The Latest Kantar Worldpanel ComTech Sales Share Data (3 m/e March 2013) ...

Today Kantar Worldpanel released its latest set (for the 3 months ending March 2013) of estimated Worldpanel smartphone sales share in nine countries and a composite of the EU 5 (Great Britain, Italy, Germany, France, and Spain), and separately released expanded data for the US market where Windows Phone continues to show growth and BlackBerry has declined to less than 1% of smartphones sold through to end users.

Kantar Worldpanel reports its data monthly as a percentage market share of sales in the preceding 12 weeks (i.e. a three month moving average). The data is drawn from a continuous survey methodology, where consumers are interviewed and consumer behaviour recorded.

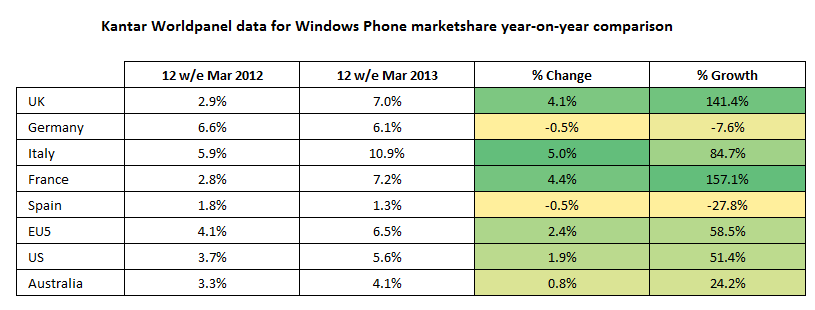

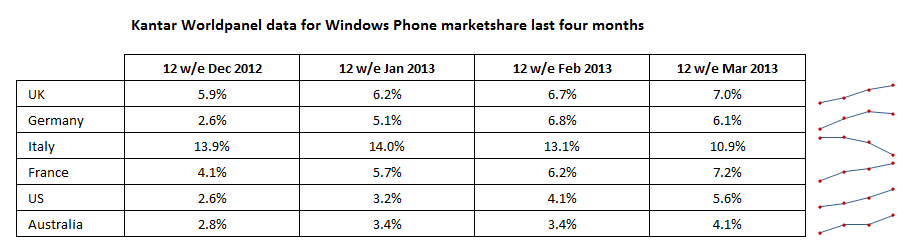

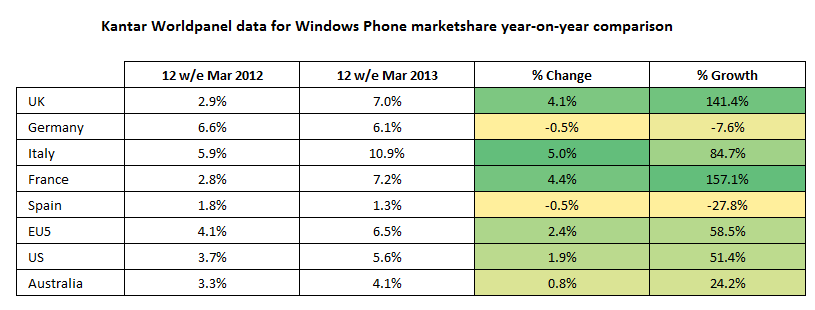

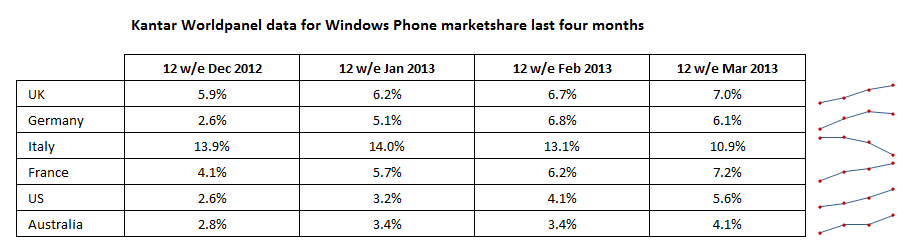

The data shows substantial growth for Windows Phone in the UK (2.9% to 7%), France (2.8% to 7.2%), and the US (3.7% to 5.6%) over the last year, although some markets, such as Germany (6.6% to 6.1%), show a small decline. While Windows Phone is still a relatively small player compared to iOS and Android (19.4%, 68.8% and 6.5% in the EU5 respectively), it is now firmly in third place ahead of Blackberry and other competing platforms and is showing strong positive growth.

[While Kantar doesn't make note of it, it should be noted that in the year ago 1st quarter comparison figures 'Windows' share is comprised of both Windows Mobile (about 30% of total 'Windows' share) as well as the newer Windows Phone platform.]

Below are Kantar's 2 press releases -- the 1st with a US focus and the second with a broader focus. I'll post additional graphics data based on the Kantar data in follow on posts.

>> Windows sees steady growth in the US in Q1 2013

Kantar Worldpanel ComTech

New York

April 29 2013

kantarworldpanel.com

While accounting for just 5.6% of smartphone sales in the first quarter of 2013, Windows showed continued growth, gaining 1.9% compared to the same period last year, according to data released today by Kantar Worldpanel ComTech (to see the data, click on this link).

With nearly half (49.3%) of smartphone sales, Android remains the top selling operating system, but saw only slight growth compared to the same period last year, and is down versus the 3 months ending February 2013 (-1.9%). iOS remains in second place with 43.7% of smartphone sales, down throughout Q1 2013. Little movement is seen among the top smartphone carriers in the U.S market. Verizon continues to lead smartphone sales with 37.2% of smartphones sold in the 3 months ending March 2013. AT&T remains in second place at 27.9%, and Sprint in third place with 12.3%. T-Mobile is the only carrier to decline this period, seeing a 3.2% loss versus the same period a year ago, down to 9.5% of smartphones sold.

The data is derived from Kantar Worldpanel ComTech USA’s consumer panel, which is the largest continuous consumer research mobile phone panel of its kind in the world, conducting more than 240,000 interviews per year in the U.S. alone. ComTech tracks mobile phone behavior and the customer journey, including purchasing of phones, mobile phone bills/airtime, and source of purchase and phone usage. This data is exclusively focused on the sales within this 3 month period rather than market share figures. Sales shares exemplify more forward focused trends and should represent the market share for these brands in future.

Kantar Worldpanel ComTech analyst Mary-Ann Parlato states, “As iOS and Android continue to battle it out for top selling smartphone OS, we have seen Windows steadily grow over the past year and is now at its highest sales share figure so far.”

Windows share growth has continued to rise in European markets, particularly where Windows is supported by the legacy of its hardware partners. The US market differs in the fact that there are still many users in the market that are yet to upgrade to their first smartphone device. And Windows is starting to capture these consumers.

“Windows strength appears to be the ability to attract first time smartphone buyers, upgrading from a featurephone. Of those who changed their phone over the last year to a Windows smartphone, 52% had previously owned a featurephone. Comparatively, the majority of iOS and Android new customers were repeat smartphone buyers, with 55% of new iOS customers, and 51% of new Android customers coming from another smartphone. While the differences between these figures are small, with over half of the US market still owning a featurephone, it’s likely that many will upgrade over the coming year, which will ultimately contribute to more growth for the Windows brand.” Parlato continues.

One of Windows’ key handset manufacturers, Nokia, has seen the greatest benefit from the OS’ growth. Although, still only 4% of smartphones sold in Q1 2013, Nokia has seen its share rise from just 1% in the same period a year ago. ###

>> Android set to spike with HTC One and Samsung Galaxy S4 launches

Kantar Worldpanel ComTech

London

April 29 2013

kantarworldpanel.com

The latest smartphone sales data from Kantar Worldpanel ComTech shows Android continuing to dominate the number one OS spot in Great Britain, with 58.4% of the market (for 3 m/e March 2013), and this looks set to grow with new phone releases (to see the data, click here).

iOS remains the number two OS in Britain, but its share has declined by 1.4 percentage points to 28.9%. Windows Phone has now hit 7% market share for the first time, up from 2.9% a year ago.

Dominic Sunnebo, global consumer insight director at Kantar Worldpanel ComTech, comments: “Android is the top selling OS across key global markets, only beaten by iOS in Japan and now accounting for 93.5% of the Spanish market. We expect to see a further spike in its share in the coming months, as sales from the HTC One start coming through and the Samsung Galaxy S4 is launched. This will pile pressure on Apple, BlackBerry and Nokia to keep their products front of consumers’ minds in the midst of a Samsung and HTC marketing blitz.”

Samsung and Apple continue to dominate the top ten best-selling smartphones in Britain, with the LG Google Nexus 4 and BlackBerry Curve 9320 the only other individual brand models featuring.

Dominic continues: “Samsung already accounts for half of the ten bestselling smartphones in Britain and much has been said in the past about Samsung’s strong distribution, but it is clear that one of the key drivers of Samsung’s performance is how targeted each device is. Kantar Worldpanel ComTech data clearly shows that different Samsung models are appealing to a very different type of consumer. The Galaxy Note II is popular with affluent 25-34 year old males, the Galaxy SIII Mini appeals to younger females, the Galaxy Ace to older females while the Galaxy SIII has broad appeal. The fact that Samsung has so many models available in the market is not indicative of a scatter gun approach, simply a realisation that different consumers demand very different handsets, both in functionality, design and price.”

In the latest three months to March 2013 smartphone penetration in Britain remained at 63%, with smartphones making up 84% of mobile sales. ###

- Eric - |