Aurcana: Commercial Production at Shafter is Now a Reality

By Christopher Wood

December 16, 2012

Aurcana investors have been waiting a long time for this day, and the wait is finally over; this past Friday, Aurcana announced commercial production at their newest mine, Shafter in Texas [1]. Here are the highlights from the press release that caught our attention:

* Production on a continuous basis at an average rate of 600tpd

* The plant is now exclusively processing higher grade ore mined from the underground (having transition from processing lower grade ore mined from the open pit that has been ongoing since June)

* A plan is in place to gradually increase production, towards a Phase I target rate of 1500tpd

* Q1-2013: additional thickener tanks will be installed, providing increased processing capacity at the plant

* Q2-2013: upgraded filters will be installed

This is a big deal... the mine now crosses the threshold from being a major cash drain (requiring millions of dollars to build and bring online) to becoming a cash flow machine. Once operating at full capacity for Phase I (1500tpd), Aurcana has indicated they expect it to generate ~$100M annually in cash flow (at current silver prices). And there is further upside too as Aurcana has already laid out a plan for a Phase II expansion to 2500tpd, which would further increase cash flow.

Although this announcement is a major accomplishment for the company, it unfortunately lacks the details necessary for investors and analysts to make accurate projections for how this mine will impact the bottom line. Specifically, there is no mention of any of the following (all of which we were hoping for):

* Average silver grade in the ore being processed at the mill

* Average silver recovery

* Update on the "gold contamination" found in some of the ore processed during the testing phase

* A target date for reaching Phase I target production of 1500tpd

* A Phase I ramp up plan with target dates/rates... we would have liked to see quarter-by-quarter projections for the full year

* Estimate on costs per tonne of ore processed

The lack of this type of information was a disappointment to us. Also, for such a major milestone, we would have expected a conference call to give analysts and investors a chance to gather additional information they may need to fine-tune their models and projections (as well as build excitement about Aurcana in the investment community). We feel the limited detail in this news release, combined with the fact that it was released so close to the holiday season when market volume is already reduced, has led to the subdued response we have seen in the share price. Here is what happened to the stock on Friday:

* V.AUN was up 5% on volume of 614K (below average volume)

Not bad, but nothing spectacular either (at least nothing in line with the magnitude of the importance of this event to the company's bottom line). Frankly, we were a little disappointed with the what appears to be the lack of interest in this major milestone by the market participants. The good news is, we don't think this can last. In the coming quarters, the impact of this mine will be seen in Aurcana's financial results; earning will climb, and we believe the share price will inevitably follow. The big question is when, and unfortunately, accurately answering this question is difficult. The best answer we can offer is once the earnings potential become obvious to market participants. That could take as long as the Q1-2013 financial results release (expected in May-2013); or it could be once the Q1-2013 production results are reported (expected in April-2013); or it could be as soon as analysts release reasonable/reliable reports on projected earnings for this mine and upgraded share price targets. Unfortunately, without much hard data regarding production from Shafter, it will be difficult to do this. However, we are going to take a shot at it.

First let's look at what we do know: Shafter is operating at a rate of 600tpd. If we assume they are seeing grades (~8oz/t) and recoveries (~84%) similar to what was anticipated in the feasibility study [2], and we assume mill efficiency/availability of ~90% (to account for breakdowns and upgrades; La Negra has historically been able to hit a mill efficiency/availability rate of ~95%) Shafter should currently be producing ~1.3Moz Ag annually. To put that in perspective, La Negra is currently on track to produce ~1.5Moz Ag for 2012 (and ~2.7Moz AgEq). So, even at the rate of 600tpd, this announcement means a near doubling in annual silver output for the company.

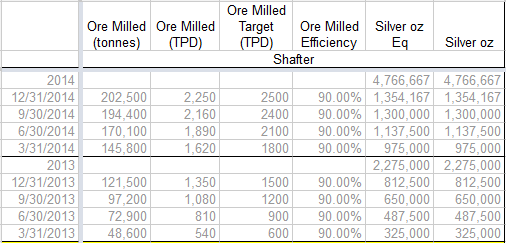

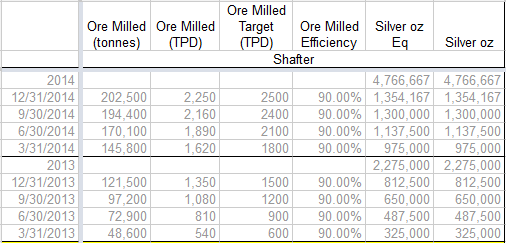

For production projections, we are going to assume they run at 600tpd in Q1-2013 (this is likely an underestimate since they are already operating at this rate today) and that they are able to ramp up production at a rate of 100tpd per month (this is based on the ramp of rate they have demonstrated so far since they announced commencement of open-pit mining back in June... this is also likely a very conservative estimate). This gives us the following production projection (for Shafter alone):

The tougher projection is how will this impact cash-flow and earnings. Unfortunately, without any detailed information from management to help us here we again resort to very conservative assumptions. So bear that in mind when you examine the numbers here... we fully expect the actuals to be better than this and will revise them once more detailed financial information is available to extrapolate from (hint, hint, managment... if you want a higher share price you should release this informatin sooner, preferably along with the Q4-2012 financials and/or production results ... don't make us wait for the Q1-2013 numbers for this).

For our costs estimate we'll use a cash cost of ~9/oz as forecast in the feasibility study. However, since mining is happening at a lower rate (600tpd) than modelled in the feasibility study (1500tpd), we'll assume a worst case scenario... the same total cost as if they were running at 1500tpd, which works out to a cash cost of ~$22.5/oz right now (1500/600*9=22.5). And we'll reduce that down to ~$9/oz as production ramps up to 1500tpd. If we do that, and use a silver price of $32/oz, we end up with the following financial projections (for Shafter alone).

Even using these very conservative estimates, we can see that Shafter should be cash-flow positive now and become increasingly profitable over the coming quarters. To put this financial projection for Shafter in 2013 in perspective, here is what we expect from La Negra in 2012:

* Revenue: $47.7M

* Earnings from Mining Operations: $26.4M

Thus, Shafter coming online in 2013 should conservatively increase revenue by ~150% and earnings from mining operations by ~165% as compared to 2012. Again we turn to the question of how and when will this improved financial performance be reflected in the share price? We currently have a 12-month price target of $2.00 on the stock. This is based on a P/E of 20x (conservative compared to their peers) and expected earnings in 2013 of upwards of $50M, giving a projected market capitalization of upwards of $1B.

Note: there is plenty of opportunity for these estimates to be revised upwards; any of the following could occur which would warrant that (all of which are arguably likely):

* A faster than modelled ramp-up to 2500tpd

* Extraction of gold from the ore

* A higher price of silver

* Lower than modelled cash costs in 2013

* Higher mill efficiency

Better silver grades in ore (Block III, which will be mined initially actually has a grade of ~9.5oz/t as opposed to the 8oz/t figure we used in our estimates)

To conclude, we'd like to mention one thing we noticed in the Shafter production announcement that we really liked. Aurcana finally appears to be becoming more conservative in their estimates and projections. Specifically, they said:

"Aurcana has implemented a production ramp up plan to gradually increase production towards the phase I planned capacity of 1500tpd, as mining operation proceed"

Coming from a company that has a history of over-promising and under-delivering, this relatively conservative projection is a nice change. This leaves them room to over-achieve in our opinion, which would be a pleasant change for investors... positive surprises tend to be very good for the share price.

References

[1] http://www.aurcana.com/i/pdf/Shafter-Com-Prod-NR-Final.pdf

[2] http://www.aurcana.com/i/pdf/Shafter_Feasibility_Report.pdf

Posted by Christopher Wood at 17:14 12/16/12

http://www.investmentrevaluationcatalyst.com/2012_12_01_archive.html

Dan  |