Just in

Real Estate - the Next Five Years

Part 3: Real Estate Investments - Luck or Skill?

Bob received his engineering degree and started working for GE in San Diego, during the early 1970s. To save for retirement, Bob started buying rental houses in San Diego. In the mean time, GE offered Bob a promotion but the opening was in San Jose, a little city South of San Francisco that no one had ever heard of if not for Dione Warwick (do you know the way to San Jose?) Bob took the job and started buying up little houses in San Jose, same as what he was doing in San Diego. He did not realize that he actually bought in Silicon Valley at the absolute most opportune time. Needless to say, Bob retired a very rich man.

Had Bob stayed in San Diego, he would have done very well also, though not as well as San Jose. What if Bob had taken a job in Detroit instead? He may be living off his GE pension now instead of his real estate fortunes.

There are many stories like Bob's in California. Buying some rental property here is not just an investment, it is a hobby, a pastime, something we all did. Fortunes have been made in real estate. Years later, we looked back at how smart we were but was it skill, or just plain luck?

In my opinion, many were plain lucky. The Greenspan bubble was the last hurrah. The market has shown us that real estate can decline in value. Between 2007 and today, more investors lost money in real estate than profited, if their investments are marked to market. While it is true that they have rental income, what they made probably cannot offset the decline in value during these past few years. They would be better off if they had delayed their purchase. Many are still hoping for that V-shape recovery, not realizing that the "recovery" is well on its way.

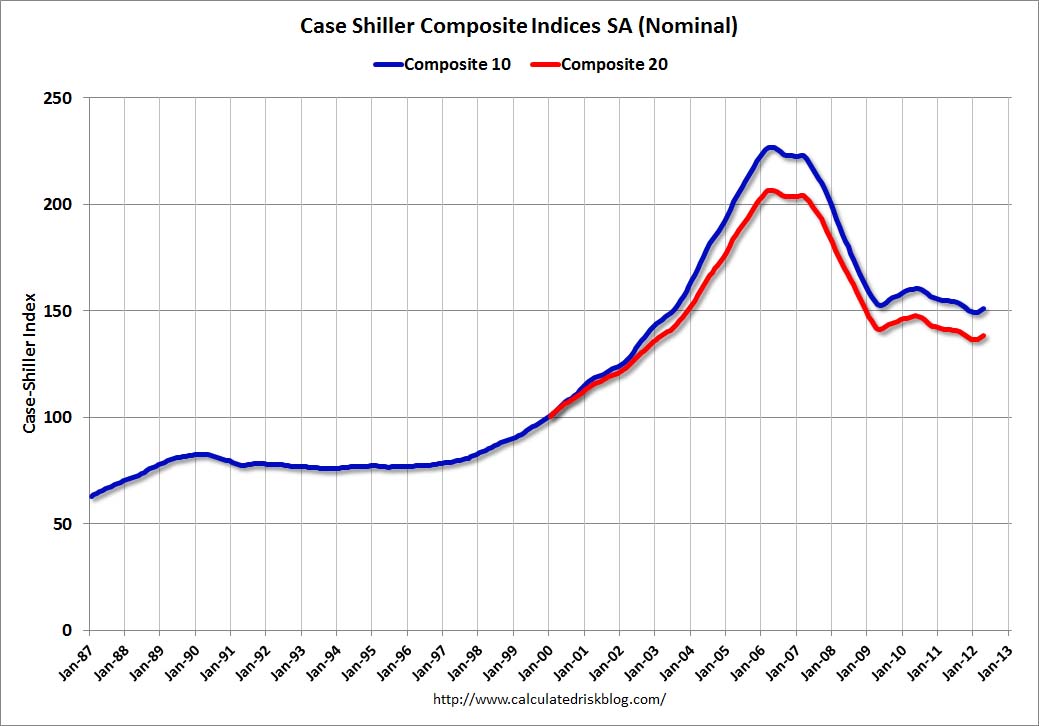

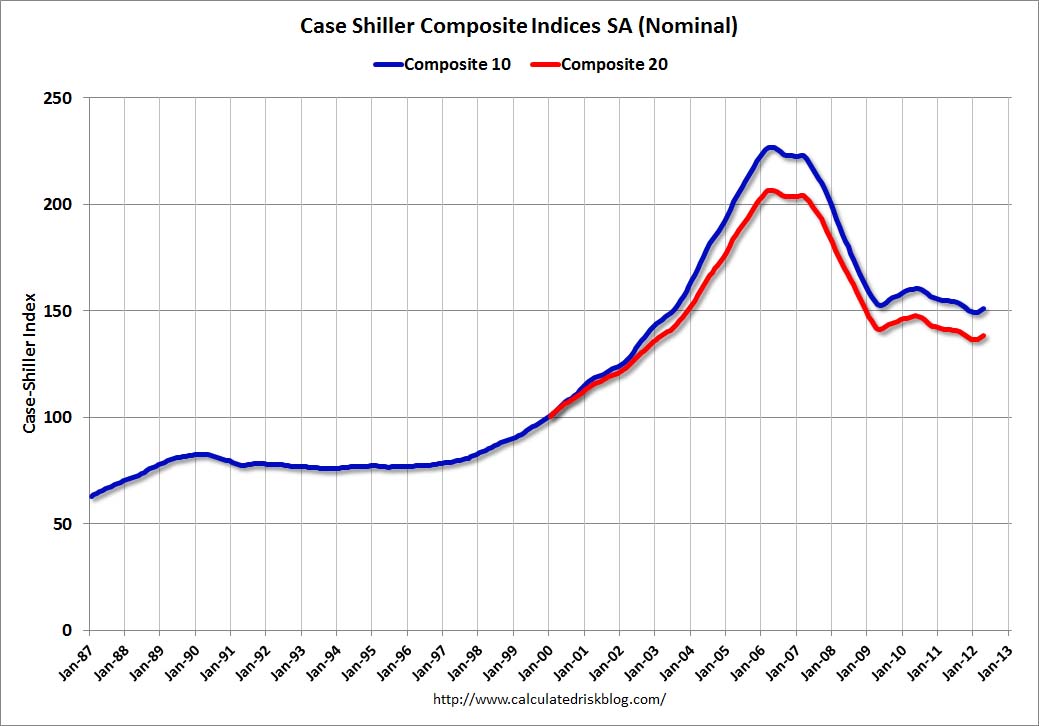

Here is the chart from my cyber friend Calculated Risk, a chart that I have used many times before. The V-shaped recovery is very obvious, just turn the chart upside down.

Imagine real estate as a victim of assault, hanging on to dear life in intensive care. That was 2007. Real estate was at a bottom. Loans required no qualifications, no down payment, no income, no assets and no verification. Debt to income ratio often exceed take home pay. House prices were over 10 times the median income in many markets. Builders were building second homes, third homes, spec homes and homes in the middle of nowhere just because there are suckers who would buy them. That was the "bottom".

The victim is now out of intensive care but is barely rolling around in a wheel chair. The quacks who call themselves policy makers are trying hard to drive the victim back to intensive care. "Recovery" is to allow prices to fall to a market based equilibrium. Recovery is to surgically remove all the old blood clots, the loans that should have never been made. Recovery is to prescribe strong medicines for the future, something that would include savings for down payment, qualifying for loans, recourse for defaulting borrowers and housing that matches borrowers' ability to pay. Instead, the quacks are just prescribing more and more morphine to dull the pain, hoping the ailments would just go away by themselves.

As a real estate investor, you need to ask yourself if a real estate investment can withstand the headwind of a slowing US and global economy, wage deflation pressures, unfavorable demographics and insane public policies? Do you have the skills to overcome all these obstacles and be profitable? If you think that the 2007 prices are "normal" and we are heading back there, then all I can say is --- GOOD LUCK. |