| | | Re: B&G Foods Inc. (BGS)

- Armanino Foods of Distinction Inc. (AMNF) is a much better "Value" buy.

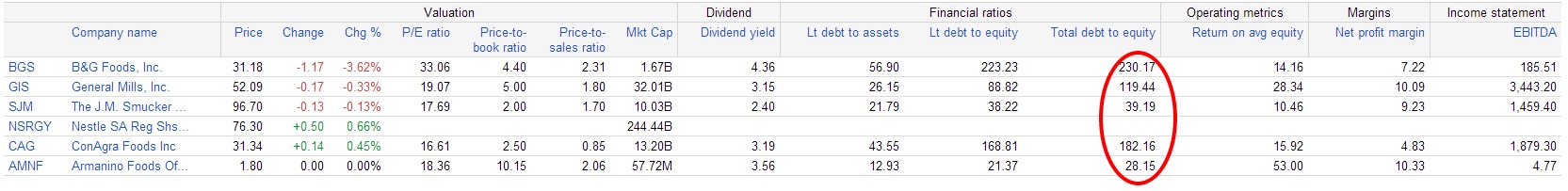

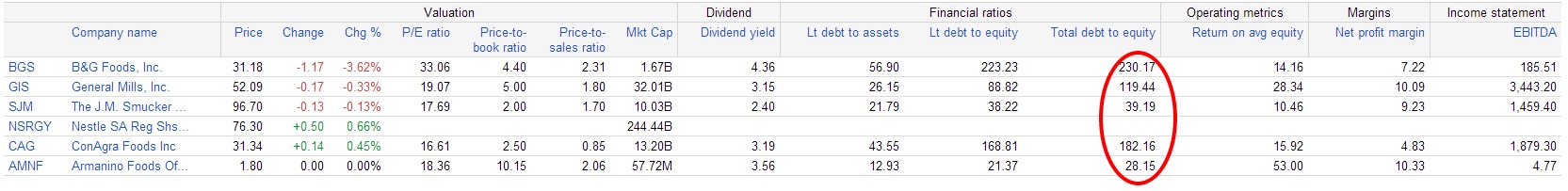

I like this sector (Processed Food & packaged good) and think it will be somewhat defensive if/when interests rates rise. Therefore, going into such an environment, Long Term debt must be as low as possible since their pricing power may be limited.

I compared five companies in this sector to get an idea how BGS's LT debt compares and for me it's still too high but manageable. From the list I currently own NSRGY but it may be a sell candidate because of valuation and just added shares to AMNF. I also have owned CAG and have that one on my buy list at $28.00/share or lower.

If you look at the 2012-1014 time period AMNF is the best performer (by a factor of 3x) but for the large Caps stocks, BGS is still one of the better performers, while CAG is the lager.

The positive is BAG is the smallest of the group, 6x smaller than SJM, when you exclude the micro-cap. Armanino Foods of Distinction Inc. (AMNF). I am not too sure that bigger is always better.

My favorite is still AMNF mainly because of their low debt profile, consistent revenue growth YoY of 10% or more and a 10 year history of dividend payments.

goo.gl (Note: you need to slide the time line bar under graph to get a better picture of price performance)

Maybe I would consider SJM at a 20% lower price. That would bring it more in line w/ AMNF's debt profile and dividend. The PE's for these are all quite high but of the group I think AMNF could grow revenues that justfies their 18x PE.

FWIW, my last buy for AMNF was last week at $1.63/share, when some fund must have sold a chunk of their shares before the earnings report. I upped my holding by 15%. At that price I locked in a 4% dividend and PE at 16. For me, one of my best buys of 2014.

Thank You for your alert on AMNF at the Dividend investing for retirement thread.

EKS |

|