Don't you just "love it". The boss goes out and says the company "is now" going to emphasize profits.

<<The goal is to improve profitability and ensure that return on equity is high, Adams indicated.>>

Today, MU is on a "tear" to the upside, at the moment leading the SOXM stocks with a 4 percent gain. The market obviously believes what he says.

Micron's 4th quarter and FY close at the end of August. Cur Yr(2013) and Nxt Yr(2014) earnings are presently estimated at -0.27 and +0.98 as posted today by Yahoo. That is a nice jump and certainly gives some emphasis to the price rise lately. Micron stock price has more than doubled since the beginning of the year.

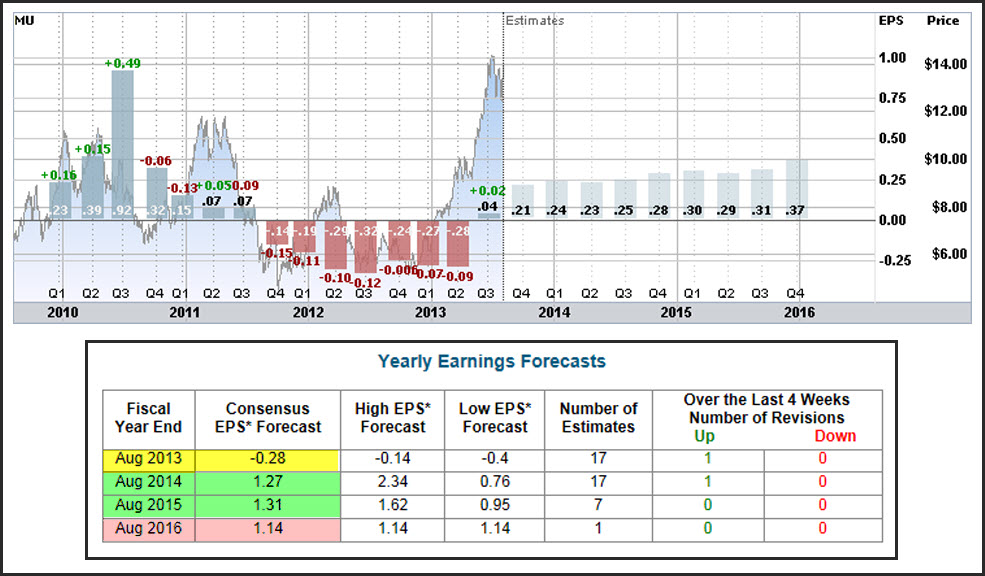

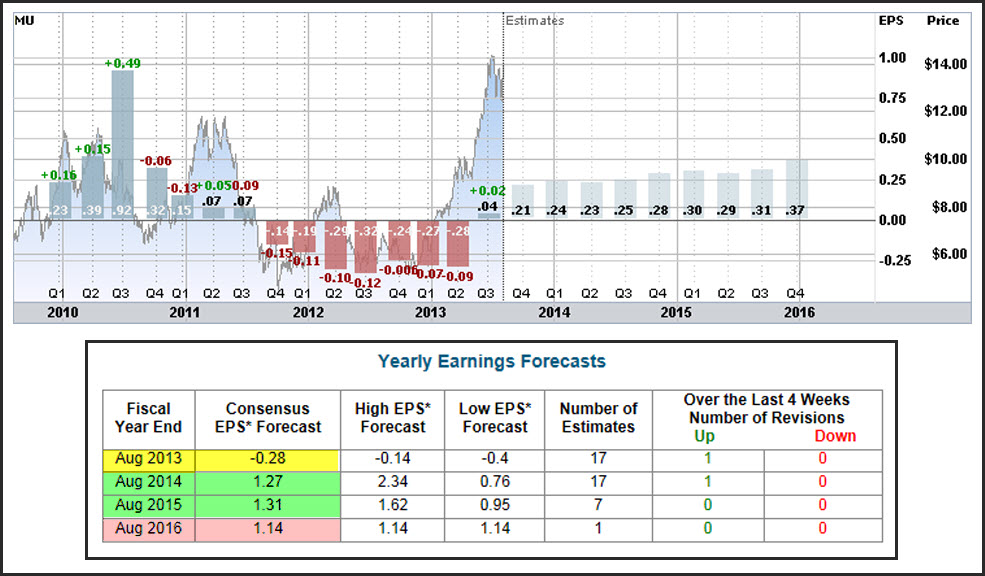

While the present earnings estimate for FY2014 is great compared to FY2013, what about the years after? The chart below looks the "outlying" years. The top part of the chart looks at the quarterly data, and the bottom table is a summation of the yearly estimates. The chart and table come from different sources and do not match exactly, but should be adequate for the subject of this post(the numbers will undoubtedly change as the weeks go by anyway).

Micron is coming out of a series of losing quarters and is expected to post a profit this 4th quarter of 0.21 cents, not enough to make FY13 a positive earnings year. However, as the chart shows, the coming quarters are all shown to be positive in a slight positive uptrend as the quarters go by.

Shifting to look at the yearly table, FY14 is estimated at 1.27, and FY15 is estimated at 1.31, a very small 4 cent increase. This number is the consensus of 7 analysts. FY16 is shown at 1.14 by 1 analyst. This number is so far out it is essentially meaningless.

|