Here Is The Shocking Chart That Has The Big Money Worried

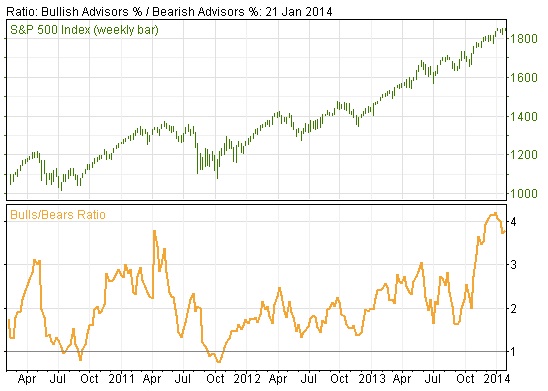

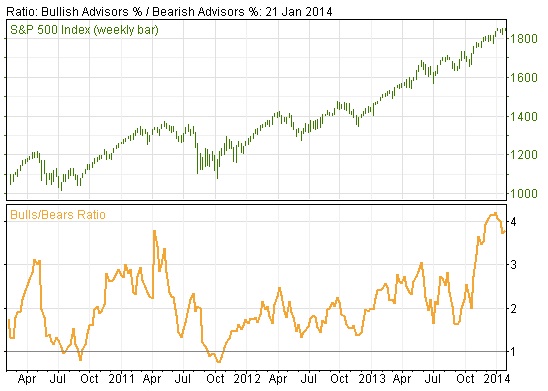

There is reason to be concerned here as we end January, even with global stock markets trading near all-time highs. There is a stunning chart featured below which all KWN readers around the world need to see.

If you look at the chart below it reveals there are some serious warning signals even as many major indexes have been trading near all-time new highs. You will see figures in here that are close to records not seen since 1987!

Here is the latest Investors Intelligence report along with the all-important sentiment chart: “Indexes ended mixed last week but there were new records for both the S&P 500 and NASDAQ Comp. Breadth was positive and the short term indicators all shifted back to bullish status. They ended below their prior highs allowing room for more market gains. Overall they are also forming large overbought tops. Sentiment was little changed with some noting indicator rebounds. Overall the sentiment still signals high risk conditions.

After two lower readings the bulls moved up to 57.6%, from last week's 56.1%. The last three readings have held below the six-year high of 61.6% that finished 2013. That was clearly an extreme but the last nine weeks have held in danger territory above 55%. Some bulls are worried for a pullback but not enough to yet trim their holdings. After the recent negative reading, similar to the 62.0% bullish level from October 2007, the short term shift usually accurately forecasts the market direction. The sentiment readings of importance should be when the correction or bearish readings expand to reflect a market retreat.

For another week the bears were little changed at 15.1% after edging higher last time to 15.3%. The differences were only due to changing totals, not opinion shifts. Late December their number fell to a 26-year low ago at 14.1%. A lower bearish level was last shown on 20-March-1987 at 13.6%. The bears say the market advance without any notable correction means conditions are ripe for a major tumble. Once the decline gets underway they expect it to quickly accelerate to the downside. However they have little technical evidence to offer in support.

Again the changes were between the bulls and correction, with the latter contracting slightly to 27.3%, from 28.6% a week ago. Last fall the reading was well above 30% but the market weakness through mid-December was enough for them to shift back to bullish to avoid missing the year-end rally. Their latest decrease occurs with some new index highs and if they expand, we could again see their number grow.

The spread between the bulls and bears expanded to 42.5%, after narrowing to 40.8% last issue. 2013 ended with the difference at 46.4% for another record extreme. The data has been negative territory for more than three months, pointing to increased risk. The spread was 42.4% in October 2007. In contrast August 2013 ended with the spread at 13.4%, close to the 10% (or less) reading that allows for buying. The bears haven't outnumbered the bulls (negative spread) since October 2011, after the correction from highs that April. Viewed another way in this week's chart the bears are now more than 25% of the bulls.

King World News note: The bottom line here is that the reading above is a very troubling sign for the bulls. It is waiving a red flag as investor sentiment remains at extremely bullish levels.

My Blog |