Aurcana: A Billion Dollar Valuation for La Negra

Summary

Based on a plan of increasing grades a the La Negra mine and by analysing projected earnings that could result, we ascribe a value of $2.14/share to Aurcana based on the La Negra mine alone; read on if you are interested to see how we arrived at that number.

Review

In our last post, we presented one possible option for increasing production at the La Negra mine. It is simple plan: increase grades by mining the Negra ore body instead of the lower grade ore bodies currently being mined. Currently, Aurcana is mining ore that grades ~80g/t. If instead they were to mine the Negra ore body, it would provide ore grading 169g/t. At a processing rate of 3000 tonnes/day (which the mill will be capable of in Q1-2013), the Negra ore body has enough high-grade ounces to feed the mill for 10-15 years. We showed that if this plan is implemented, La Negra could produce the following on an annual basis:

- Silver (Ag): 4.76Moz

- Silver Equivalent (AgEq): 7.30Moz

This compares with the current production levels over the last 4 quarters:

- Silver (Ag): 1.30Moz

- Silver Equivalent (AgEq): 2.37Moz

In this post, we'll analyse what kind of effect this plan could have on earnings and present a valuation for La Negra based on that analysis.

Projected Revenue

To estimate earnings, we need to look at both projected revenues and expenses. Revenues would appear to be easy... simply multiply that AgEq production number by the projected price of silver to get gross revenue. That almost works, except the revenues Aurcana reports are not actually that value. Instead, Aurcana reports "revenue from mining operations" which is different than gross revenue. Revenue from mining operations is the money Aurcana receives from the refiners/smelters for its concentrate minus any royalties it pays. For example, in the last quarter, here is what Aurcana reported on revenues [ 1]:

- Gross revenues from mining operations: $17.1M

- Deductions T.C., refining and smelting charges: $3.3M

- Royalties: $0.5

- Net Revenues from mining operations: $13.3M

To further complicate matters, it is only recently that Aurcana started providing this breakdown on revenue (the last two quarterly reports), so the amount of data we have to work with is limited. To arrive at a revenue projection we first need to determine the ratio of net revenues to gross revenue. Here is what we have to work with:

- Q2-2012: $17.1/$13.1M = 77.62%

- Q1-2012: $14.6/$11.6M = 79.33%

- Average: 78.47%

Then of course we need to decide on a price of silver. For simplicity, well use the last bid reported by Kitco as of November 10, 2012, which happens to be $32.63. Then we arrive at the following projection for annual revenue from mining operations:

- Revenue: $187M (7.30Moz * $32.63/Moz * 0.7847)

One other factor to consider is whether or not they actually sell every ounce of silver they mine the day they mine it. Typically not, there is some lag, but for the sake of simplicity, we'll assume they do.

Projected Costs

There are two different approaches that Aurcana could pursue with respect to increasing production; increase grades and/or increase mill throughput. In the plan we've presented, we focused exclusively on increasing grades. The reason for doing so is the effect this plan has on costs, which would be substantially smaller than a plan focused on increasing mill throughput. In particular, this plans results in the same about of ore being mined and processed; the only difference is that more end product is extracted from the ore. Aurcana lists all of the following items as costs on their financial statements:

- Mining operating expenses

- Administrative costs

- Financing expense and others

- Stock-based compensation

- Foreign exchange (gain) loss

- Other expenses

- Income tax expense

Which of these costs would be impacted under this plan? Strictly speaking, it should only be the two we've highlighted, mining operating expenses and income tax expense. Here is what mining operating expenses consists of:

- Mine and Mill supplies

- Power

- Salaries and benefits

- Freight and delivery

- Depreciation and amortization

- Depletion of mineral properties

It is hard to know without additional information how each of these expenses will be impacted, but likely most of them (with the exception of possible depreciation and amortization) would rise. For example, although more mine supplies and mine workers are probably not required, more mill supplies and mill workers are likely required, so the impact there is partial. Same goes for power. With respect to freight and delivery and depletion of mineral properties, since both relate directly to the amount of silver being produced, the impact here is likely full.

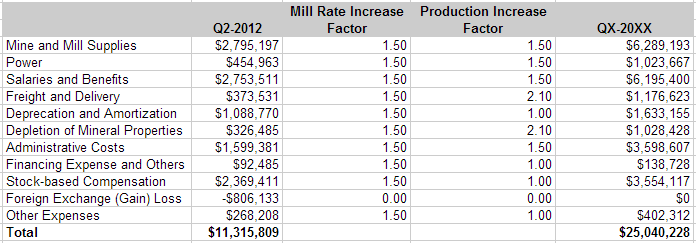

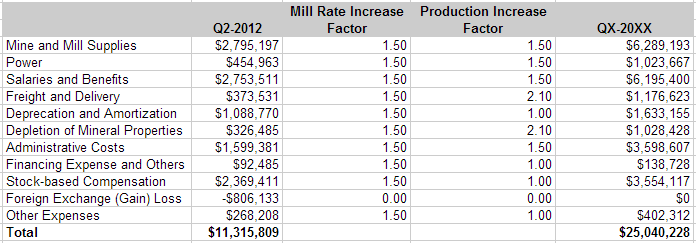

To arrive at an estimate for costs, we decided to use the most recent data, specifically the costs listed in the Q2-2012 financial report, and then scale that up by an appropriate factor. During the period this report covers, the mill was being operated at a target of 2000 tonnes/day (and an actual rate of 1941 tonnes/day). Since our plan requires an operating rate of 3000 tonnes/day, we'll scale up all the costs (except taxes, which we'll calculate directly) by what we are calling a "increased mill rate factor" of 1.5 (3000/2000). Now I know what you're are going to say... this is overestimating costs because a bunch of those costs may not be impacted at all by an increase in the mill rate (specifically, all the ones we didn't highlight). We are aware of that, but we like to be conservative (leaving the opportunity for some upside in the estimates), so we're going to stick with that approach. Then, because some of the costs will also be impacted by the increase in grade, we scale up some of the costs again by a "increased grade factor". This one is probably a little more controversial but again, we tried to be conservative in or approach: this factor will fully impact some expenses (we used a value of 2.1 (169/81) for these), partially impact other expenses (we used a value of 1.5 for these), and not impact other expenses (we used a value of 1 for these). The table below provides our forecast for all costs excluding taxes:

| | Projected Quarterly Costs |

We then convert that number to an annual figure and we get:

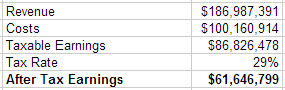

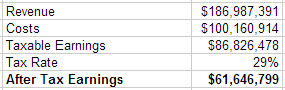

Earnings

To arrive at earnings, we have to subtract costs from revenue, then account for taxes. For taxes we use a value of 29% as predicted by PwC [ 2].

| | Projected Annual Earnings | Valuation

Now for the most important part, if this plan were implemented, what would the La Negra mine be worth to Aurcana? To figure that out, we first need to take a look at the price to earnings ratios of their peers, specifically, their closest peers operating in Mexico. The following P/E ratios where reported by Google Finance on November 10, 2012):

- Endeavour Silver Corp: 34.31

- Excellon: 58.66

- First Majestic: 30.53

- Fortuna: 29.22

- Great Panther: 37.64

- Scorpio: 45.92

- Average: 39.38

Aurcana's peers are able to command rather high price-earnings multiples. So again, to be conservative, we're not going to use the average P/E of their peers, but half of that or 19.69 in our valuation model. Plugging in the earnings number from above, the P/E we selected, and the fully diluted share count, we arrive at the following valuation:

- Projected total value of La Negra: $1.214B

- Projected per share value of La Negra: $2.14

| | Projected Valuation |

Conclusion

Aurcana has the opportunity to unlock significant value at La Negra simply by shifting mining operations to the Negra ore body from the lower grade ore bodies currently being mined. Doing so would have a massively positive impact on earnings, which should be reflected in valuation of the company. While many people look to Shafter as the major future catalyst for share price appreciation (and we agree, Shafter offers significant upside), we think La Negra offers equal or possibly even better opportunities.

Note

A few more Aurcana interviews took place this week that you should be aware of:

References

[1] http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=00003467&fileName=/csfsprod/data133/filings/01946507/00000001/C%3A%5CSEDAR%5CFILINGS%5CAUNFS081712.pdf

[2] http://www.pwc.com/en_CA/ca/mining/publications/pwc-mining-in-the-americas-2012-03-en.pdf

Posted by Christopher Wood

at 17:44 February, 10, 2013

investmentrevaluationcatalyst.com |