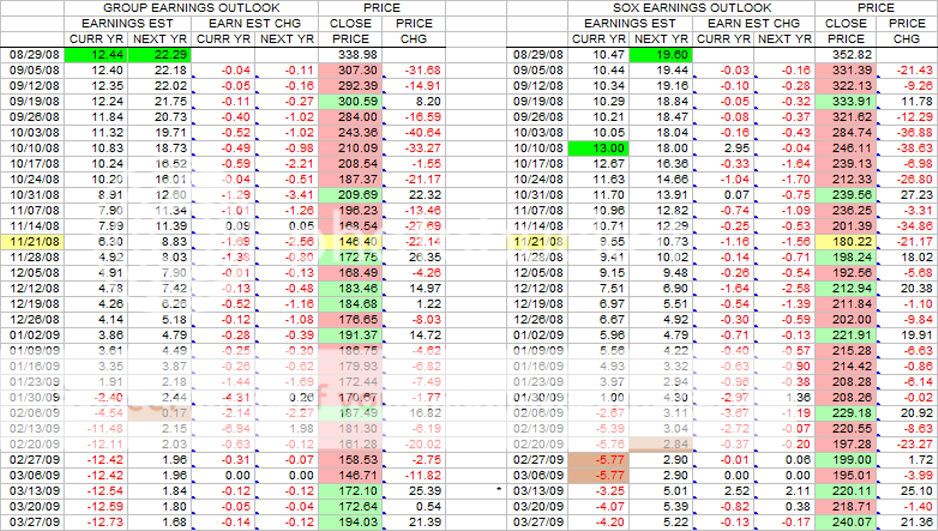

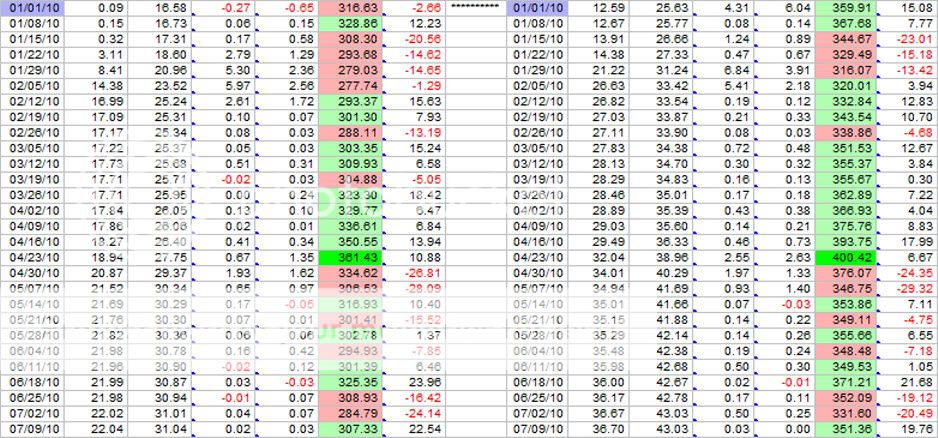

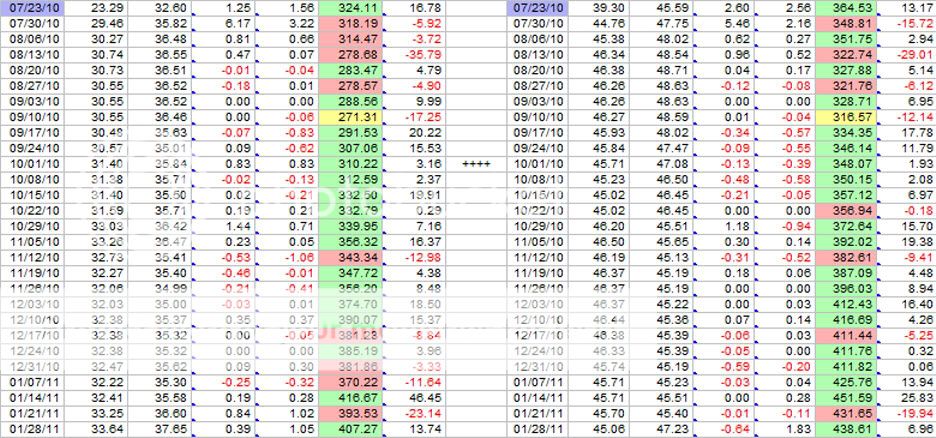

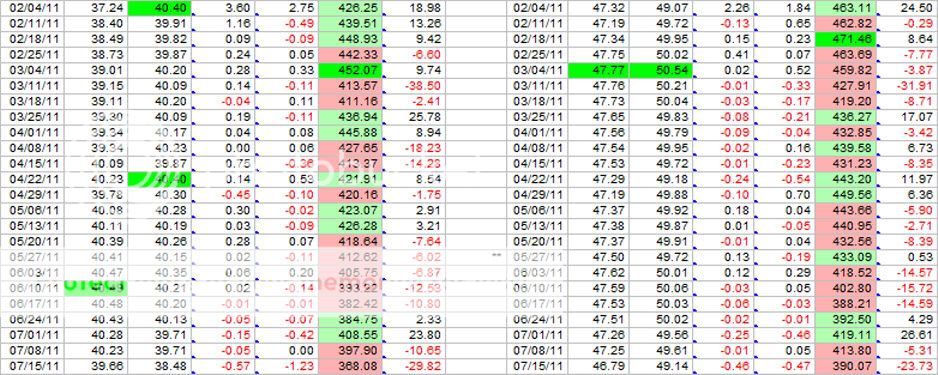

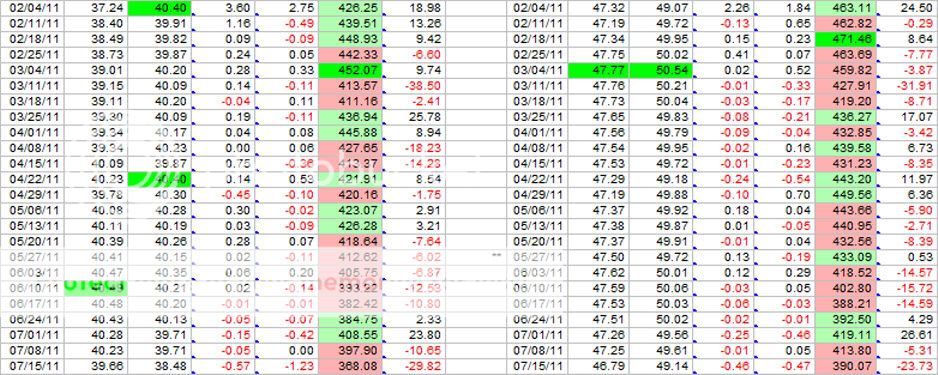

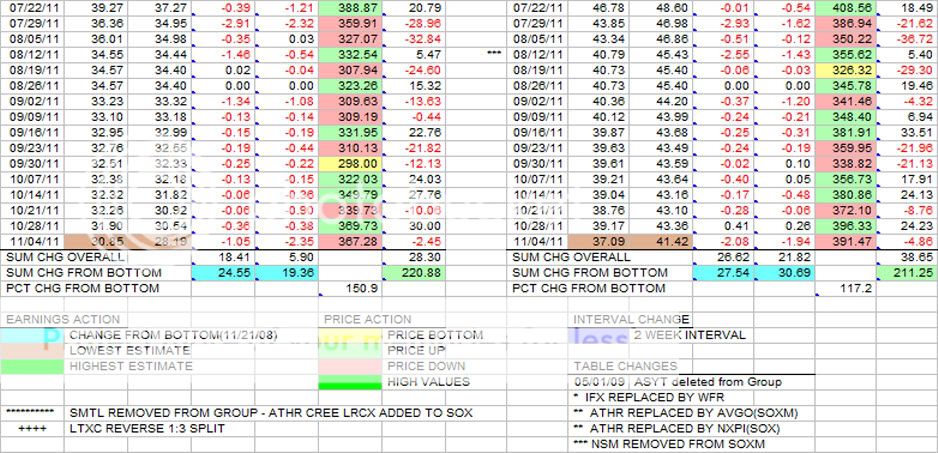

This is the weekly update of the Group and SOXM(SOX) tables in terms of earnings estimates and price changes.

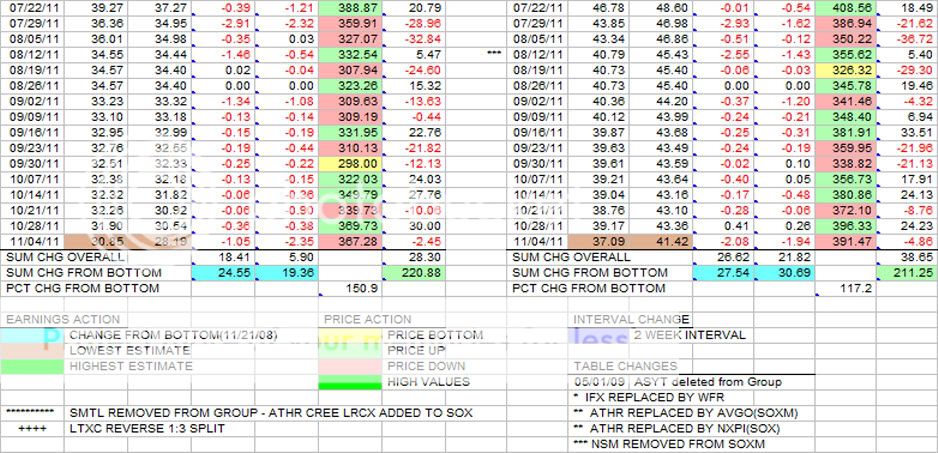

Earnings estimates were all negative this week, and of greater magnitude than usual. The last time this happened was at the end of the June quarterly reporting cycle, the week of 8/12.

Both the Group and the SOXM now have interim earnings estimate numbers at a near term minimum this week.

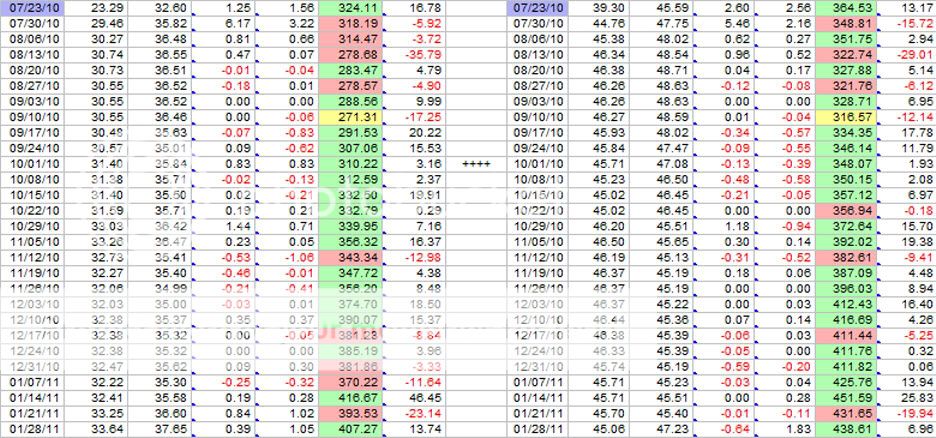

The prices are trying to rise from the interim lows of 9/30 and 8/19. The SOX is knocking at the door of 400, last seen the week of 7/22.

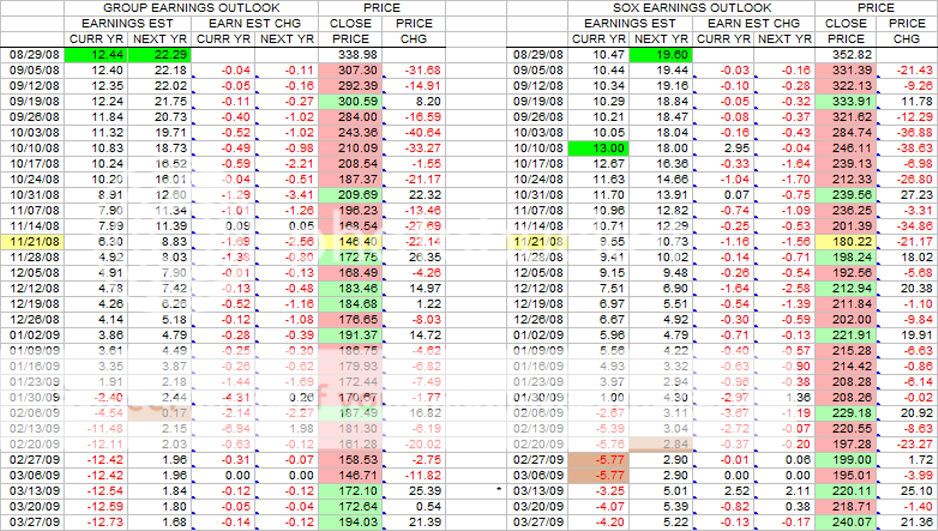

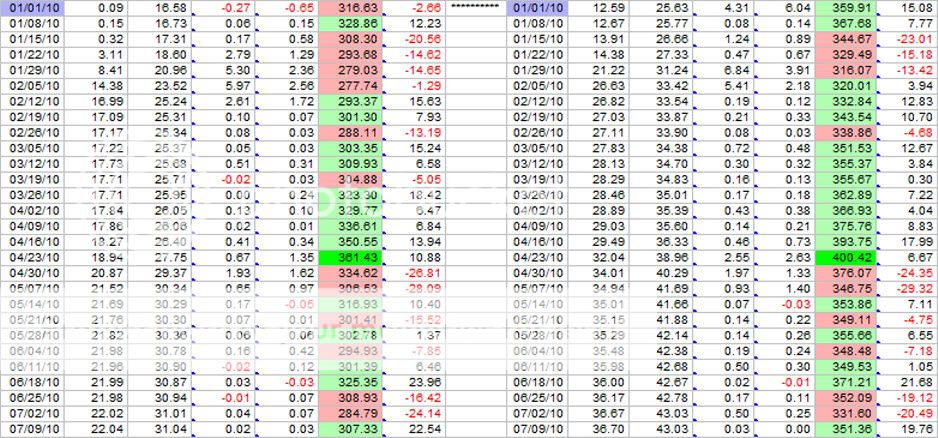

The last many months of choppy price action is easily seen by looking in the right hand columns. A week or two up, and then a week or 2 down. No strong uptrend or downtrend, just a trading range since about the middle of June. Prior to that, the SOX peaked at 471.46 the week of 2/18 and fell to 402.80 the week of 6/10. Now, this week, the SOX finished at 391.47. The index is going nowhere fast. Some of the up down action has been quite substantial, but nothing sticks. We always come back to the "norm".

Since the earnings estimate peaks(dark green) earlier this year, the trend has continued down, but the value is nothing close to the values at the start of the table back in 2008/09. So far from the peak values, the SOXM and Group estimates are down about 20 percent.

|