If its far in the future, counting it as the interest forgone on a free loan for that amount can eventually show it as being an even larger break than just making it tax free to begin with. Even 1% interest forever adds up to more than the initial amount over time (assuming no compounding, because your measuring the break as forgone interest on the initial amount but not interest on the interest, then at100 years for 1% interest, or 10 years for ten percent interest, you have an amount equal to the initial break, and greater after that), reasonable the initial amount should be a limiting factor. Letting me borrow $100 for a a century interest free isn't actually worth more than just giving me the money as a gift.

"Companies can count most of the cost of boring a new well against their taxes at the time the money’s spent, rather than recognizing it over several years."

Is in effect borrowing a tax break. You pay less taxes now, but you can't claim the deductions later. It doesn't go off towards infinity, the specific investment costs, would get deducted according to a normal depreciation schedule anyway. The delay is the several years, not indefinite. If they drill more wells that's a new instance of investment, with its own separate deductibility, not an extension of deductibility of the old investment.

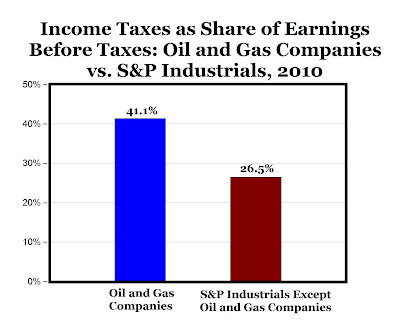

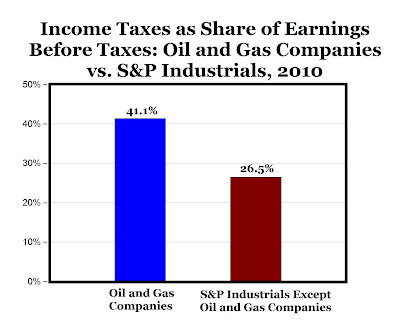

Once you accept the idea that taxes are on profits, not revenue (and that is the basis of our corporate tax system), then you can just as reasonably call not allowing immediate expensing to be an extra burden on corporations, as you can call faster expensing to be a giveaway to them. The only somewhat solid argument for it to be considered a government benefit is the relative speed and amount of various breaks. The oil companies get quicker deductions on intangible drilling costs, but they are limited to a 6% deduction on the "Domestic Manufacturer’s Deduction (Section 199)", when other industries don't have that limitation. (see hotair.com and reason.com ), and looking at the big picture, oil companies pay a larger percent of their income in taxes than other companies do.

mjperry.blogspot.com

So even just considering the income tax, the idea that oil companies are subsidized is questionable (and if they are they are subsidized less then other industrial companies).

And that's before

1 - Considering that a tax break really isn't a subsidy (its taking less from you, not giving more to you)

and

2 - All the extra taxes on the products of the oil companies. |