Hi Box, I have been around SI..... I was in Australia working for Citi but that was prior to the birth of Silicon Investor.... I have had my business ups and downs and have spent much of my time of S I on my Market Lab thread.

the Bond secular bull market is over, the global environment is deteriorating..... institutional money is moving away from risk assets....

Here is a post from late last year that presents a theme or two.... The Global QE programs should ultimately create significant inflation, that will dwarf the inflation of the 1970's... so In that kind of world we can see an DJIA at 36,000 or 40,000 in 8 or ten years.... but on an inflation adjusted basis...... it might be losing money... depending on what you are comparing it too. I believe we have seen the top for the year in risk assets.

This post is a sampling of my thinking

-------------------------------------

| To: da_cheif™ who wrote (13389) | 11/28/2012 2:17:55 AM | | From: John Pitera | 13 Recommendations Read Replies (3) of 14172 | | | I'm talking about a market collapse in 2013 possibly continuing into 2014 , so my post was a bit imprecise saying this year. I have a multitude of reasons and I have been doing this for almost 40 years too.

I was working as Chief Market Technician and trading in a bill and bond futures profit center for Citibank in 1986-1987, and I gave several presentations including one at the Sydney; futures exchange in front of several reserve bank governors of the Reserve Bank of Australia and I ended my discussion of Technical Analysis with a couple of Fundamental Charts from the Montreal forecasting firm that showed public sector debt, private sector debt and governmental debt to GDP and how it had advanced to the same very high levels of the 1929-1930 time period. And that equity values were so stressed that we had a market crash coming. I specifically remeber an employee of the RBA coming up to personally thank me at the end of my talk.

I first spoke of the coming Credit Default Swaps crisis and collapse on Sept 15th of 2005 on this thread...... and was ahead of the curve articulating how large the Magnitude of losses measured in trillions of dollars would occur.

I was on this thread in April of 2008 when the founder of Vanguard said the FED had committed $400 billion or it's $800 billion balance sheet and his view was that the FED would be out of bullets at $800 billion. I SAID that this was ludicrous as the FED has an unlimited ability to expand it's balance sheet Up until the currency collapses. We've made it up to 2.7 Trillion and then the FED was talking about reducing it's balance sheet for a while last year before re engaging in an additional round of quantitative easing.

And now the FED and people in general have the Hubris of believing that the FED can hold interest rates at zero going out into 2014-15.

The FED has said that it has to keep equity prices up to keep the deflationary global deleveraging from occurring.

Bloomberg pointed out that George Soros was a big net buyer of gold this past Q as if John Paulson who managed to turn a billion plus into 15 billion by working with Goldman Sachs who personally let him put together his own packages of credit default swaps that he would trade against.

Bloomberg’s headline article sunday night was that Goldman Sachs was not going to be involved in the underwriting of bond issues from Banks in the South of Europe, Spain, Italy, and several other countries .... even though GS makes huge profits from underwriting. JPM and MS are still underwriting these upcoming debt issuances.

it's a big tell when Goldman is walking away from lucrative underwriting business, they know the dangers of underwriting the sales and then getting caught with losses and litigation issues.

Obama is firming his spine and wants to portray the Republicans as driving us over the fiscal cliff. He's not an LBJ , Eisenhower or Lincoln type negotiators as Doris Kerns Goodwin and several others including Chris Mathews has pointed out.

Europe is having failures with Greece, Catalonia citizens have voted to become their own country and let the rest of the Spanish deal with their debt situation.

The Arab spring is now transforming into a summer of 1968 type of burn down the cities. Israeli is facing more hostilities and the most fighting with neighbors since the 1973 war.

Syria is a total disaster with at least 40,000 killed....... chemical weapons that are not secured..... no solutions, but the Russians have their key military base and naval base there that 'THEY MUST RETAIN" as it's their key base to get Russian warships subs etc into the Mediterranean.

Japan has had 5 prime ministers in 5 years and are gearing up for a new election, the WSJ has shown how the currency has managed to maintain enough global safe haven value to suffocate the export markets.

The issue is not what level stocks are trading at ...... everyoneshould read John Mauldin's NYT bestseller , the endgame" and we should be anticipating a european currency collapse and a US dollar currency collapse (ie hyperinflation) in the next 4 years.

John McLauglin Group has a PBS show they have been doing for 30 years and this past friday, the final point was made that when interest rates inevitably go back up it will add several trillion dollars a year to the annual budget deficit just to service the interest on the existing debt.

Art Cashin has spoken of the 16.7 year cycle that is also known by a number of market experts. I've been meaning to post the highs and lows of that since 1929 for Augustus Gloop, since we peaked in 2000. We will not have worked out our secular bear market for another 5 years or so.

and we shall have another bear market prior to that that will be as bad as 2000-2003 and late 2007- until March of 2009. The 3rd one will hurt the worst as we collectively don't have the asset cushion we had in the glorious bubble days of 1999 and the euphoric real estate and equity market of 2006-2007.

John

this is my opening salvo..........only the tip of the iceberg.

-------------------------------

| To: robert b furman who wrote (12726) | 4/4/2011 1:32:53 AM | | From: John Pitera | 1 Recommendation of 14172 | | | Hi Bob, great to talk to you. I saw the comment you made about us having much more energy in this country than was conceivable 6 or 10 years ago.

The technological advances in horizontal drilling and other new technology tools have created a real boom, for the Exploration and production companies. There's a huge demand for Oil Landman in Texas, Colorado, North Dakota, Canada etc.

just a small snippet from Wiki:

(www.landman.org), these services include: negotiating for the acquisition or divestiture of mineral rights; negotiating business agreements that provide for the exploration for and/or development of minerals; determining ownership in minerals through the research of public and private records; reviewing the status of title, curing title defects and otherwise reducing title risk associated with ownership in minerals; managing rights and/or obligations derived from ownership of interests in minerals; and unitizing or pooling of interests in minerals.

Since the services provided by the "Landman" to the oil and gas exploration industry and other industries are so varied it is not uncommon for a "Landman" to specialize in certain aspects of the profession that requires specific knowledge, such as title and lease negotiations and acquisition, onshore/offshore contracts, rights-of-way and surface land management, federal lands, and numerous other areas. The term "Landman" and nuances thereof

properties adjacent to what are thought to be mature depleted oil fields, provide access to additional deposits that you recover when you drill horizontally. There also a huge expansion in extracting natural gas, from the shale formations and new drilling and recovery innovations.

As it turns out when companies capture the Carbon emissions from Power plants etc. what they are collecting can be pumped into the energy fields and it provides much higher yields. Companies like Exxon and several other majors have been doing this and I recall a WSJ article last year where the writer was commenting that the firms play it close to the vest in discussing the pricing and metrics of the process.

Obviously there is an incredible amount of oil and gas in Alaska.

It's widespread knowledge even Al Gore admits that the corn conversion into ethanol is not yielding a net energy savings, it's a huge subsidy for ADM, and the big Agricultural firms.

One our old time buddies the stocktrasher, who was out at the Reno Piffer get together at the Golden Nugget in 1999, put together by Jan and Jorj (Tom D) ... well Rick has been working in a firm that deals with the new composites and nanotechnology enabled products like graphene; which he's pumped up about.

He sent me an email with some links to the technology and these newer materials are 200 times stronger than steel and have incredible tensile strength. The Nano industry will enable a radically different world over the next 10-15 years fuel efficiency increases that are ALMOST beyond imagination. ...and as you know there are people and companies who are going to be ringing the cash register with these innovations.

AviationWith its immense tensile strength and light weight, it may be possible to realize the dream of a vacuum airship, first proposed by Francesco Lana de Terzi in 1670

the idea is that just as a boat is lighter than the liquid it floats in graphene is lighter than air and can rise into the sky. The Graphene article at Wiki is interesting and the 2010 Nobel prize in Physics.

The Nobel Prize in Physics for 2010 was awarded to Andre Geim and Konstantin Novoselov "for groundbreaking experiments regarding the two-dimensional material graphene

I attended a Nanotech Adult Ed course at Rice in Houston a few years ago, Rice had a Nobel prize winner in Physics for work doing with Carbon Isotopes. The giest of the Nanotechnology is that when you work with materials from zero to 400 nanometers in size, the properties of the materials defy the Laws of Physics that apply to materials larger than that. As you know these physicists have been mapping out quantum mechanics, string theory and other exciting stuff that's above my pay grade!!!!!!! -g-

so there is a brighter future down the road, but we've got the second act of The end of the Debt Supercycle and how it changes everything......... btw that's the subtitle of John Mauldin's most excellent new book ENDGAME.

I have my copy write next to my keyboard. It's got a real cool cover picture of two Chess Pieces the two Kings in motion. I really love Chess and just don't get to play enough.

check out graphene...we have a realtionship with a company that can make KG's of this stuff at a time.

en.wikipedia.org

sciencedaily.com

wired.com

(a few links he sent me.)

great talking to you.

John |

-----------------------------

| To: pcyhuang who wrote (12787) | 9/18/2011 5:22:34 AM | | From: John Pitera | 3 Recommendations of 14172 | | |

Paul Ryan -- Reading "The Endgame: the end of the Debt SuperCycle"

September 17, 2011

By KATE MURPHY

Kate Murphy is a journalist in Houston who writes frequently for The New York Times.

United States Representative Paul Ryan, a Republican from Wisconsin, is. chairman of the House Budget Committee and a senior member of the Ways and Means Committee. His plan to end the debt crisis, titled “The Path to Prosperity,” proposes to cut government spending by $6.2 trillion over the next decade. We asked him what he finds interesting.

READING I am reading the “Read and Learn Bible” to my 6-year-old son. I’ve already read it to my daughter and older son. Without the help of my children but with the help of a Kindle, I’m reading John Mauldin’s “Endgame: The End of the Debt Supercycle.”

I find myself confusing the author’s name with maudlin — which pretty much says it all.

What I look forward to reading the most is Quality Whitetails Journal. It’s from the Quality Deer Management Association and gives insight on deer biology and habitat stewardship. I was planting clover this past weekend at my mom’s place in a rural part of Wisconsin. Yes, deer like to eat clover.

LISTENING In this kind of job you do a lot of driving. I drive around Wisconsin every week in my truck and I always have a book or lecture on tape. Right now I have “The Wisdom of History” — a series of provocative lectures by Professor J. Rufus Fears of the University of Oklahoma. When working out, I usually have my iPod up pretty loud — Led Zeppelin, AC/DC and Rush. That’s Rush the band, not the man.

WATCHING I like to start my mornings with CNBC.

FOLLOWING There are few days in which I don’t spend time at RealClearMarkets.com. It’s an aggregator Web site that has financial news from a lot of sources: newspapers, magazines, academic journals. On Twitter, I get daily updates from @NationalDebt.

STALKING Hunting season starts in one week and to prepare I’ve upgraded to two new tree stands that I just installed so my 11-year-old nephew and I can sit side by side. I’m teaching him to bow hunt this fall and we are all set with the gear.

EATING My wife and I were the top bidders on a quarter steer donated by a local farmer at a charity auction, and it’s delicious meat. And my smoked venison brats are always a hit. I butcher my own deer, grind the meat, stuff it in casings and then smoke it. Not much to it. |

------------------------

| To: pcyhuang who wrote (12791) | 9/23/2011 3:21:30 AM | | From: John Pitera | 2 Recommendations Read Replies (1) of 14172 | | | As the ENDGAME ambles down the road... John Mauldlin from last weekend...

Twist and Shout?

By John Mauldin | September 17, 2011

I

Bailing Out Europe’s Banks Yesterday the Fed announced that along with the central banks of Great Britain, Japan, and Switzerland it would provide dollars to European banks that have lost their ability to access dollar capital markets (basically each other and US-based money market funds that are slowly letting their holdings of European bank commercial paper decrease as it comes due. And if they are “rolling it over,”they are buying very short-term paper, according to officials at the major French bank BNP Paribas.

Are US taxpayers on the hook? We will deal with that in a minute. The more interesting question is, why do it at all and why now? Was there a crisis that we missed? Why the sudden urgency?

One of the little ironies of this whole Great Recession is that the central banks of the world rolled out this policy on the 3rd anniversary of the Lehman collapse. The Fed acted AFTER that crisis to provide liquidity. And we know the recession and bear market that followed.

The only reason for this move must certainly be that they are acting to prevent what they fear will be another Lehman-type crisis. Otherwise it makes no sense. They can give us any pretty words they want, but this was not something calculated to make the US voter happy. To do this, you have to be convinced that “something evil this way comes.” And to recognize the costs of not doing anything, and try to head them off.

My guess (and it is that, on a Friday night) is that the European Central Bank made a presentation to the other central bankers of the realities on the ground in Europe, and the picture was plug ugly. It should be no surprise to readers of this letter that European banks have bought many times their capital base in sovereign debt. The ENDGAME is getting closer (more on that in a minute).

Let’s look at just one country. French banks are leveraged 4 times total French GDP. Not their private capital, mind you, but the entire county’s economic output! French banks have a total of almost $70 billion in exposure to Greek public and private debt, on which they will have to take at least a 50% haircut, and bond rating group Sean Egan thinks it will ultimately be closer to 90%. That is just Greek debt, mind you. Essentially, French banks are perilously close to being too big for France to save with only modest haircuts on their sovereign debt. If they were forced to take what will soon be mark-to-market numbers, they would be insolvent.

Forget it being simply French or Greek or Spanish banks. Think German banks are much different? Pick a country in continental Europe. They (almost) all drank the Kool-Aid of Basel III, which said there was no risk to sovereign debt, so you could lever up to increase profits. And they did, up to 30-40 times. (Greedy bankers know no borders – it comes with the breed.) For all our bank regulatory problems in the US (and they are legion), I smile when I hear European calls for US banks to submit to Basel III. Bring that up again in about two years, when many of your European banks have been nationalized under Basel III, at huge cost to the local taxpayers.

Next, let’s look at the position of the ECB. They are clearly seeing a credit disaster at nearly every major European bank. As I keep writing, this could and probably will be much worse for Europe than 2008. So you stem the tide now. But for how long and how much does it cost? A few hundred billion for Greek debt? Then Portugal and Ireland come to mind. If bond markets are free, Italy and Spain are clearly next, given the recent action in Italian and Spanish bonds before the ECB stepped in.

Could it cost a half a trillion euros? Probably, if they have to go “all in.” And that is before the ECB starts to buy Italian and Spanish debt (Belgium, anyone?), which no one in Europe is even thinking that the various bailout mechanisms (EFSF, etc.) could handle, which leaves only the ECB to step up to the plate. The ultimate number is quite large.

WWGD? What Will Germany Do? That has to be the question on the mind of the new ECB president, Mario Draghi, who takes over in November, just in time for the next crisis. I believe German Chancellor Angela Merkel at her core is a Europhile and wants to do whatever she can to hold the euro experiment together. But for all that, she is a politician, who knows that losing elections is not a good thing. And the drum beat of the German Bundesbank and German voters grows ever louder in opposition to the ECB printing euros. Can she explain the need for this to her public?

As my friend George Friedman wrote today, Europe is complex. Speaking about Geithner going to the Eurozone finance meeting this weekend in Poland, he says:

“Geithner’s presence is particularly useful for two reasons. First, despite the vitriol that is a hallmark of American domestic politics, American monetary policy is remarkably collegial. The transitions between Treasury secretaries are strikingly smooth. Geithner himself worked for the Federal Reserve before coming into his current job, and Geithner’s partners in managing the U.S. system – the chairmen of the Federal Reserve and the Federal Deposit Insurance Corporation – are typically apolitical. Geithner holds the United States’ institutional knowledge on economic crisis management.

“Second, what Geithner doesn’t know, he can easily and quickly ascertain by calling one of the chairmen mentioned above. This is a somewhat alien concept in Europe, which counts 27 separate banking authorities, 11 different monetary authorities, and at last reckoning some 30 entities with the power to carry out bailout procedures.

“Getting everyone on the same page requires weeks of planning, a conference room of not insignificant size and a small army of assistants and translators, followed by weeks of follow-on negotiations in which parliaments and perhaps even the general populace participate in ratification procedures. The last update to the European Union’s bailout program was agreed to July 22, but might not be ready for use before December. In contrast, the key policymakers in the American system can in essence gather at a two-top table for an emergency meeting and have a new policy in place in an hour.

“Geithner will undoubtedly point out that the European system is not capable of surviving the intensifying crisis without dramatic changes. Those changes include, but are hardly limited to, federalizing banking regulation, radically altering the European Central Bank’s charter to grant it the tools necessary to mitigate the crisis, forming an iron fence around the endangered European economies so that they don’t crash everyone else, and above all recapitalizing the European banking sector to the tune of hundreds of billions (if not trillions) of euros – so that when trouble further intensifies, the entire European system doesn’t collapse.”

That is the standard Europhile leader’s line. I talked this week with a leader of that faction, and that could be his speech. But again, that is not what Germany signed on for. They thought they were getting open markets and an ECB that would behave like the Deutsche Bundesbank. And it did for ten years. Now, in the midst of crisis, the rest of Europe is talking about needing a less restrictive monetary policy. That means potential inflation, which still strikes fear in the hearts of proper German burghers.

If George is right, Geithner will be speaking to (mostly) a receptive audience. But he is a central banker talking, not a politician. And his message will not play well in Bavaria, or in any country that still thinks of itself as a country, which is to say all of them. Remember this, in order to get the European treaty passed in France and in the Netherlands, they had to remove the parts about the flag and other symbols of unity. It is still 27 countries in a free trade zone, with different languages.

What Is the Fed Really Risking? This will be where I lose a few readers. The actual answer to the above question is,“Not much.” The Fed is not lending to European banks or even to the various national central banks. Its customer is the ECB, which will deposit euros with the Fed to get access to dollars. Making the safe assumption that the Fed knows how to hedge currency risk (fairly easy), the only risk is if the ECB and the euro somehow ceased to exist. And these are swap lines. This is not a new concept; it has been authorized since May, 2010. The real difference is that previously it has been used only for loans with 7-day maturity, and now that is extended to 3 months. This gives the ECB the ability to lend dollars for 3 months, which they must think will entice US money-market funds back into at least short-term commercial paper. (Just stay one step ahead of the ECB and the Fed, and your loan is “safe.” We will see how enticing this is.)

Now, this is not without costs. It is effectively another round of QE, although theoretically less permanent than the last rounds, as the swap lines have a finite and rather short-term end. And those banks need the money for existing business, so it should not flood the market with new dollars. If that were to happen, the Fed should withdraw the lines or withdraw dollars from the system on its own. Allowing their balance sheet to expand through a back-door mechanism like this is not appropriate monetary policy and would draw deserved criticism.

Why do it? It is not for solidarity among central bankers. The cold calculation is that a European banking crisis would leak into the US system. Further, it would throw Europe into a nasty recession, when growth is already projected (optimistically) to be less than 0.5%. That means the market that buys 20% of US exports would suffer and probably push us into recession, too (given our own low growth), making a far worse problem for monetary policy in the not-too-distant future.

Finally (and this is one I do not like), if the ECB was forced to go into the open market for dollars, the euro would plummet. As in fall off the cliff. Crash and burn. Which would make US products even less competitive worldwide against the euro. While I think we need a stronger dollar, that is not the thinking that prevails at higher levels. You and I don’t get consulted, so it pays us to contemplate the thought process of US monetary leadership and adjust accordingly.

Finally, I think that the end result of lending to the ECB will be to postpone the problem. The problem is not liquidity, it is insolvency and the use of too much leverage by banks and governments. This action only buys time. And maybe time is what they need to figure out how to go about orderly defaults, which banks and institutions to save and which to let go, which investors will lose, whether some countries must leave the euro, etc. Frankly, the world needs Europe to get its act together.

What Will the Fed Do Next Week? Bernanke has taken the highly unusual step of adding an extra day to next week’s FOMC meeting. While that raised my eyebrows, I thought his monetary policy movements would continue to be constrained. Given yesterday’s announcement of coordinated policy with the ECB, I am not so sure now. These things do not happen overnight or in a vacuum. The phone lines must have been open to Europe. The Jackson Hole meeting seemed innocuous enough, but I bet there were some very deep private conversations. This is something they have seen coming for some time. It is not like the whole euro problem is a surprise. Now, Bernanke has to bring his fellow FOMC members along for the next round.

Operation Twist seems to be priced into the market. The original Operation Twist was a program executed jointly by the Federal Reserve and the (freshly elected) Kennedy Administration in the early 1960s, to keep short-term rates unchanged and lower long-term rates (effectively “twisting” the yield curve). The US was in a recession at the time, but Europe was not and thus had higher interest rates. The equivalent of hedge funds back then (under the Bretton Woods system) would convert US dollars to gold and invest the proceeds in higher-yielding assets overseas. Billions of dollars worth of gold was flowing into Europe each year. (Incidentally, President Kennedy announced Operation Twist on February 2, 1961, which basically corresponded to the business-cycle trough.)

The notion behind Operation Twist was that the government would encourage housing and business investment by lowering long-term rates, and at least not encourage gold outflows, by maintaining short-term rates. Mechanically, the Federal Reserve kept the Federal Funds rate steady while purchasing longer-term Treasuries. The Treasury reduced its issuance of longer-term debt and issued mostly short-term debt. ( self-evident.org)

Before I comment, let’s look at what Bill Gross had to say in the Financial Times:

“The front end of the curve has for all intents and purposes become inert and worst of all flat as opposed to steeply positive. Two-year yields are the same as overnight fund rates allowing for no incremental gain – a return that leveraged banks and lending institutions have based their income and expense budgets on. A bank can no longer borrow short and lend two years longer at a profit…

“By flooring maturities out to two years then, and perhaps longer as a result of maturity extension policies envisioned in a forthcoming Operation Twist later this month, the Fed may in effect lower the cost of capital, but destroy leverage and credit creation in the process. The further out the Fed moves the zero bound towards a system-wide average maturity of seven to eight years the more credit destruction occurs, to a US financial system that includes thousands of billions of dollars of repo and short-term financed-based lending that has provided the basis for financial institution prosperity.

Bernanke made it clear in his infamous November 2002 “helicopter” speech that moving out the yield curve was in the Fed’s bag of tricks. By that, I mean they could do what Gross fears. They put a ceiling on the price of (say) the 10-year bond at 1.5%, in hopes of bringing banking and mortgage rates down, thereby theoretically spurring the economy and boosting the housing market. And in a normal business-cycle recession such a policy might work. But in a normal business cycle, it has never been necessary.

Twist and Shout? The main point of Bernanke’s speech was that the Fed had many policies it could use, even if interest rates were at zero, if it needed to fight inflation. It was a nice academic speech given to professional economists. But it offers some insight into his thinking.

First, that was then and this is now, as my kids like to remind me. Then, deflation was an issue on the minds of many. Now, this week’s CPI data suggest that, at least for the near future, deflation is not the issue. The Consumer Price Index rose 3.8% for the month, compared to a year earlier. That's up from 3.6% in July and is the highest reading since September 2008. On a month-to-month basis, prices rose 0.4% in August, twice the rate of increase forecast by economists surveyed by Briefing.com. (CNN.com)

Real yields (after inflation) are already sharply negative. A 10-year bond is only 2.05%. Five-year TIPS are a negative 0.83%! Three-month rates are 0%! How much lower can it get? Yes, they can go (briefly) negative, but that is not a sign of a healthy economy. See the chart below from Bloomberg.

Second, high rates are not the problem with the housing market. Rates are already historically low. The “problem” is that bankers now want 20% equity at reduced prices to grant a mortgage. Imagine, bankers wanting to get paid back! Even very creditworthy refinancings cannot get done, because borrowers must bring cash to the table, even as their home values have fallen.

]The same holds for business borrowing. The latest NFIB survey shows the vast majority of small businesses have access to all the lending they want or need. The survey shows the #1 problem they face is sales.

Do consumers need lower rates? Consumer spending is now an almost-record 71% of GDP. Consumers are repairing their balance sheets and reducing debt. (Personal anecdote: next month I will buy a new car, as my youngest son will claim possession of my present car (which has only has 100,000 miles on it and is in very good shape. Checking out new cars, I find that rates are anywhere from 0% to a high of 3%. While I am happy about that, if I did not have to get another car, no matter how low rates went, I would not buy. Auto sales are not even at replacement level in the US. We are clearly driving our cars longer.)

And retirees are being savaged by low interest rates on their savings. Do we really want retirees increasing their risk by seeking more yield? Just as we are going (in my opinion) into recession? That is precisely the wrong policy to pursue. I know rates would naturally be low as the economy slows, but pushing them down further and for longer is not helpful in a world where core inflation is over 2%.

This next Fed meeting will likely produce a very interesting statement at its conclusion. If the Fed does nothing, you do not want to be long. If they go“all in” you do not want to be short. Guessing what they will do is very serious business, so let’s go back to another Bernanke speech from October of 2003, called “Monetary Policy and the Stock Market” (hat tip, David Rosenberg). You can read the whole speech at www.federalreserve.gov/boarddocs/speeches/2003/20031002/default.htm, but let me highlight a passage to give us a preview of this week’s FOMC meeting:

“Normally, the FOMC, the monetary policymaking arm of the Federal Reserve, announces its interest rate decisions at around 2:15 p.m. following each of its eight regularly scheduled meetings each year. An air of expectation reigns in financial markets in the few minutes before to the announcement. If you happen to have access to a monitor that tracks key market indexes, at 2:15 p.m. on an announcement day you can watch those indexes quiver as if trying to digest the information in the rate decision and the FOMC's accompanying statement of explanation. Then the black line representing each market index moves quickly up or down, and the markets have priced the FOMC action into the aggregate values of U.S. equities, bonds, and other assets.

“On occasion, if economic conditions warrant, the FOMC may decide to make a change in monetary policy on a day that falls between regularly scheduled meetings, a so-called intermeeting move. Intermeeting moves, typically agreed upon during a conference call of the Committee, nearly always take financial markets by surprise, at least in their precise timing, and they are often followed by dramatic swings in asset prices.

“Even the casual observer can have no doubt, then, that FOMC decisions move asset prices, including equity prices. Estimating the size and duration of these effects, however, is not so straightforward. Because traders in equity markets, as in most other financial markets, are generally highly informed and sophisticated, any policy decision that is largely anticipated will already be factored into stock prices and will elicit little reaction when announced. To measure the effects of monetary policy changes on the stock market, then, we need to have a measure of the portion of a given change in monetary policy that the market had not already anticipated before the FOMC's formal announcement.”

From that speech, Bernanke clearly believes that stock prices are a tool of monetary policy. He goes so far as to say that the Fed should not try to “prick” what might be perceived as a bubble, because “… attempts to bring down stock prices by a significant amount using monetary policy are likely to have highly deleterious and unwanted side effects on the broader economy.”

But a rising market is evidently not a problem. He uses all sorts of statistical research that shows a seemingly clear correlation between stock prices (risk assets) and monetary policy. I would argue that correlation is not causation. The data is basically over the last 60 years and does not include a balance-sheet/deleveraging recession like we are now in. The underlying economic tectonic plates have shifted. Ask Japan how much an easy monetary policy helps stock prices.

There has been some chatter that the Fed move to coordinate with the ECB will provoke Tea Party criticism, not to mention Governor Perry’s. I hope not, as that would be foolish, and show that whoever takes that tack is not thinking seriously or simply does not get the broader macro environment. To think that policy would be any different under a Republican means you are not paying attention. This should not be that controversial.

But if the Fed does indeed pursue an Operation Twist or “moves out the yield curve,”then vehement criticism is more than warranted. I will be shouting myself!

Europe, Houston, NYC, and South Africa I have enjoyed being home for the last nearly two months. But next Friday my“vacation” ends and I go “on the road again.” I have an aggressive travel schedule, where I am gone for about 40 of the next 50 days. I think I will add close to 70,000 miles to my airline mileage.

I leave Friday for a whirlwind trip to Europe (London, Malta, Dublin, and Geneva) and then back. A quick trip to Houston for an excellent conference with very good speakers ( www.webinstinct.com/streettalkadvisors), and then I fly to New York for the weekend, where I will be speaking at the Singularity Summit, October 15-16. You can learn more at www.singularitysummit.com/. And then I’ll fly to South Africa for two nights, and head back home.

We are already planning next summer. Tiffani has once again arranged for us to rent a small villa in the village of Trequanda, in Tuscany, Italy. It will be our third year, and it is a slice of heaven. You can pick you own fresh vegetables and herbs from the garden. Walk to fabulous restaurants. Have gourmet chefs come in and cook. All at very reasonable prices. (If you are interested in the villa, you can go to www.ifiordalisi.com/)

This Sunday the award-winning design team of Bob and Dylan from Fahrenheit Studio come for a few days of much-needed strategy. There is so much going on. If you like my website, you can see more of their work atwww.fahrenheit.com[/url, or call them at (310) 282-8422 begin_of_the_skype_highlighting (310) 282-8422 end_of_the_skype_highlighting. They will plunge into a raucous Mauldin family brunch, with guests and sundry hangers on.

This is a night for firsts. I got up from writing to go to Tiffani’s house for a Shabbat (long story). It was the first one for her on her own, and she wanted me there. It was also the first time I interrupted a letter in progress on a Friday evening. And this is the latest I have ever stayed up writing a letter. It will be 5 AM before this is off, but it is my privilege to come into your homes each week. And tonight, I just kept editing and adding! But I’m ready to call it a morning and hit the send button.

Have a great week! Trade carefully out there! And I hope you have wonderful fall weather! Something should go right this week!

------------------------------------------

| To: Augustus Gloop who wrote ( 13501) | 1/19/2013 3:48:09 AM | | From: John Pitera | 7 Recommendations Read Replies (2) of 14172 | | | Hi famed Wonka prognosticator.....Michael you have been around these parts for ages........ so you get a special mention in this post I put up on the Silicon Investor Discussion thread.... did not mention you there but I get you early here!!

, so we have a new owner of SI , Craig Longhurst sounds like he may be able to do some very dynamic things to keep this quite remarkable site going ... lots of history on these threads. It's a time capsule. The things that have transpired over the years will make a heck of a good book, if written with a pithy "inside baseball" style ...... I'm pondering what that might look like.

Memory lane: Tom Dorsey, you Jan and the piffers, Jim Cramer's early exploits.... Antman getting Bill Meehan of Cantor Fitzgerald to use the code word "Myth" on a CNBC interview...... Bill's tragic death on 9-11-01.

[url=mailto:Anthony@Pacific]Anthony@Pacific.... shorting bubble scam stocks, with inside information from a couple of FBI white collar agents from Arizona, I believe. The incredibly insightful posts of Henry Volquardsen.... maybe the smartest guy I have ever know on how the Money Center banks (citi) trade FX spot, forwards, long-dated FX which brings interest rate differentials acutely into view, as well as his trading of a variety of things like AUD bonds and bills, and of course his work with swaps. He was running a book of swaps for a combination of UBS and I believe AIG, in the first several years of this century.

The frenetic response when someone seemed genuine in offering to sell one of their kidneys because of financial dire straights.

Your prolific output on SI.... yours truly enhancing the phrase from the WSJ That ThunderChicken...... it's Fingerlickin'

Lucretius Taurus and The Mighty Myth Man........I had a 50,000 post grub on the myth thread with a dirk diggler reference...... Henry Volquardsen created the Post Grubbers trophy case...now that I think about it.

The bubble day traders in 1999 who knew that it was a a total mania and would take a proverbial hit off the glue bongbefore putting on the trade.

It was like Cramer on CNBC in May of 1997 saying that anyone who had been long the whole way upwas like a monkey with a buy buttonsaid in his best "the Hindenburg has exploded...." hysterical rapid fire banter.

Cramer also had the classic that this is the kind of market that if a stock opens up 10 bucks you buy 500 shares, if it's up 20 bucks you buy 1000 shares.... and so it was such a beast in 1999.

B2B, .com, eyeball views of a website were monetized....... the net company that shot small furry animals out of a cannon and had no perceptible business model. the Billions of employee stock options that made so many "paper wealthy" if only they had vested and were exercisable.

The US Equity Market in March of 2000 was 44% of the global stock market capitalization....... interestingly, that is about the same 44 Global market capitalization that Japan had on Dec. 31st 1989 at Nikkei - Dow 39300 or so. 23 years later and Kyle Russ is explaining why Japan is really getting ready to go through the ENDGAME over the next one to two years.

I was exchanging text messages with Patrick Slevin today, I saw Chip McVikar posting that it was good to see Patrick posting.

Of course we had that classic trip to Las Vegas of the piffers and an assortment of Nasdaq bubble participants... who can forget us at the MGM feeding spot at 3 AM having late night salads, after hours at the craps tables and Patrick and Gary having a "spirited" discussion on the virtues of New Jersey aquifer water.

The theme song of my eighth grade graduating grade school class in Mendham NJ was "Memories" the one that was used so heavily in the Kodak ads...... will you remember the times of your life........as it turns out it was the value of their patent portfolio.

I got to play guitar with the school band for that song and the other starting pitcher on our division winning baseball team, Craig Cooper, played the drums.

SI has been a very storied and interesting place. Hope it stays with us for many years....

as Art Cashin has memorably said " always have enough gold to bribe the border guard" and he loves his pithy 4th of July maxim..... I had a "fifth on the fourth" .....

The one board I wished that I started back in 2000-2001 was to have everyone come up with companies that reached their price high in 2000 and how many shares there were so as to come up with maximum market capitalization, and how much had been lost by late 2002 early 2003. So many companies Commerce One is one of hundreds of companies that disappeared... with all that loot off to Money Heaven

John... |

-----------------------------

| To: Augustus Gloop who wrote (14125) | 6/10/2013 1:03:16 PM | | From: John Pitera | 1 Recommendation Recommended By Recommended By

roguedolphin

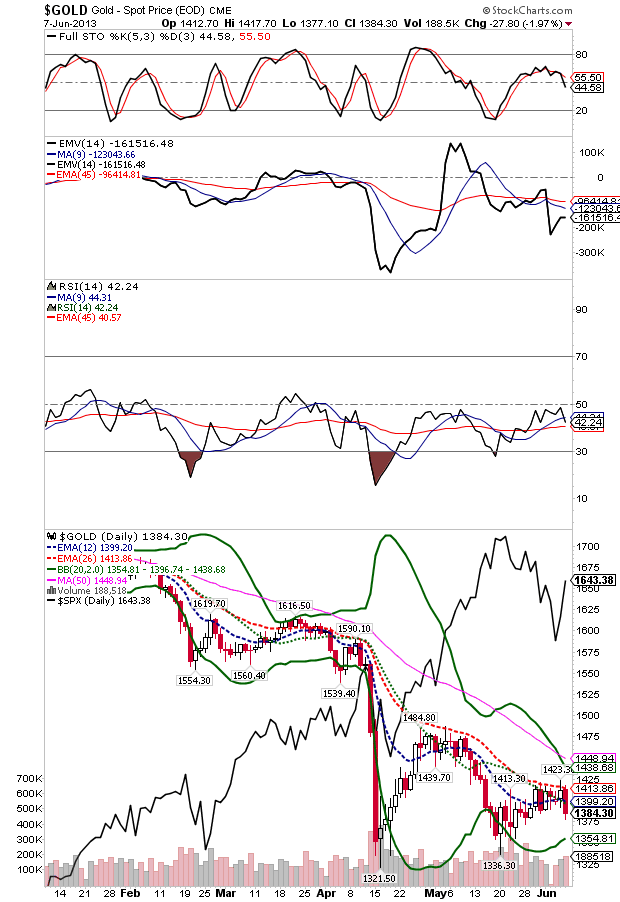

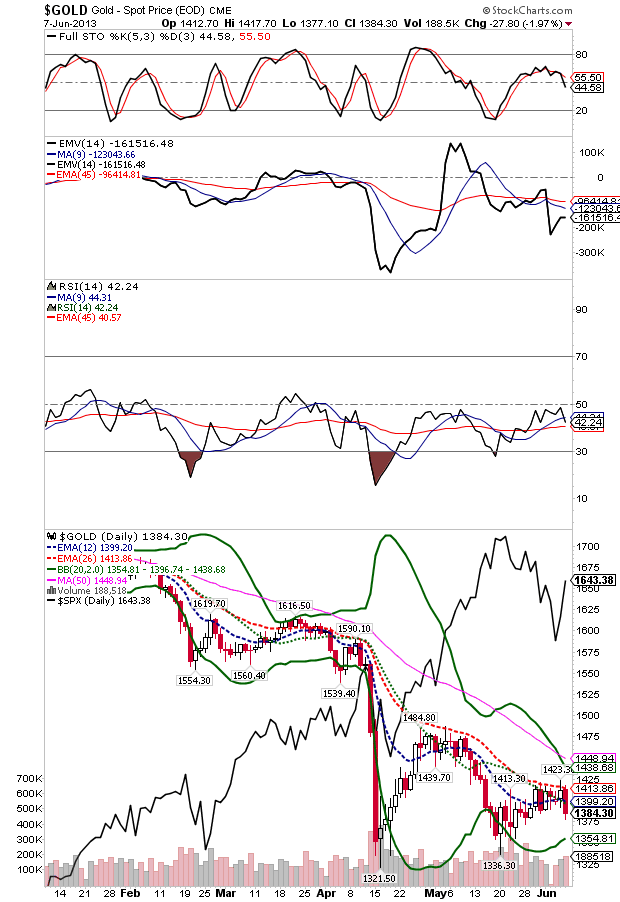

of 14172 | | |  The Outlook for GOLD continues to look negative..... as we will recall I illustrated on April 4th how the 2 year GOLD Chart was in a very bearish descending triangle and when support broke in the low $1500's.... the most logical read was for an intermediate term decline of $400 dollars.....we knocked $225 off when it broke down the Thursday after Goldman piled on to the trade "piling on was originally a Rugby term" The Outlook for GOLD continues to look negative..... as we will recall I illustrated on April 4th how the 2 year GOLD Chart was in a very bearish descending triangle and when support broke in the low $1500's.... the most logical read was for an intermediate term decline of $400 dollars.....we knocked $225 off when it broke down the Thursday after Goldman piled on to the trade "piling on was originally a Rugby term"

as we can see by from this chart....the price actions on the rallies has been feeble, GOLD is just quitely rolling over and is getting ready to take out the 336 and the $321 price support levels.

the technical traders have sold it at the 26 day Exponential moving averageand GOLD has not even been strong enough to rally to the 50 day Simple moving average where many professionals have been hoping it would get to so that they can put out more shorts...After the initial $225 plummet we had a reasonable rally that retraced about half of the first major thrust down. When the SPX bottomed and we had the 300 point move in the $/JPY and the EUR on June 6th... it pushed the 10 year yield down, fueled a rally in SPX ........

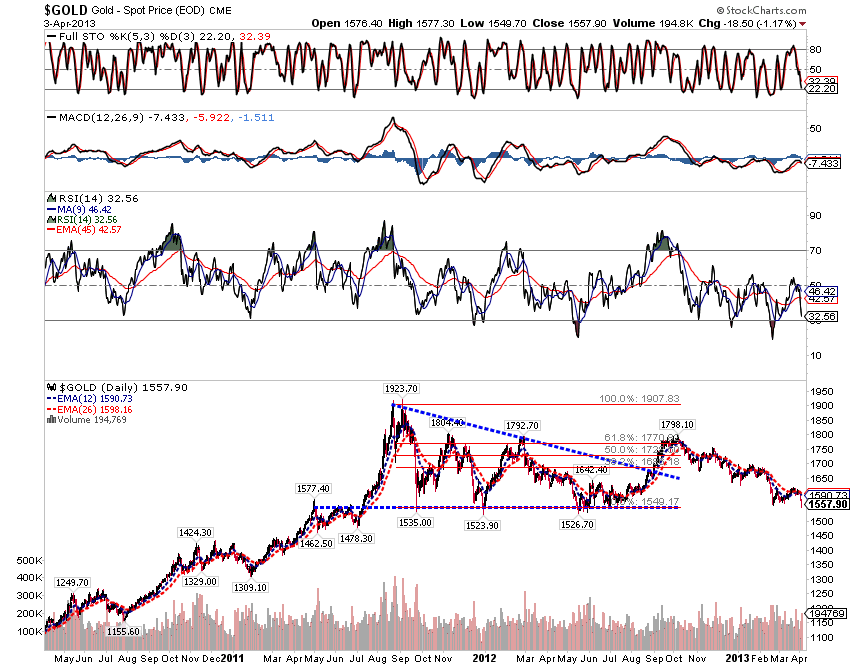

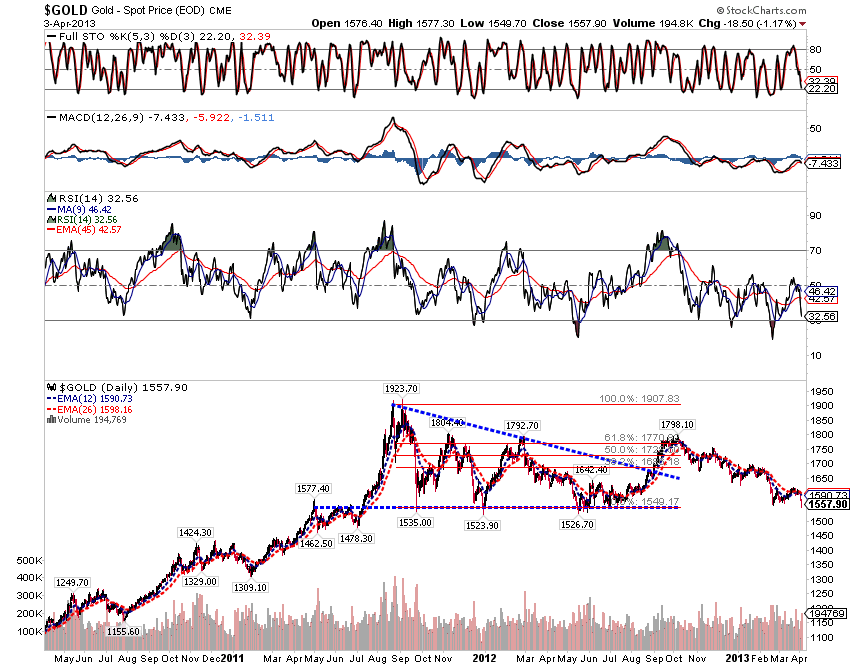

a quick review of the bigger picture in GOLD and the talk about a $400 decline....

---------------------

| To: Yorikke who wrote ( 13977) | 4/4/2013 1:59:05 AM | | From: John Pitera | 1 Recommendation Read Replies (2) of 14155 | |  Hi Y, Hi Y,

here is a chart........GOLD is in a very interesting and fairly complicated pattern.....it has many elements

of a market that is in a descending triangle which usually one of the most reliable chart patterns to which would suggest that we will break the horizontal baseline support and in that case a reasonable target for the ultimate end of the decline would be about $400 lower than 1923$ price top out in Sept of 2011 and these jagged lows

in say thw 1528-1535 range....... the chart looks lousy and I would not be looking to buy this support but would be shorting it on a break 2 day close below $1500 andwondering what will be happening in the global economy if it goes down $400 bucks from here.

The very deep momentum generated on the RSI on it's Feb 2013 decline almost mandates that this chart is going go break down and the price of GOLD denominated in USD is going lower.

The XAU is down 50% and, is showing a double momentum buy signal but a quarter of those companies are on the financial rocks....... if GOLD breaks down and we see a meaningful decline, then I do not know how you can say that TA is Nonsense.

Our FED and the Central Banks of the world have driven us off into fantasy worlds........ but I would not throw the baby out with the bathwater......... Interesteing the XAU..... which is down from 228 to 128...... that chart is actually showig a double momentum buy divergence...... but remember its for the companies that stay in business....

John

PS constance brown has written an excellent book on TA that has been updated in 2012.....she has a very interesting of using a methodology of using specifice ema averagers overlaid on the RSI and I believe she's on to something good.

I hope to discuss her methodology..... and maybe generate a few books sales for her sometime soon.

John

-----------------

feel free to peruse the above posts and I am prepared for questions, comments, concerns....... I do believe that we reached a psychological peak in euphoria when I had several time cycles peaking and we had the Jupiter, Venus, Mercury conjuction on Sunday May 26th..... we had a Applying full Moon occurring on May 23rd and 24th and there was a tremendous amount of nervous frenetic activity and in people minds..... The Japanese 5 year bond shot up from the low .60's in basis points and moved up to .86 and the Japanese average broke real hard with it's first 7.3% decline in one day.. back at that point... we have subsequently seen the Japanese stock market decline by over 20% and the Asian and European economies are moribund....... and the earnings outlook is not good going forward in the US.

credit spreads are widening since this time turning point.... and It looks like we should have seen the top for the year in risk assets.

John |

|

|

|

: |

Recommended By

Recommended By The Outlook for

The Outlook for  Hi Y,

Hi Y,