3Q11 solar results:

seekingalpha.com

My comments:

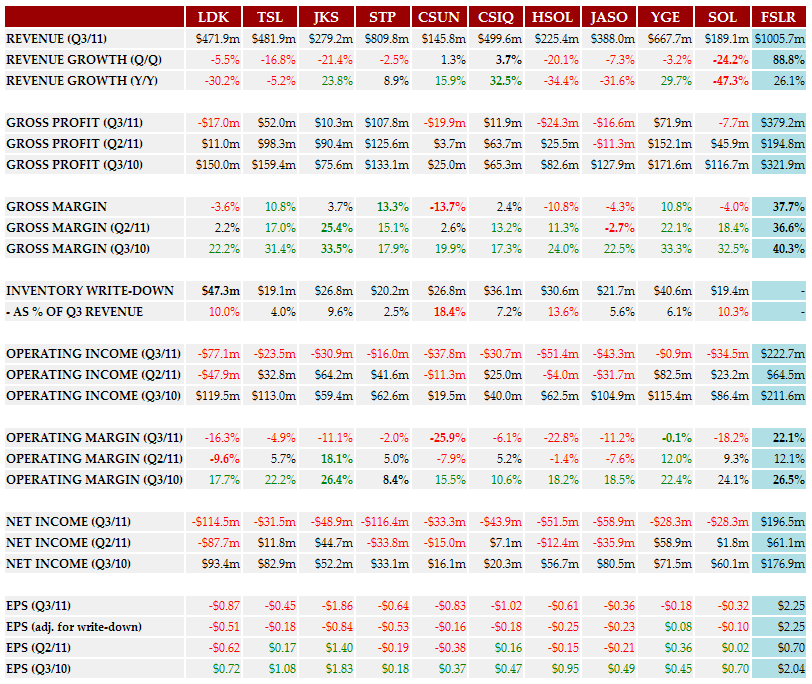

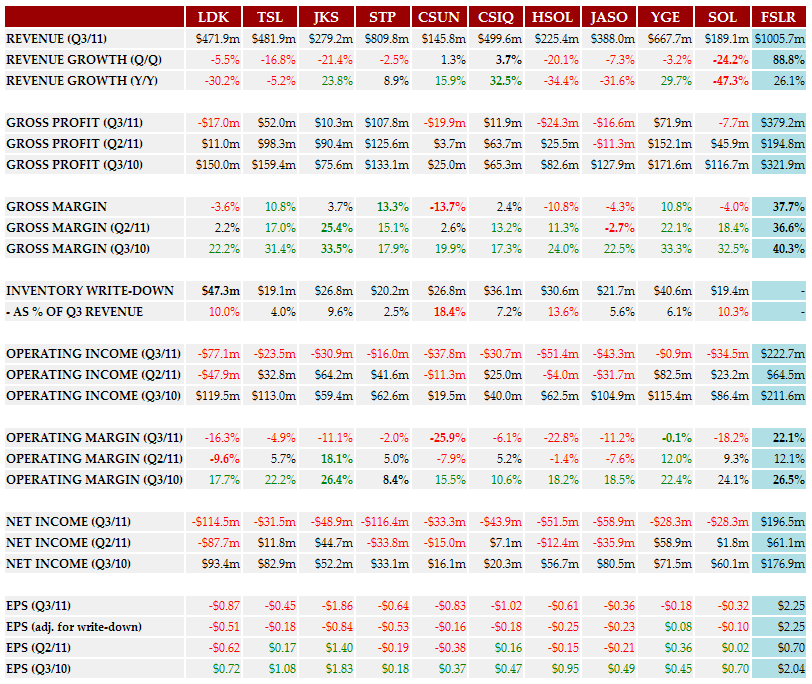

1. FSLR's numbers continue to put it in a class by itself. They will be profitable in 2011, while everyone else loses money (using GAAP EPS).

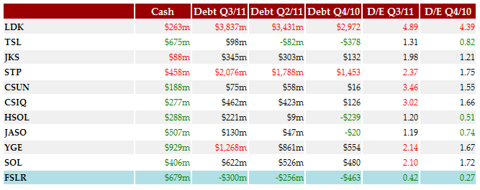

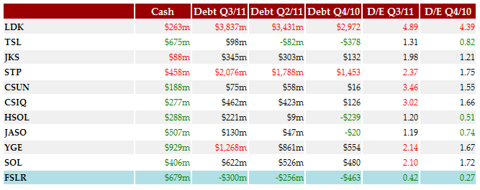

2. LDK is in a death spiral, with huge short-term debt. Expect serial forced asset sales at distress prices, a slow-motion liquidation.

3. Gross margin rankings: FSLR 38% alone at the top; YGE, TSL, STP (also SPWRA) at 11-13% in the second rank. JKS falls out of that group; everyone else with negative or barely positive gross margins, mainly due to big inventory write-downs. Industry conditions are so painful, they can't last.

4. Solar capacity buildout has now come to a complete halt. Much existing capacity is obsolete, non-bankable, and/or high-cost.

5. Stock prices are collapsing, because falling panel prices haven't caused a surge in demand. I remain confident we'll see that surge in demand (timing uncertain, though), because grid parity is in sight in some major markets. |