Global Windows Phone Sell-In and Market Share in Q2 2013 (Strategy Analytics) ....

>> Strategy Analytics reports 8.9 million Windows Phone shipped in Q2 2013

Rafe Blandford

All About Windows Phone (AAWP)

August 2nd 2013

allaboutwindowsphone.com

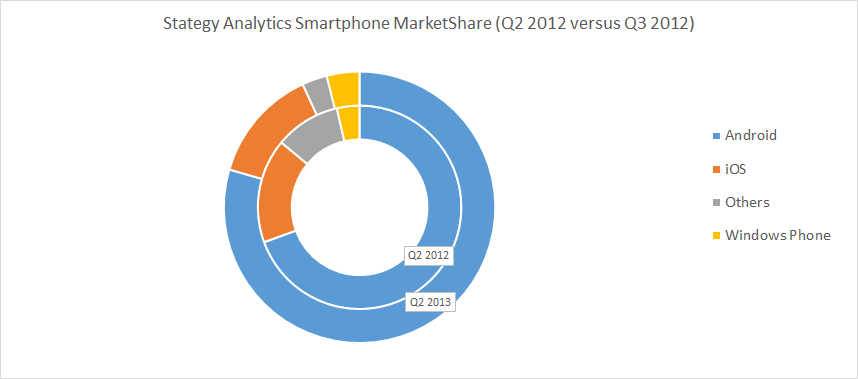

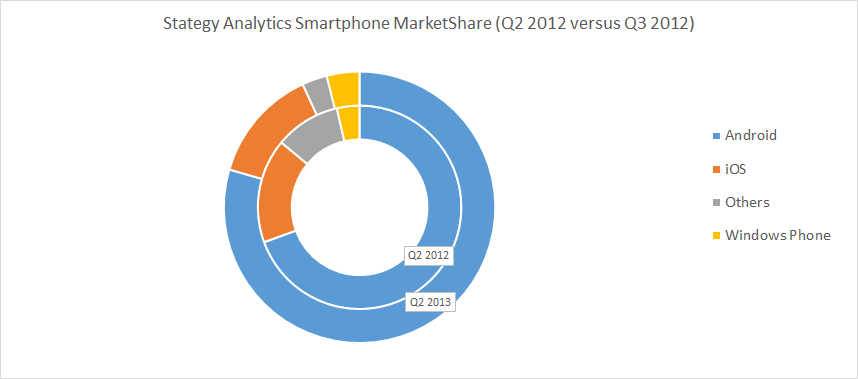

Strategy Analytics, a research firm, in its latest report on global smartphone shipments says that Windows Phone shipped 8.9 million devices in the second quarter of the year for a unit marketshare of 3.9%. Those figures are up year-on-year from 5.6 million and 3.6% respectively. The numbers for Windows Phone are small compared to Android (182.6 million 79.5%) and iOS (31.2 million, 13.6%), but are now well ahead of the other category (6.9 million 3%) that includes Symbian and BlackBerry shipments.

Nokia shipped 7.4 million Lumia devices in Q2 2013, which using Strategy Analytics numbers, suggests that non-Nokia manufacturers (HTC, Samsung, and Huawei) collectively shipped 1.5 million Windows Phone devices. In percentage terms this would mean that Nokia shipped 83% of Windows Phone devices in Q2 2013, a strengthening of its position from previous quarters.

In terms of overall smartphone marketshare there are a number of interesting changes that are somewhat hidden by the continued oversall growth of the smartphone market (from 156.5 million shipments to 229.6 million shipments). Windows Phone (3.6% to 3.9%) and Android (69.5% to 79.5%) have both made market share gains in the last 12 months, but iOS has fallen from 16.6% to 13.6%. This is primairly a result of smartphone growth being driven by lower cost devices, a segment of the market in which Apple does not currently compete.

In a press release Strategy Analytics' Linda Sui is quoted as saying there are two areas where Microsoft needs to improve:

"Microsoft is making steady progress in the smartphone market due to strong support from Nokia. However, we believe Microsoft’s WP8 platform still needs to improve in at least two areas before it truly takes off. First, the license fee charged to smartphone makers for WP8 must be more competitive to compete with Android in lower price-bands. And second, Microsoft must dramatically accelerate its support for advanced technologies, such as octo-core chipsets, because WP8 continues to lag behind Android in the premium smartphone category." The license fee issue may be valid argument, especially at the lower end of the market, but this should be understood in the context total cost of licensing, taking into account patent licensing fees and associated costs, in addition to platform licensing costs. That because while Android is made freely available by Google it generally incurs higher patent fees than is the case for other platforms, reflecting Google's relatively recent entry into the mobile space.

The argument that Microsoft need to accelerate support for advanced technologies is not uncommon, but whether that should extend to octo-core chipsets is more controversial. Microsoft is already planning to move Windows Phone to quad-core processors in the GDR3 update that is scheduled to arrive later this year, but has always argued that experience trumps specifications and indicated a desire to avoid a specification race. Windows Phone, primarily due to its architecture, is regarded as being less resource hungry than Android. This is most apparent at the high-end, but can also be seen in the mid tier. ###

Global Smartphone OS Provider Sell-In and Market Share in Q2 2013 (Strategy Analytics)

========================================================================================

Q2'12 Q2'12 || Q2'13 Q2'13

Global Smartphone OS Sell-In (in Million Units) Units Share || Units Share

================================================= ======= ====== || ======= ======

Android 108.7m 69.5% || 182.6m 79.5%

Apple iOS 26.0m 16.6% || 31.2m 13.6%

Microsoft Windows Phone 5.6m 3.6% || 8.9m 3.9%

Others 16.2m 10.4% || 6.9m 3.0%

------------------------------------------------ ------ ------ || ------ ------

Total 156.5m 100.0% || 229.6m 100.0%

------------------------------------------------ ------ ------ || ------ ------

Global Smartphone Sell-In Growth Year-over-Year +41.6% || +46.7%

========================================================================================

- Eric - |