This extrapolation adds to the details surrounding data as viewpoints. The RBN Energy team has done a magnificent job reporting on the onions layers.

Sittin' On The Dock of the Bay – Watching Eagle Ford Roll In

published by Sandy Fielden on Tue, 06/25/2013 - 20:00

The volume of crude moving out of Corpus by barge and tanker increased from 7 Mb/d in January 2012 to 370 Mb/d in May 2013. At the same time two 300 Mb/d plus pipelines from the South Texas Eagle Ford to Houston are running at less than half full. We know these stats because of information from a company called Clipper Data, which among other things provides detailed waterborne movements of Eagle Ford crude from the Port of Corpus Christi to Gulf Coast destinations. Today we examine the shipping data for clues.

At the end of May 2013 Market Intelligence firm Clipper Data launched an Eagle Ford Marine Data Survey to complement their weekly survey of US crude oil imports – US Import Week. The basis of the Clipper Marine Data is shipping information about crude movements out of the Port of Corpus Christi. The company uses proprietary methods that we will describe in a minute to identify how much crude is shipped out of Corpus and where it ends up on the Gulf Coast. Using that data Clipper then estimates local refinery consumption of Eagle Ford crude and subtracts those volumes from crude production estimates to imply pipeline movements into Houston.

While RBN Energy has described these crude movements we haven’t had access to the destination detail and volumes that Clipper provide. We did describe the significant increase in marine (barge) traffic out of Corpus and the 6 marine terminals in the Port (see We’re Jammin’ But Can All Dat Crude Get Through?). In 2011 the Port of Corpus Christi reported just 14 barges were loaded with crude (all year). During 2012 the outbound waterborne volume from Corpus increased from 7 Mb/d in January to 250 Mb/d in December and has continued to increase to a total of about 370 Mb/d in May 2013 (see chart below). We described the Eagle Ford takeaway infrastructure and capacity in detail at the end of January 2013 (see Too Much Too Soon). In that post we calculated that there was at least 4 times as much pipeline takeaway capacity in the Eagle Ford as was required. Clipper estimate that Eagle Ford crude production in May 2013 was close to 1 MMb/d with local refinery consumption of just under 400 Mb/d – leaving 600 Mb/d needing transportation to market. The great majority of that crude is being shipped out of Corpus Christi by barge and tanker.

Source: Port of Corpus Christi Data (Click to Enlarge)

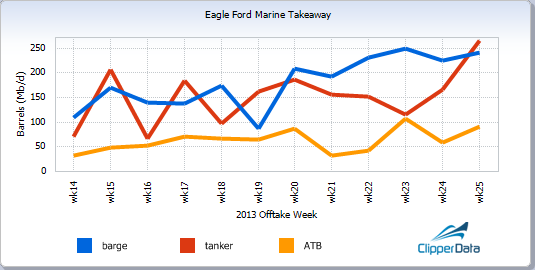

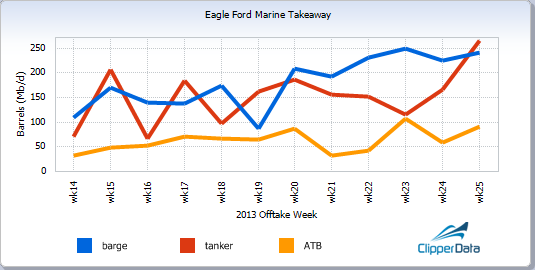

The chart below from Clipper shows the breakdown of marine traffic out of Corpus between weeks 14 and 25 of this year. Movements occur on one of three vessel types – large ocean going tankers (~350 MBbl capacity), articulated tank barges (ATBs, 120-230 MBbl) and smaller barges that carry 10 or 30 MBbl each in convoys of up to three at a time. (For more on coastal crude movements by barge see Good Year for the Barges). As you can see from the chart, barges (blue line) carry most crude barrels out of Corpus, closely followed by tankers (red line) and ATBs (orange line). All of these vessels are subject to the Jones Act (see The Sea and Mr. Jones). Clipper capture this data by tracking ocean-going tankers, ATBs and barge tugs using publically available Internet based automatic identification system (AIS) data. In addition, Clipper has set up cameras along the Gulf Intracoastal Waterway to capture the size of the barge(s) being pushed.

Source: Clipper Data www.clipperdata.com (Click to Enlarge)

Using this technology, Clipper tracks vessel movements out of Corpus Christi to destinations along the Gulf Coast. The table below shows all the outbound crude movements from Corpus Christi in May 2013. The left hand column lists the ports where the crude loaded at Corpus is delivered to (Offtake Port). Column two lists the specific terminal (Offtake Point) within each port that the crude was delivered to. For example the first port in column 1 is Morgan Point and deliveries are all made to the Louisiana Offshore Port (LOOP) terminal. The second port in column 1 is Houston and there are 11 terminals inside the port listed in column 2 etc. The third column indicates the actual volume delivered to each terminal in total barrels and the right hand column is the average in Mb/d. The red lines in the table are the subtotals of deliveries to each Port.

Source: Clipper Data www.clipperdata.com (Click to Enlarge)

The data shows that 62 percent of the 370 Mb/d total waterborne movement out of Corpus in May was destined for either Houston or LOOP. Just under 32 percent of the Corpus outbound volume (121 Mb/d) goes to LOOP - the largest crude oil import terminal on the Gulf Coast – built to offload large crude tankers and as the gathering point for offshore Gulf of Mexico crude production (see Thrown for a LOOP). We don’t know for sure but it is a pretty good bet that most of this volume of Eagle Ford production is in fact condensate that is shipped from LOOP to St. James, LA via the LOCAP pipeline where it is transferred to the Capline pipeline for shipment to the Chicago area. From Chicago, supplies of Eagle Ford condensate are then shipped to Western Canada on the Enbridge Southern Lights pipeline for use as diluent to be blended with heavy bitumen crude (see Plains Trains and Diluent Deals).

The 107 Mb/d of waterborne Eagle Ford crude identified by Clipper as deliveries to Houston locations is destined for Houston Ship Channel refineries or to blending terminals. It is believed that a good deal of Eagle Ford crude is blended - usually with heavier crude to make it more attractive to refiners. That is because Eagle Ford crude has very high gravity and as much as 43 percent of production is actually condensate (see our recent post Too Wrong For Too Long? The Eagle Ford Condensate Challenge). These light crudes are too light for refineries configured to process heavier crudes.

A similar fate awaits the remaining barrels of Eagle Ford listed in Clipper’s table – direct to refineries or to storage and distribution terminals on the Texas and Louisiana Gulf Coasts or the Mississippi River. What the data shows is a fairly wide distribution of Eagle Ford to area refineries that are adapting to using this local resource as they eliminate imported crudes from their diet. And as we have learned in the past few months, Eagle Ford crude prices are frequently discounted by as much as $10/Bbl to the Gulf Coast benchmark - Light Louisiana Sweet (LLS). That is partly because LLS has more desirable refining qualities but also because refiners have learned that they can pay less for light crudes or condensates that have a high gravity. The higher gravity produces a lot of gasoline components that are not as valuable as middle distillate diesel components and if the crude is too light then it can overwhelm refinery light ends process capacity.

Finally, using Clipper’s Eagle Ford May 2013 production estimate of 1 MMb/d and assumed regional refinery consumption of 400 Mb/d we can estimate takeaway crude at 600 Mb/d from Eagle Ford. If waterborne shipments out of Corpus are 370 Mb/d that leaves 230 Mb/d of production that must be headed to Houston by pipeline. That is pretty interesting because the two pipelines from the Eagle Ford to Houston each have 300 Mb/d of capacity or more. These are the Enterprise Eagle Ford Crude pipeline (350 Mb/d capacity) and the Kinder Morgan Crude and Condensate pipeline (300 Mb/d). By implication from the waterborne data we can determine that these two pipelines are running at considerably less than half full.

We do not know for sure the reason why Eagle Ford pipelines to Houston are running less than half full when - as Clipper put it eloquently - “anyone with a rowboat and a jug can find good work floating Eagle Ford out of Corpus”. In other words – since pipelines should be cheaper than barges – why is all the crude being moved out by water? Here are a few thoughts on the issue. We know that the Seaway pipeline south from Cushing, OK to Houston has run into congestion problems in Houston and had to restrict shipping volumes. Since the Enterprise Eagle Ford pipeline route into Houston passes through the same Rancho Junction terminal as Seaway the capacity on the former is likely also restricted. That could explain the Enterprise situation.

Looking at the Kinder Morgan pipeline, it is shipping condensate to that company’s Galena Park terminal in Houston for transfer to the Explorer pipeline and onward shipment to Western Canada as diluent (see It’s a Kinder Magic). The Cochin reversal that will take those barrels of diluent to Canada will not be in service until July 2014. Until then diluent volumes on Explorer have to travel to the Enbridge Southern Lights pipeline through several third party pipelines in Chicago. That circuitous route is likely a constraint on volumes.

And in general it is also true that waterborne crude out of Corpus has a lot more options than pipeline crude into Houston these days. The Houston pipeline system is subject to congestion as witnessed by the Seaway problems. Until the end of 2013 when the Shell Ho-Ho pipeline reversal is completed, crude cannot travel further East than Port Arthur by pipeline. So if you want to reach Louisiana (e.g. Loop or St James) your only option is to send your crude on the water.

Data from companies such as Clipper helps analysts build a more complete picture of domestic crude movements to Gulf Coast refineries. This will prove invaluable as more domestic and Canadian crude arrives at the Gulf Coast from the Midwest, West and South Texas by pipeline in the next 12 months. As that happens, crude pricing is likely to reflect how far refiners are adapting their configuration to process increased volumes of cheaper domestic crude versus paying more to keep processing imports. The destination and volume of waterborne movements out of Corpus will be important indicators of those trends.

Each business day RBN Energy releases the Daily Energy Post covering some aspect of energy market dynamics. Receive the morning RBN Energy email by signing up for the RBN Energy Network.

|

“Sittin’ On the Dock of the Bay” was recorded in 1967 by Otis Reading – just days before his death. It was a worldwide hit in 1968

Tags:

Eagle Ford

crude

Corpus Christi

Barge

Tanker

ATB

Gulf Coast

pipeline

LOOP

Category:

Crude Oil |