Yup, nothing wrong with a couple of billionaires buying off congress.

In addition to anything else that might be wrong with it, one thing that's wrong with it is that its a fantasy that some take as reality.

Link to supporting facts

You don't provide any facts for your side. Common sense would say that it does, taxing something discourages it, even more generally increasing costs without increasing return reduces supply.

Beyond commons sense (and basic econ 101) --

"We examine the determinants of venture capital fundraising in the U.S. over the past twenty-five years. We study industry aggregate, state-level, and firm-specific fundraising to determine if macroeconomic, regulatory, or performance factors affect venture capital activity. We find that shifts in demand for venture capital appear to have a positive and important impact on commitments to new venture capital funds. Commitments by taxable and tax-exempt investors seem equally sensitive to changes in capital gains tax rates that decreases in capital gains tax rates increase the demand for venture capital as more workers are incented to become entrepreneurs. Aggregate and state level venture fundraising are positively affected by easing of pension investment restrictions as well as industrial and academic R&D expenditures. Fund performance and reputation also lead to greater fundraising by venture organizations."

ideas.repec.org

In an influential 1998 study Harvard Professor (and Obama supporter) Josh Lerner and his coauthor Paul Gompers found that capital gains tax cuts increased venture capital investments, driven by higher rates of entrepreneurial activity. They measure investments as how much money Venture Capital funds raise each year in commitments. The link between the capital gains tax and venture capital commitment is so strong that it is visually detectable, which is rare in economics. Here is the graph, which only goes up to 1994.

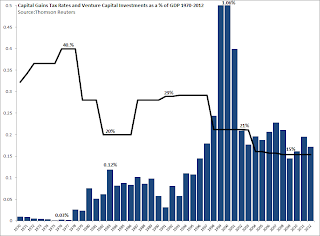

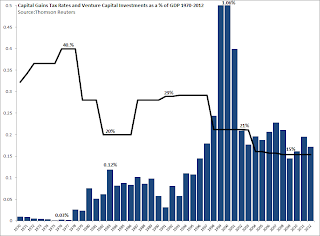

Let me update the Lerner, Gompers graph through 2012. I will use Venture Capital investments as a share of GDP rather than the absolute amount (results are unchanged if the absolute amount is used). I will rely on the left-leaning Tax Policy Center for the historic long-term capital gains tax. Data for total U.S Venture Capital commitments is from the textbook Entrepreneurial Finance up to 1995 and from PricewaterhouseCoopers until the first half of 2012 (both are based on Thomson Reuters).

Again we see a remarkably strong association between the capital gains tax and Venture Capital Investments. Following tax cuts in the late 1970s Venture Capital fund-raising explodes. The tax increase a decade later is followed by a decline in committed fund. Investments again increased when Clinton cuts the capital gains tax in the late 1990s. The Bush-tax-cut - which the left claims had no effect - is also followed by an uptick in Venture Capital investments as a share of GDP.

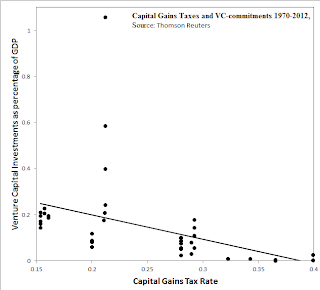

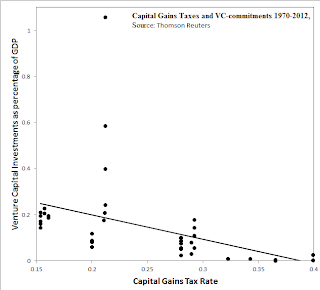

This methodology is as I mentioned crude. I use it because Professor Burman used an even cruder method (correlating capital gains taxes with GDP as a whole). By the standards left-of-center economists themselves have defined, I can indeed detect a strong negative correlation between capital gains taxes and a strategically important component of economic activity.

The correlation between the capital gains tax rate and VC-investments as a share of GDP 1970-2012 is -0.45. (The correlation is even stronger if the outlier year 2000 were to be excluded).

...

Regardless of the economics, isn’t it unfair to tax “unearned” capital gains at a lower rate than wages? First, capital gains of entrepreneurs are hardly “unearned”. Innovative entrepreneurs produce more economic value in relation to their income (even if the income is in billions of dollars) than other groups in the economy. This furthermore ignores double taxation. The capital gains tax is only part of the total tax burden, the company where capital gains are generated also has to pay taxes at the corporate level. The effective corporate tax rate is estimated at 27%. When Mitt Romney pays a visible capital gains tax of 15%, his total tax burden including the corporate tax is on around 38%. The impression that capital gains taxes are unfairly low is based on the government hiding much of the statutory capital tax burden through fiscal obfuscation.

super-economy.blogspot.com

In 1968-81, when capital gains taxes gradually rose from 25 percent to as high as 40 percent, average GDP growth fell from 3.8 percent to 3.1 percent per year (See table). Likewise, after 1987, when the rate increased from 20 percent to 29 percent, average annual growth declined from 3.5 percent back down to 3.1 percent.

If Obama wants to produce more jobs, he must grow the economy. To do that, instead of hiking the capital gains tax, he must cut it. After the devastating dot-com bust and terrorist attacks of 2001, annual growth averaged just 1.8 percent. But after George W. Bush gradually cut the rate (from 21.19 percent to 16.4 percent by 2003) average annual GDP growth increased a full percentage point, to 2.8 percent. Similarly, when Bill Clinton cut the capital gains tax rate from 29 percent to 21 percent in 1997, economic growth rose from an average of 3.1 percent to 4.5 percent per year. The same thing happened when Ronald Reagan slashed the rate in half (from 40 percent to 20 percent) in 1981: average annual growth rose from 3.1 percent to 3.5 percent. In each case, economic growth brought more jobs.

humanevents.com

Key Points:

Eliminating the reduced tax rates on capital gains and qualified dividends would:

- Increase tax revenues by $108 billion on a static basis;

- Reduce GDP by $983 billion;

- Actually reduce revenues by $122 billion on a dynamic basis;

- Reduce employment by the equivalent of approximately 1.3 million full-time workers; and

- Reduce hourly wages by 5.3 percent.

Eliminating the rate differential and trading the static revenue gains for individual rate cuts would:

- Allow for an across-the-board rate cut of 9.2 percent;

- Still reduce GDP by $681 billion per year;

- Reduce federal revenues by $150 billion on a dynamic basis;

- Reduce employment by the equivalent of approximately 300,000 full-time workers; and

- Reduce hourly wages by 4.2 percent.

taxfoundation.org |