Lock-up over, Groupon shares tumble 9%

By Wailin Wong

Tribune reporter

10:44 AM CDT, June 1, 2012

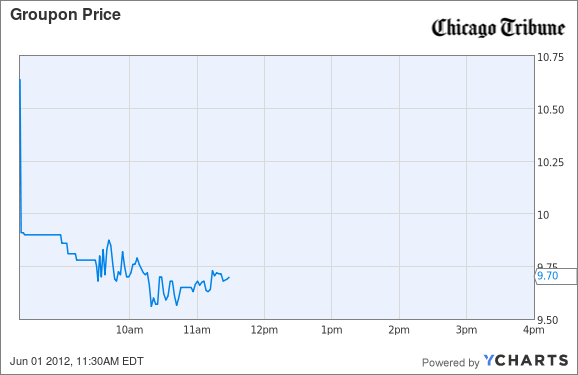

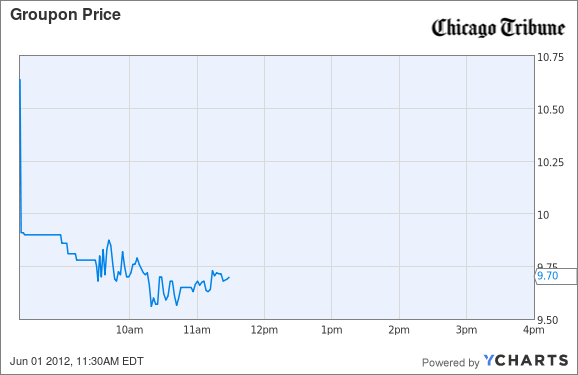

GRPN data by YCharts

Shares of Groupon Inc. are tanking in mid-day trade, reflecting heavy selling as restrictions on insider sales of stock are lifted.

The stock was tumbling 9 percent, or 97 cents, to $9.67 per share. Earlier in the session, it hit a 52-week low of $9.53.

Today marks the end of the company's lock-up period, which prevented insiders from unloading their Groupon stock. Groupon went public in November with a small float. The expiration of the lock-up period puts into play 600 million shares, amounting to 93 percent of the company's total outstanding shares. About one-third of those shares will not be sold, as they are in the hands of co-founders Andrew Mason, Eric Lefkofsky and Brad Keywell. Mason, who is also chief executive, said last month that the trio had no intention of selling their holdings.

Analysts had said they expected downward pressure on Groupon's shares as a result of the lock-up expiration but that many insiders -- a group that includes current and former senior executives, board members and early investors -- would hang onto their stock to wait for a rebound in the price. While Groupon's shares rebounded last month after the company reported first-quarter earnings, they remained well below their IPO price of $20.

Groupon was also seeing heavy trading volume on Friday, with 11.6 million shares traded, compared with an average of 4.46 million in the last 30 trading days.

Other technology companies that have recently gone public also saw significant declines in their stock price when their lock-up period. According to an analysis by Susquehanna Financial Group, the average price of LinkedIn's shares in the week after its lock-up expiration was down 10 percent from the week before it ended. Angie's List saw a 7 percent decline in average share price.

Companies that go public often sign lock-up agreements with their IPO underwriters to help ensure that the stock price remains relatively stable. Lock-ups generally last for 180 days, although Groupon extended its period for another month after having to restate its fourth-quarter and full-year earnings in March.

wawong@tribune.com | Twitter @VelocityWong

Copyright © 2012, Chicago Tribune

chicagotribune.com |