seekingalpha.com

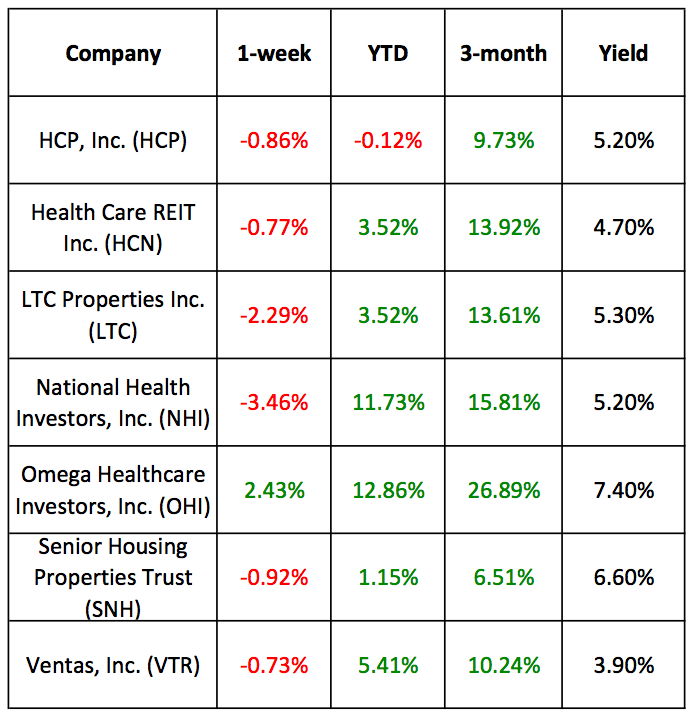

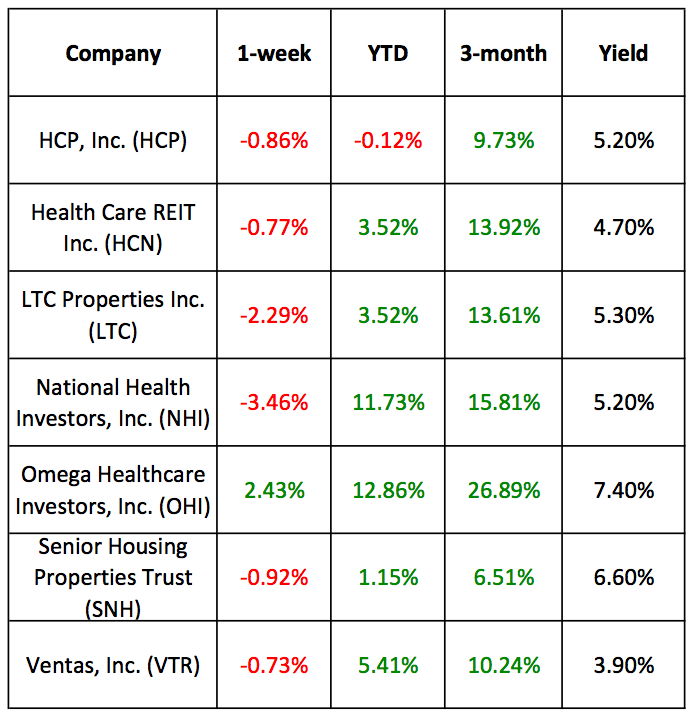

Below are recent performance numbers for seven publicly traded healthcare REITs: HCP, Inc. ( HCP), Health Care REIT Inc. ( HCN), LTC Properties Inc. ( LTC), National Health Investors, Inc. ( NHI), Omega Healthcare Investors, Inc. ( OHI), Senior Housing Properties Trust ( SNH) and Ventas, Inc. ( VTR). I have included their current dividend yields, as well as their 1-week, 2012-to-date and 3-month equity performance rates.  So far within 2012, the average performance of these healthcare REITs is an up 5.44 percent, with an average annual yield of 5.47 percent. The best performing single listed equity over all three time-frames is OHI, which also has the highest yield. So far within 2012, the average performance of these healthcare REITs is an up 5.44 percent, with an average annual yield of 5.47 percent. The best performing single listed equity over all three time-frames is OHI, which also has the highest yield. |