigma trick. So let's do that here. We'll start with the author's assertion that Consumer Spending drives the economy.

* Consumer Spending drives the economy. Why?

* It's 2/3rds. of GDP. Why?

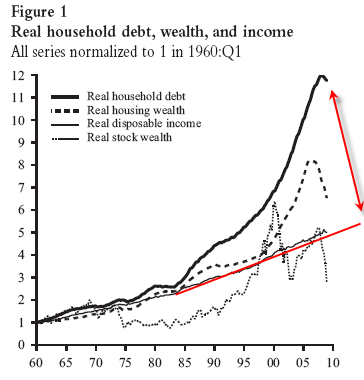

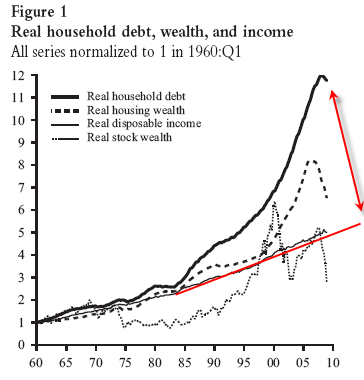

* Because as a percentage of GDP, it has grown dramatically over the last 30 years. Why?

* Because consumers and the whole country have been on a borrowing binge for 30 years. Why?

* Because interest rates have decreased over that same 30 years to historical lows. Why?

* Because our Federal Reserve has engaged in a 30 year game meeting recessionary events with lower interest rates on everything, which had the salutory effect of minimizing the pain in the short term to kick the can down the road for the long term.

Conclusion:

The problem with the Fed's actions is that they didn't allow recessions to fully deleverage the economy, so that we could renew growth through capital investment. Wealth through savings and investment is sustainable. The illusion of wealth through borrowing is NEVER sustainable, as it will always blow up eventually. We have reached the point of "eventually" right now. As I've said in the past, the reckoning is here. Do you think your neighbor who has all the outward signs of wealth, but is in debt to his eyeballs and has zero net worth, is really wealthy? Or is your other neighbor who drives a honda, spends frugally, has everything paid off, and has a high net worth the really wealthy one? Most Americans think the former is the wealthy one, which is why we're in this mess as a country.

Charts to back up the statements above:

|