Sprott - Expect A Failure To Deliver Gold & Lawsuits

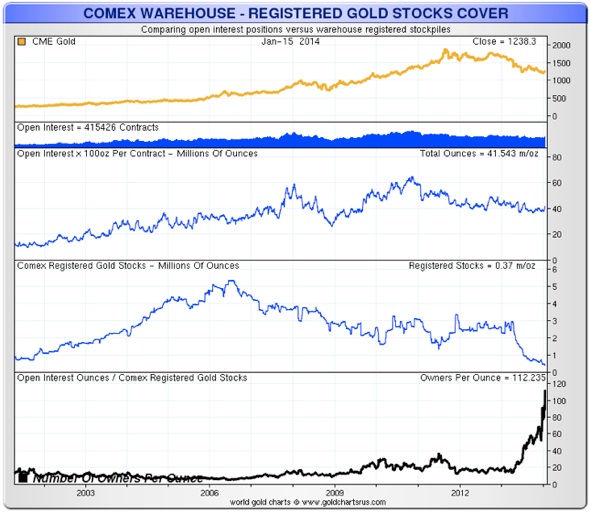

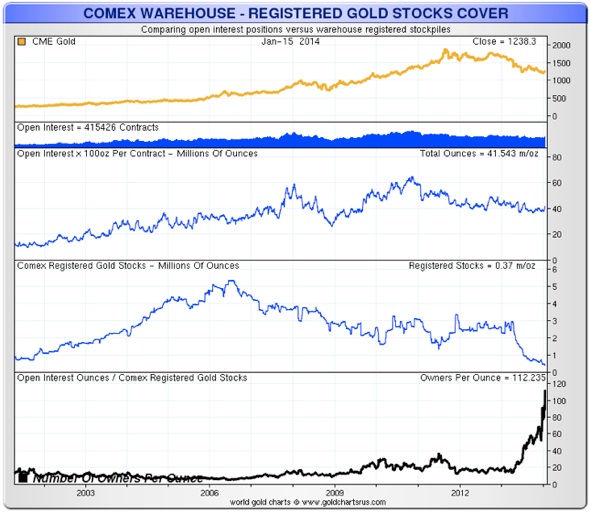

Eric King: “Eric, are we looking at a possible gold shortage here? As you know, paper claims vs available physical gold have skyrocketed to 112 to 1 -- absolutely amazing.”

Sprott: “Well, I think it’s ridiculous that dealers have something like 11 tons of gold on the Comex. 11 (tons reiterated). China imports about 100 tons a month. 11 tons is nothing. “And of course it keeps going down all the time (the supply of available gold).

Look at the bottom two portions of the above graphs which show dwindling inventories of available gold at the Comex, and the paper claims vs that available physical gold hitting new all-time highs!

Sprott continues: “February is a big delivery month. Last year it was 40 tons (that were delivered in February). God forbid it’s 40 tons this February. There are still a lot of contracts outstanding. So, yes, all my work suggests we are going to see a failure of delivery.

In some market, in some country, something is going to give here. I get so sick of reading about how mint sales were up 35% here, or 75% there. Chinese jewelry demand is up 39%. Everything is up double-digits and yet the price of gold goes down.

It’s incomprehensible that you could see this demand data, with the US Mint running out of silver coins and the UK Mint running out of gold coins, and yet we are all watching this price languish. While at the same time it would appear that there are many, many signs of manipulation, and now we have confirmation of manipulation worse than the LIBOR rigging.

I think it’s going to be very exciting for us people who were negatively affected by this and what we all might want to do about it. I don’t know if you can imagine where I’m coming from here but there can always be litigation over these things. So it will be fun to see it all play out.”

My Blog |