Two Underdogs and a Hidden Gem from China

By Leo Sun - May 8, 2013| Tickers: DANG, RENN,

Leo is a member of The Motley Fool Blog Network -- entries represent the personal opinion of the blogger and are not formally edited.

When most American investors think of the Chinese Internet market, two names probably come to mind - Baidu, the “Google of China,” and Sina, the creator of Weibo, the “Twitter of China.” Yet there’s so much more to the Chinese Internet industry than these two names - there are multiple levels of social networking sites, online gaming companies and sprawling e-commerce giants vying for a profitable piece of the pie.

In 2012, China’s total Internet users rose 10% year-over-year to 564 million - larger than the combined population of the United States, Canada and Mexico. Out of those 564 million users, 242 million purchased products online, up from 191 million in 2011.

Source: www.qz.com, data from CNNIC

That means there’s a lot of smaller players out there that could grow to become the next Baidu and Sina. Yet there’s also a lot of losers out there that often promise high growth that isn’t held up by any fundamental scaffolding. The trick to navigating this market is understanding the underlying trends in the rapidly changing market, and I believe that studying three names in particular - Renren (NYSE: RENN), Dangdang (NYSE: DANG) and YY Inc. (NASDAQ: YY) - can help investors appreciate how deep and diverse the Chinese Internet market is.

Renren: China’s Facebook

Renren (which literally means “everyone”) was hyped as the “Facebook of China” prior to its IPO in February 2011. Just as Baidu reaped the benefits of Google getting banned from China in 2010, Renren has seen strong user growth due to the ban on Facebook. Renren’s core site closely resembles Facebook, but it also owns a Groupon-like group purchase site called Nuomi. It also owns video streaming site 56.com and operates its own online game operations. Critics have claimed that Renren is wearing too many hats at once, and this lack of focus is crimping the company’s growth prospects.

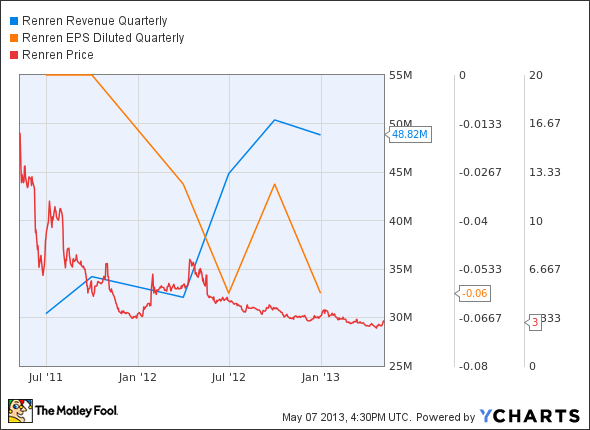

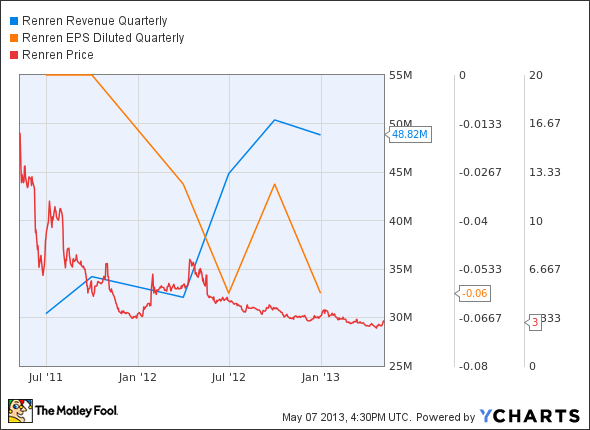

Last quarter, Renren reported 49% year-over-year revenue growth to $48.8 million, but its profit plunged from a profit of $44.3 million to a net loss of $21.1 million. In other words, Renren suffers from the classic Internet company growth problem of rapid revenue growth amid declining margins and profits.

Renren attributed much of its fourth quarter loss to an 84.2% increase in total expenses to $17.8 million, primarily attributed to higher bandwidth costs and content investments for 56.com. Research & development costs soared as a result of growing its workforce and heavier investments in mobile apps and games. Meanwhile, Nuomi, just like its Western counterpart Groupon, has been unable to squeeze out a profit despite the site’s popularity.

Renren’s active user base grew 20% year-over-year during the fourth quarter, with monthly unique log ins rising 47%. Yet the site has had trouble monetizing all these visits. Last quarter advertising revenues declined 16.7%; however, sales of Internet value-added services, similar to Facebook currency, rose 103.8%, suggesting strong growth of virtual transactions on its main site and through its online games.

Therefore, Renren is so much more than China’s Facebook - it’s actually like Facebook, Groupon and Zynga rolled together in a single package. Investors should watch for signs of improvement in the company’s bottom line growth, since improved cost controls could help stabilize this stock.

Dangdang: China’s Amazon

E-commerce China Dangdang, founded in 1999, is China’s largest online bookstore. The company offers over 200,000 books and 10,000 kinds of software products. The company controls approximately half of online book sales in China.

Despite this reputation, Dangdang is still David in a market saturated by Goliaths. As seen in the following chart, Dangdang is still dwarfed by Alibaba’s Taobao and Tmall sites, as well as Jingdong's 360buy Mall.

Source: www . qz . com, data from CNNIC

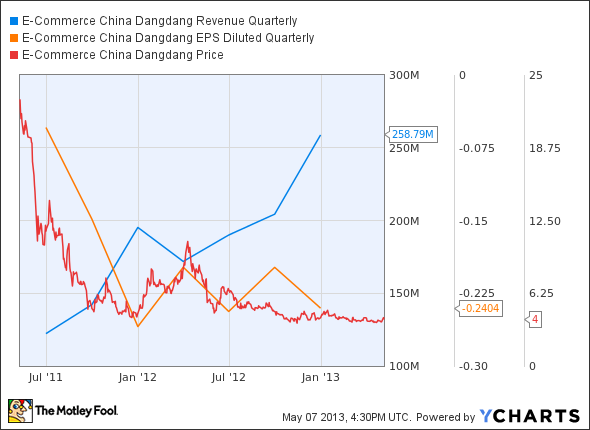

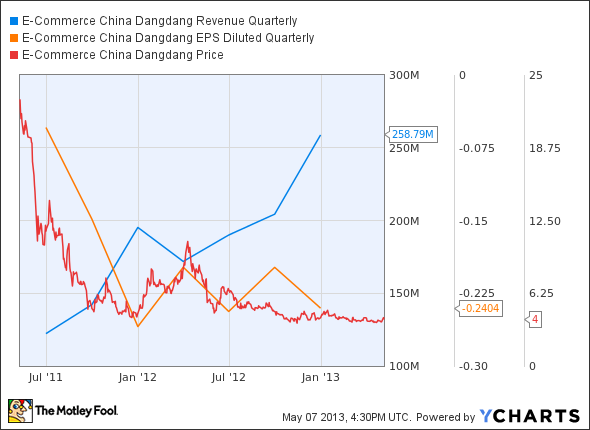

Despite having a much smaller user base than its larger rivals, both Dangdang and Jingdong have shown much stronger year-over-year growth than Alibaba’s two primary sites. For its fourth quarter, Dangdang’s revenue rose 31% year-on-year to $268.1 million. Media revenue, which includes books, CDs and software, accounted for 57% of the company’s top line, while other general merchandise sales comprised 36%. Meanwhile, gross profit rose 68% from the prior year quarter to $35.1 million. Like its larger peers, Dangdang has aggressively developed apps for mobile platforms, such as iOS, Android and Windows Phone.

ADR shares of Dangdang have fallen nearly 90% since its IPO, but the stock recently rallied after a few positive headlines.

First, the company reported that it is planning to release a touchscreen tablet e-reader device similar to Amazon’s Kindle this month. Although the Chinese tablet market has grown increasingly crowded, if Dangdang follows Amazon’s example and uses its new tablet as a loss-leader to drive digital sales, it could spur strong growth in its all-important media segment. Second, the company announced that it will launch a “flash sales channel” similar to the limited time deals offered by Amazon and eBay, which analysts believe could spur impulse buys and more return visits. Lastly, some analysts are speculating that Dangdang’s first quarter earnings report, due out on May 14, could beat estimates.

YY Inc.: The Hidden Gem

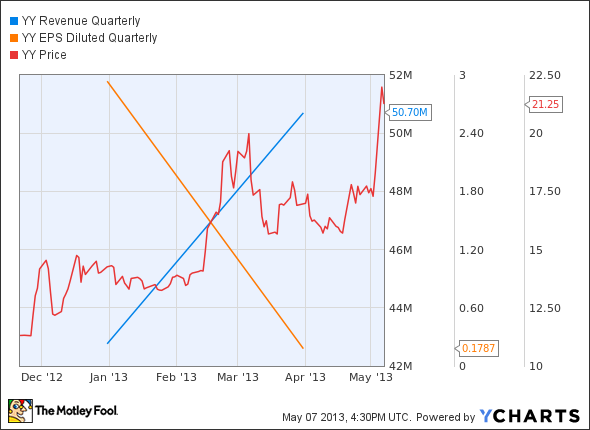

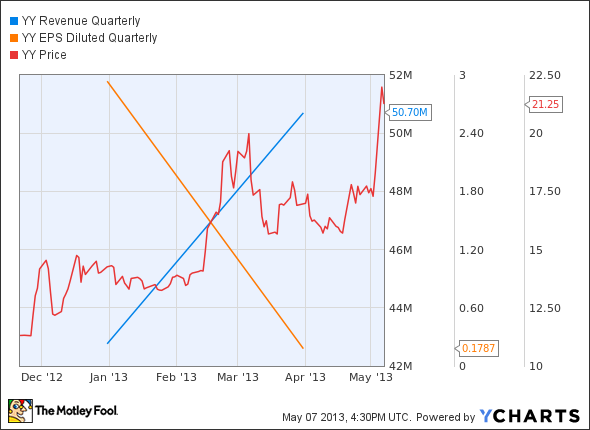

Unlike Renren or Dangdang, social network operator YY Inc. has actually risen nearly 90% since its market debut last November. YY, which has over 300 million users, is a gaming and web-chat platform that allows freelance entertainers to become Internet celebrities. YY members use the website to showcase their talents, such as singing or hosting radio shows, to attract fan followings.

Popular performers then charge their fans fees for playing online games or engaging in activities with them. Fans can also purchase virtual gifts, such as flowers or teddy bears, for their favorite members. The members then earn a cut of the revenue from the purchased products.

This oddball business model has been wildly successful, with first quarter revenues rising 130.5% year-on-year to $51.2 million. Non-GAAP operating income rose 159.9% and gross profit soared 150% to $27.5 million. The company boasted an incredible gross margin of 53.7%, up from 49.5% in the prior year quarter.

41% of the company’s revenue is generated from its online games, and 35% from its music unit, which showcases live performances and karaoke from its performers. YY’s robust video-chat platform has even attracted over 20,000 teachers in China, who now use the site to offer private lessons ranging from foreign languages to government civil employee entrance exam courses.

YY’s more popular members have been able to earn approximately $19,000 annually, compared to the average Chinese annual salary of $7,000, which makes participation in the site a win-win situation for both the company and its members.

The Foolish Bottom Line

Despite worries of a slowing Chinese economy, the Chinese Internet industry is still one of the most exciting growth markets in the world. While some companies, such as Renren, are still trying to control costs to generate profits, other companies, such as Dangdang, are slowly but steadily carving out a niche in e-commerce. Lastly, oddball companies such as YY prove that Chinese Internet companies don’t necessarily need to be labeled as the “Chinese Facebook or Amazon” to achieve incredible success. These two underdogs and one hidden gem are all risky bets, but each of them have high growth potential if their business models pay off.

If you'd like to know more about the “Facebook of China,” The Motley Fool has published a premium report on Renren, giving you a rundown of its opportunities and threats. Just click here to get started. |