Today’s howler - Bank Earnings Forecast: +57%

Posted By Barry Ritholtz In Analysts,Earnings,Really, really bad calls

The Big Picture - ritholtz.com

On January 4, 2012 @ 7:00 am

Today’s howler comes from the fundamental banking analyst community. Recall that this is the group who once existed to help investors decide where to place their monies. When that did not work out, their bosses morphed their business model towards generating IPO and syndicate business. When that failed, they moved towards driving short term institutional trading.

Today, I have no idea what their business model is.

Despite having missed 2011's declining earnings per share for the biggest U.S. banks, they are forecasting an even bigger profit surge for 2012, according to Bloomberg [1]:

“The six largest lenders, including JPMorgan Chase & Co. (JPM), Bank of America Corp. (BAC) and Goldman Sachs Group Inc. (GS), may post an average profit increase of 57 percent this year, according to 184 analysts’ estimates compiled by Bloomberg. A year ago, analysts predicted profit at the banks would climb 32 percent in 2011. Instead, earnings per share probably fell 18 percent as the economic recovery analysts counted on never took hold.

Improved trading results, more investment-banking deals, expense-cutting measures and lower credit costs will lead to the increase in earnings that didn’t materialize last year, analysts say. That may provide a boost to stock prices after financials were the worst-performing industry in the U.S. in 2011.”

Exactly how does one forecast improved trading results? “I really feel these guys are not only going to have a better trading environment in 2012, but they are going to get better insight, cleaner executions and be a whole lot luckier than they were in 2011” said no one at all.

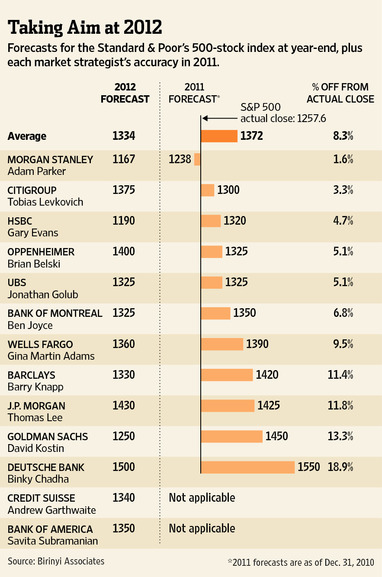

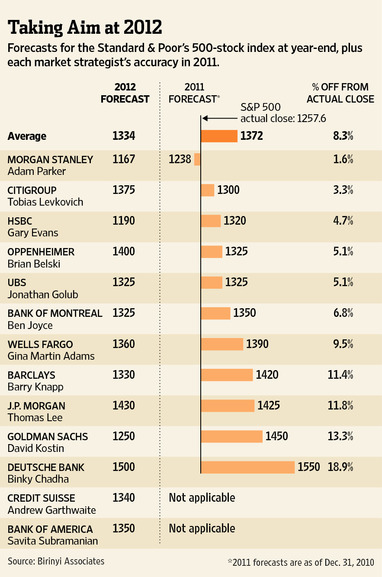

Its not just the Bank Analysts who stunk up the joint. Wall Street Market Strategists did not do much better, as this WSJ [2] graphic shows:

[3] [3]

The takeaway is you better have your own approach for investing and trading, rather than relying on 3rd party guesses . . .

>

Sources:

Bank Earnings Jump 57% in Analyst Forecasts [1]

Michael J. Moore and Dawn Kopecki

Bloomberg, Jan 3, 2012

bloomberg.com

Street Wary on Its Random Walk [2]

Strategists, on Average, See 6.1% Rise in S&P 500 for 2012 as Worries Abound on Europe, Earnings

STEVEN RUSSOLILLO

WSJ, JANUARY 4, 2012

online.wsj.com

Article printed from The Big Picture: http://www.ritholtz.com/blog

URL to article: http://www.ritholtz.com/blog/2012/01/bank-earnings-forecast-57/

URLs in this post: [1] Bloomberg: http://www.bloomberg.com/news/2012-01-04/bank-earnings-increase-57-in-analyst-forecasts-which-proved-wrong-in-2011.html

[2] WSJ: http://online.wsj.com/article/SB10001424052970204368104577139023088982182.html

[3] Image: http://www.ritholtz.com/blog/wp-content/uploads/2012/01/MI-BM895_MKTLED_NS_20120103184804.jpg

Copyright © 2008 The Big Picture. All rights reserved. |